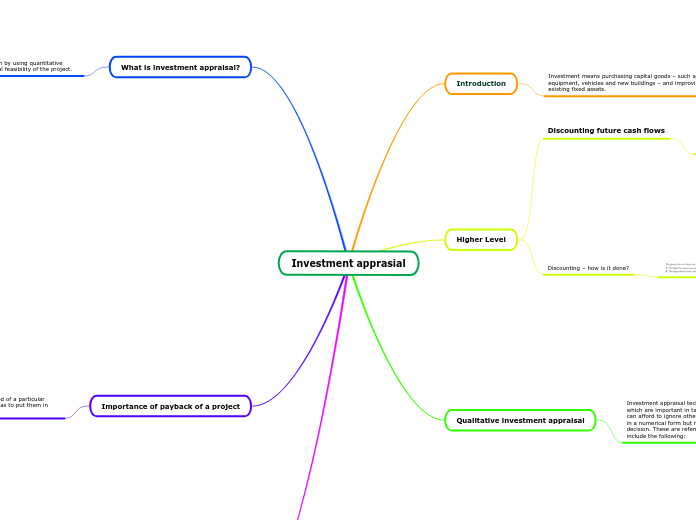

Investment apprasial

Evaluation of payback method

The payback method is often used as a quick check on the viability of a project or as a means of comparing projects. However, it is rarely used in isolation from the other investment appraisal methods.

Importance of payback of a project

Managers can compare the payback period of a particular project with other alternative projects so as to put them in rank order.

Alternatively, the payback period can be compared with a ‘cut-of’ time period that the business may have decided on – for example, it may not accept any project proposal that does not pay back within five years. The uses and benefits of the payback period technique include the following:

Some managers are ‘risk-averse’– they want to

reduce risk to a minimum so a quick payback

reduces uncertainties for these managers.

The longer into the future before a project pays back the capital invested in it, the more uncertain the whole investment becomes. The changes in the external environment that could occur to make a project unprofitable are likely to be much greater over ten years than over two.

Even if the fnance was obtained internally,

the capital has an opportunity cost of other

purposes for which it could be used. The

Speedier the payback, the more quickly the

capital is made available for other projects.

A business may have borrowed the fnance for the investment and a long payback period will increase interest payments.

What is investment appraisal?

Investment appraisal is undertaken by using quantitative techniques that assess the financial feasibility of the project.

Non-fnancial issues can also be signifcant and therefore

qualitative appraisal of a project might also be very important.

The use of such ‘intuitive’ or ‘hunch’ methods of taking investment decisions cannot be easily explained or justifed unless they turn out to be very successful.

Quantitative techniques of investment appraisal

Payback method

If a project costs $2 million and is expected to pay back $500 000 per year, the payback period will be four years.

This can then be compared with the payback on alternative

investments. It is normal to refer to ‘year 0’ as the time period in which the investment is made.

It is normal to refer to ‘year 0’ as the time period in which the investment is made. The cash fow at this time is therefore negative – shown by a bracketed for further example.

To find out this exact month use this formula:

How do we know this? At the end of year 2, $50 000

is needed to pay back the remainder of the initial investment. A total of $150 000 is expected during year 3; $50 000 is a third of $150 000 and one-third of a year is the end of month 4.

when during this year? If we assume that the cash fows are received evenly throughout the year (this may not be the case, of course), then payback will be at the end of the fourth month of the third year.

Notice that in year 3 it becomes positive – so the initial capital cost has been paid back during this year.

This latter fgure shows the ‘running total’ of cash fows and

becomes less and less negative as further cash infows are received.

This shows the forecasted annual net cash fows

and cumulative cash fows.

Example:

Quantitative investment appraisal

The forecasted net returns or net cash fows from the project – these are the expected returns from the investment minus the annual running cost.

The residual value of the investment – at the end of their useful lives will the assets be sold, earning additional net returns?

Methods of quantitative investment appraisal include:

Net present value using discounted cash fows

Average rate of return

Forecasting cash flows in an uncertain environment

All of the techniques used to appraise investment projects require forecasts to be made of future cash fows. These fgures are referred to as net cash flows.

Forecasting cash fows is not easy and is rarely likely to

be 100% accurate

With long-term investments, forecasts several years ahead have to be made and there will be increased chances of external factors reducing the accuracy of the fgures.

Example

The construction of a new high-speed rail link within the country, which might encourage some travellers to switch to this form of transport.

These future uncertainties cannot be removed from investment appraisal calculations.

The possibility of uncertain and unpredicted events making cash fow forecasts inaccurate must, however, be constantly borne in mind by managers. All investment decisions involve some risk due to this uncertainty.

Formula:

Annual forecasted net cash

flow: forecasted cash

inflow minus forecasted

cash outflows

Increases in oil prices that could make air travel more expensive than expected, again reducing revenue totals

An economic recession that could reduce both business and tourist trafc through the airport.

For instance, when appraising the construction of a new airport, forecasts of cash fows many years ahead are likely to be required. Revenue forecasts may be afected by external factors such as:

Payback period

The estimated life expectancy – for how many years can returns be expected from the investment?

The initial capital cost of the investment, including any installation costs

Qualitative investment appraisal

Investment appraisal techniques provide numerical data, which are important in taking decisions. However, no manager can afford to ignore other factors which cannot be expressed in a numerical form but may have a crucial bearing on a decision. These are referred to as qualitative factors and include the following:

Higher Level

Discounting – how is it done?

Discounting future cash flows

You will realise that managers may be uncertain which project to invest in if the two methods of investment appraisal used give conficting results: if a project is estimated to pay back at the end of year 3 at an ARR of 15%, should this be preferred to an alternative project B with a payback of four years but an ARR of 17%?

Managers need another investment appraisal method, which solves this problem of trying to compare projects with different returns and payback periods.

This additional method considers both the size of cash flows and the timing of them. It does this by discounting cash flow.

If the effects of inflation are ignored, most people would rather accept a payment of $1000 today instead of a payment of $1000 in a year’s time. Which would you choose? The payment today is preferred for three reasons:

Introduction

Investment means purchasing capital goods – such as equipment, vehicles and new buildings – and improving existing fixed assets.

Many investment decisions involve signifcant strategic issues – such as relocation of premises or the adoption of computer-assisted engineering methods.

Relatively minor investment decisions will not be analysed to the same degree of detail as more substantial decisions on capital expenditure.