jonka Rami Ramirez 3 vuotta sitten

122

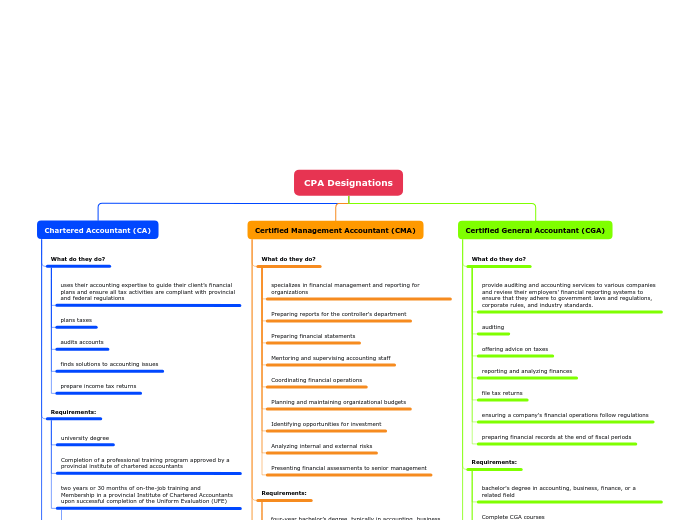

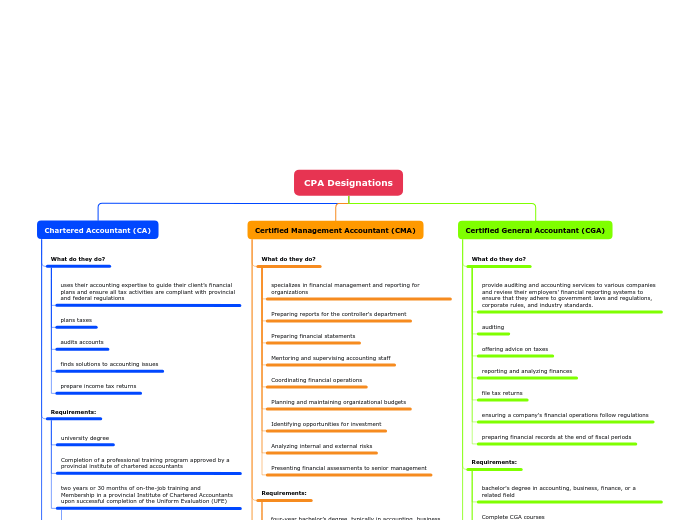

CPA Designations

In the field of accounting, two prominent designations are Chartered Accountant (CA) and Certified Management Accountant (CMA). Both roles require rigorous training and examinations.

jonka Rami Ramirez 3 vuotta sitten

122

Lisää tämän kaltaisia

length depends on what province you reside in