a Ashley Lewis 5 éve

220

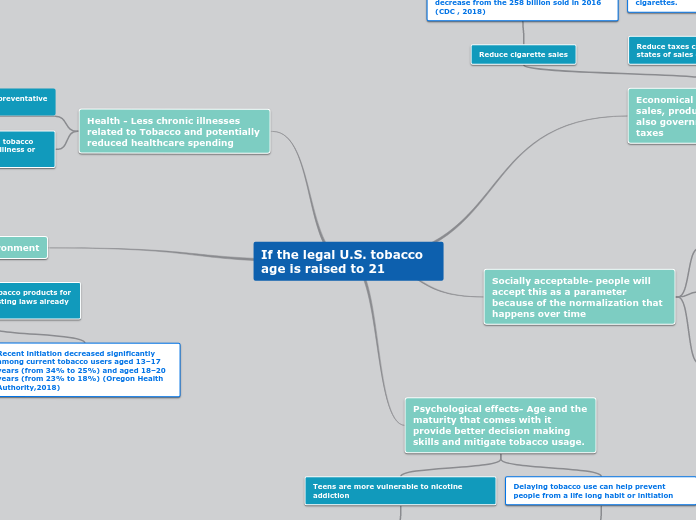

If the legal U.S. tobacco age is raised to 21

Increasing the legal age for tobacco use to 21 could significantly impact public health, reducing chronic illnesses and healthcare costs associated with smoking. With tobacco being the leading preventable cause of death in the U.