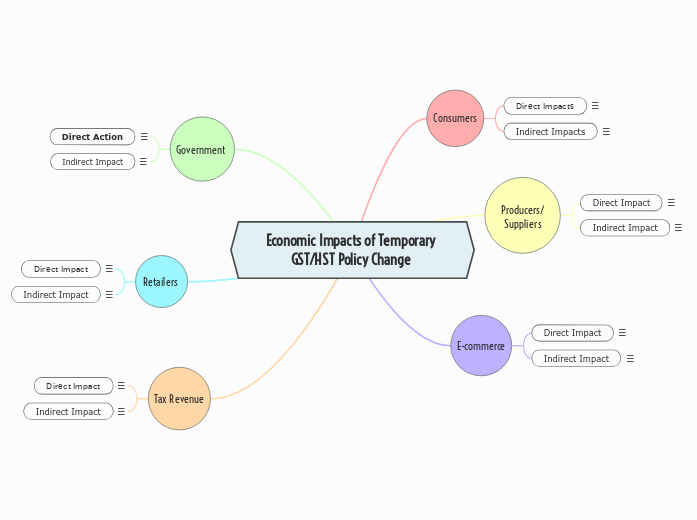

Economic Impacts of Temporary GST/HST Policy Change

Tax Revenue

Economic activity from increased spending may offset some revenue loss

Impacts future government decisions on taxation and public funding

Short term loss of $1.6 billion in federal tax revenue

Retailers

Possible shifts in focus to promote holiday essentials and children's goods

Challenges in ensuring clear communication to avoid consumer confusion

Boost in foot traffic sales and stores that sell qualifying goods

Inventory management will meet increased demand for tax-relieved items

Government

Reduced tax revenue during the relief period

May require adjustments in budget allocation for public services

Encourages economic activity to compensate for lost revenue

Direct Action

Introduces the tax relief policy and ensures implementation by businesses

E-commerce

More competition between brick-and-mortar and online businesses

Higher demand for delivery services

Online retailers benefit from increased holiday spending

Adjustments to online pricing systems to reflect tax relief

Producers/Suppliers

Indirect Impact

Stin on supply chains to meet increased production requirements

Potential for higher prices due to higher demands

Direct Impact

Higher demand for goods like children's clothing, books and holiday items

Consumers

Indirect Impacts

Increased consumer spending during the holiday season

Potential for saving or diverting spending toward other sectors like entertainment or travel

Direct Impacts

Increased purchasing power with reduced cost on groceries, children's items, and holiday essentials

Greater affordability of goods promotes spending on non-essentials