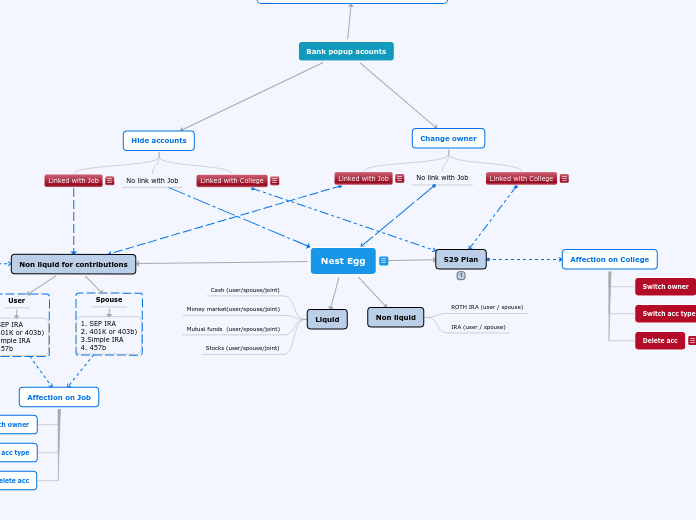

Affection on College

Account used for a College Goal

This 529 account is linked to [College Goal Name]. Deleting this account will change the [College Goal Name] goal to not use a 529 plan to fund it. Choose continue to delete the account, or go to [College Goal Name] to link a different 529 account.

[CONTINUE] [CANCEL]

Account used in a College Goal

This 529 account is linked to [College Goal Name]. By switching the account type the college goal will no longer use this account for funding. Choose continue to change the account tyet, or go to [College Goal Name] to link a different retirement account.

[CONTINUE] [CANCEL]

Account used in a College Goal

The student in [College Goal Name] and the linked 529 account beneficiary should be the same person. If you change the beneficiary we will unlink this 529 from the college goal. The goal will no longer use a 529 plan for funding.

[CONTINUE] [CANCEL]

Affection on Job

Delete acc

Subtopic

Account used for retirement contributions

Deleting this account will delete the linked retirement contribution and employer matching in [Job Income Card Name]. Choose continue to delete the account, or go to [Job Income Card Name] to link a different retirement account.

[CONTINUE][CANCEL]

Switch acc type

Account used for retirement contributions

Changing the account type will delete the linked retirement contribution and employer matching in [Job Income Card Name]. Choose continue to make the change, or go to [Job Income Card Name] to link a different retirement account.

[CONTINUE][CANCEL]

Switch owner

Account used for retirement contributions

The employee in [Job Income Card Name] and the linked retirement account beneficiary should be the same person. If you change the beneficiary we will unlink this retirement account from the [Job Income Card Name]. The job will no longer include a retirement contribution or employer match.

[CONTINUE] [CANCEL]

Company manager

FT Job Income card

Affection on NE

Switch to another acc

1. Previous Recurring acc deleted

2. New Recurring added if needed

Switches to PT

Job switching to part-time

Changing the job to part-time will cause the following changes:

1. We will delete the linked retirement contribution and employer matching associated to this Job.

2. We will delete the retirement goal associated to [Employee], since they will be no longer be employed full-time.

[CONTINUE][CANCEL]

Owner switches

Changing the owner of this job will cause the following changes:

1. We will need to re-enter any retirement contributions and employee matching. The current ones will be deleted, since they belong to a different person.

2. We will delete the retirement goal associated to [Employee], since they will be no longer be employed full-time.

[CONTINUE][CANCEL]

Delete linked acc

Recurring acc deleted

Bank popup acounts

Deleting a Bank linked to a Job Income, College, or Debt Goal Cards

Warning

This Bank has one or more accounts currently in use

Deleting this bank will trigger the following changes:

Delete the linked retirement contribution and employer matching in [Job Income Card Name].

Change the setting of [College Goal Name] to not use a 529 plan for funding.

Delete [Debt Payoff Goal Name] goal

Choose continue to accept the changes.

[CONTINUE][CANCEL]

Change owner

Account used for a College Goal

The student in [College Goal Name] and the linked 529 account beneficiary should be the same. Changing the beneficiary of this account will change the settings of [College Goal Name] goal to not use a 529 plan to fund it. Choose continue to change the owner, or go to [College Goal Card Name] to link a different retirement account.

[HIDE] [CANCEL]

Account used for retirement contributions

The employee in [Job Income Card] and the linked retirement account beneficiary should be the same person. Changing the beneficiary will delete [Job Income’s] retirement contribution and employer matching. Choose continue to change the owner, or go to [Job Income Card Name] to link a different retirement account.

[CONTINUE] [CANCEL]

Hide accounts

Linked with College

Account used for a College Goal

Hiding this account will change the settings of [College Goal Name] goal to not use a 529 plan to fund it. Choose continue to hide the account, or go to [Job Income Card Name] to link a different 529 account.

[CONTINUE] [CANCEL]

No link with Job

Linked with Job

Account used for retirement contributions

Hiding this account will delete the linked retirement contribution and employer matching in [Job Income Card Name]. Choose continue to delete the account, or go to [Job Income Card Name] to link a different retirement account.

[CONTINUE][CANCEL]

Nest Egg

https://docs.google.com/document/d/1cV4DFIOlrAIE2b7q4r2rqGXL_oDLi7mfTFY0cBoDxug/edit#heading=h.qnrp2tjyub7j

https://docs.google.com/document/d/1qt7pbQtGseWABFUWWK8tcMYP8GwouqZwFuYIia3-LCA/edit#heading=h.qwa85qj67j5n

https://docs.google.com/document/d/17kbWv682KPuI2wYKyMAYybAerSIcwjD_1bJM4FCYvWo/edit#

https://docs.google.com/document/d/1JmAt3vvod1agk5xpobGgBTQuPdK1DHS-tePEoeznKu8/edit#

Test cases

https://docs.google.com/spreadsheets/d/14ndfNZ4Iz2naGxtBeqyZuS8-QgnVdkoTnhLigtZ-IUk/edit#gid=1755209321

https://docs.google.com/spreadsheets/d/18BvsUVUdA0BZAWgncKxVm6tfbH28Gdz8u8Wdi7Af1eE/edit#gid=0

529 Plan

529 (user / spouse / user)

Liquid

Stocks (user/spouse/joint)

Mutual funds (user/spouse/joint)

Money market(user/spouse/joint)

Cash (user/spouse/joint)

Non liquid

IRA (user / spouse)

ROTH IRA (user / spouse)

Non liquid for contributions

Spouse

User

1. SEP IRA

2. 401K or 403b)

3.Simple IRA

4. 457b