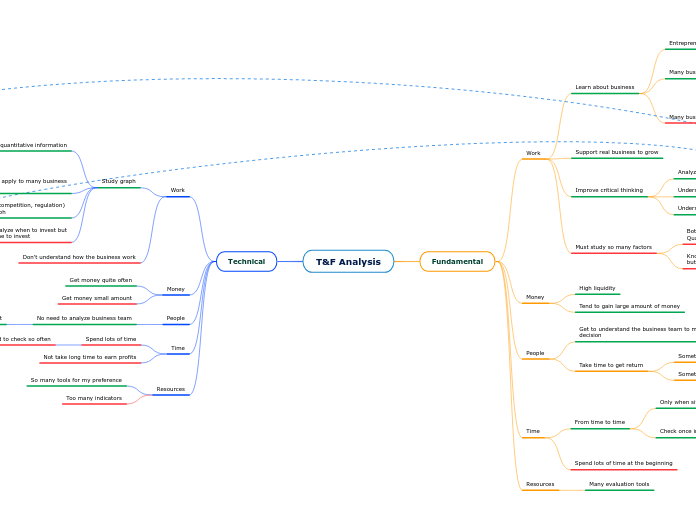

T&F Analysis

Technical

Too many indicators

So many tools for my preference

Not take long time to earn profits

Spend lots of time

Need to check so often

Can use bot to solve this

No need to analyze business team

Good for introvert

Get money small amount

Get money quite often

Don't understand how the business work

Study graph

Great for analyze when to invest but

not which one to invest

Use fundamental analysis to filter the

high potential companies

All information (market trends, competition, regulation)

has already reflected on the graph

No need to concern many factors other than graph

One concept can apply to many business

industries

Focus on quantitative information

Can get misled by one indicator

Cross check with several indicators

Get confused by so many indicators

Understand what is the main objective of each

indicator

We are trend followers

What reflects on graphs has already led

by some one (market maker)

Practice to think steps ahead

Fundamental

Resources

Many evaluation tools

Time

Spend lots of time at the beginning

From time to time

Check once in a while

Any new regulation implemented?

Fundamental remains the same?

Only when situation change

People

Take time to get return

Sometimes even get lost

Sometimes to late to adjust

Get to understand the business team to make investment decision

Money

Tend to gain large amount of money

High liquidity

Work

Must study so many factors

Know which companies to invest

but not when

Both Quantitative and

Qualitative

Qualitative analysis may get misled by

market maker propaganda

Cross check with technical analysis

Improve critical thinking

Understand business flows

Understand cause and effect

Analyze qualitative information to list high potential companies

Support real business to grow

Learn about business

Many businesses, industries do not share the same ideas

Must understand business in many industries

You will get lost if trying to analyze all industries in the same way

Many businesses share the same ideas

Compare the same businesses to pick up the best one

Some businesses can share the same analysis

Entrepreneur can also apply the common knowledge