Works Cited

Works cited

CDC, Economic Trends in Tobacco. (2019, July 23). Retrieved from https://www.cdc.gov/tobacco/data_statistics/fact_sheets/economics/econ_facts/index.htm#anchor_1548357936093

Glover-Kudon R, Gammon DG, Rogers T, et al., Cigarette and cigar sales in Hawaii before and after implementation of a Tobacco 21 LawTobacco Control Published Online First: 13 January 2020. doi: 10.1136/tobaccocontrol-2019-055248

Oregon Health Authority, Oregon's Tobacco 21 Law: Impact Evaluation. (2018). Retrieved from https://www.oregon.gov/

oha/PH/PREVENTIONWELLNESS/TOBACCOPREVENTION/Documents/Oregon-Tobacco-21-Impact-Evaluation-Report.pdf

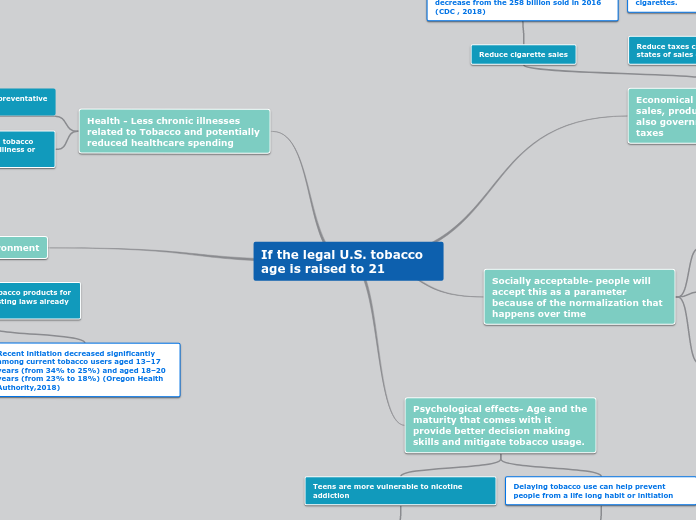

If the legal U.S. tobacco age is raised to 21

Societal Environment

More difficult to obtain tobacco products for teens which reinforce existing laws already in place

Recent initiation decreased significantly

among current tobacco users aged 13–17

years (from 34% to 25%) and aged 18–20

years (from 23% to 18%) (Oregon Health Authority,2018)

According to Oregon's Tobacco 21 law impact evaluation report, after the percentage of tobacco users aged 18–

20 years who reported that it was “sort of

easy” or “very easy” to obtain tobacco

products decreased significantly.

Health - Less chronic illnesses related to Tobacco and potentially reduced healthcare spending

The earlier a teen starts to use a tobacco the higher the risk for a chronic illness or disease

According to the CDC, Smoking-related illness in the United States costs more than $300 billion each year.

Tobacco use is the number one preventative cause of death in the U.S.

Raising the legal age of tobacco could lower the number of deaths related to tobacco

Psychological effects- Age and the maturity that comes with it provide better decision making skills and mitigate tobacco usage.

Delaying tobacco use can help prevent people from a life long habit or initiation

Data collected from grocery store chains in Hawaii concluded a decrease in sales of products most likely used by young adults or teens after they raised the age of tobacco purchasing to 21.

Teens are more vulnerable to nicotine addiction

According to the Oregon Health Authority 90% of adults who smoke

report starting before they turned 18, and almost 100% started before they turned 26.

Socially acceptable- people will accept this as a parameter because of the normalization that happens over time

Smoking under the age of 21 will become stigmatized and not socially acceptable.

A risk factor contributing to teens using a substance is interaction within their social group. If the social group doesn't have access to tobacco, then the individual might not either.

Risk factors still increase the chance of teens using a substance like tobacco and vary from person to person because of different experiences in how we grow up and personalities.

According to the Drugs, Society, and Human Behavior textbook, the association between low academic performance and cigarette smoking...leads most people to conclude that it's the kids who are getting low grades anyway who are more likely to be cigarette smokers.

If tobacco laws are tighter by raising the age of purchase, this enforces the perception of the laws as a protective factor for teens

Economical Impact- It may effect sales, production of tobacco and also government revenue from taxes

The United States is the number four tobacco producer in the world. If sales decrease production might as well.

In 2018, two states–North Carolina and Kentucky–accounted for more than 70% of total tobacco cultivation.

This could effect the communities of North Carolina and Kentucky the most.

Reduce taxes collected by the federal & states of sales of cigarettes

On average, federal and state excise taxes account for 44.3% of the retail price of cigarettes.

Reduce cigarette sales

During 2017, about 249 billion cigarettes were sold in the United States—a 3.5% decrease from the 258 billion sold in 2016 (CDC , 2018)