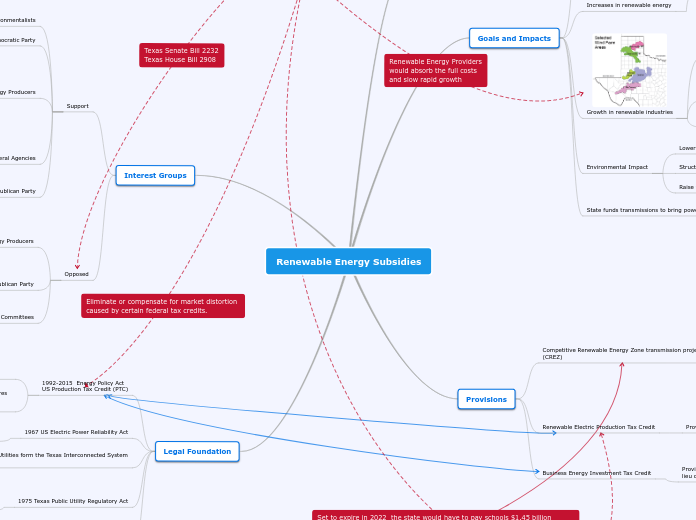

Renewable Energy Subsidies

Legal Foundation

1999 Texas Senate Bill 7

Deregulation of energy market

1975 Texas Public Utility Regulatory Act

Creation of the Public Utility Commission

(PUC)

2005 Texas Senate Bill 20 PUC in consultation with the ERCOT to designate competitive renewable energy zones (CREZ)

1999 PUC oversees competitive retail markets of electricity

1941 Electric Utilities form the Texas Interconnected System

(TIS)

1970 TIS forms Electric Reliability Council of Texas

(ERCOT) to comply with NERC requirements

2002 ERCOT operates the grid

which connects Texas power producers

1967 US Electric Power Reliability Act

1968 Creation of North American Energy Reliability Corporation (NERC)

1992-2015 Energy Policy Act

US Production Tax Credit (PTC)

Between 2018 and 2022, under current law, tax expenditures for the renewable electricity PTC are estimated to

be $25.8 billion.

Renewable electricity production tax credit (PTC) is a per-kilowatt-hour (kWh) tax credit

Interest Groups

Opposed

Conservative Political Action Committees

Empower Texans

Texas Public Policy Foundation

Fiscally Minded Legislators

Traditional Energy Producers

Coal

Natural Gas

Oil

Support

Republican Party

Rural Legislators

Federal Agencies

Department of Energy

Environmental Protection Agency

Alternative Energy Producers

Biomass

Hydro

Wind

Solar

Democratic Party

Environmentally minded Legislators

Environmentalists

Sierra Club

State Rejects Tax Subsidies for Renewable Energy

Provisions

Business Energy Investment Tax Credit

Provides businesses with a 30% investment tax credit (ITC) in lieu of the PTC

Renewable Electric Production Tax Credit

Provides Tax incentives to Renewable Energy Producers

Chapter 313 abatements limit taxes for 10 years for school district maintenance and operations in exchange for property improvements and job creation

Chapter 312 abatements exempt all of part of the increase in property value from taxation for as long as a decade

Competitive Renewable Energy Zone transmission project

(CREZ)

1996-2005 3,600 miles of high-voltage transmission lines installed to better connect energy grids

Goals and Impacts

State funds transmissions to bring power to customers

Environmental Impact

Raise the surface temperatures of the earth

Structures change the Texas Landscape

Tall structures create "wind shadows"

Lower Carbon Dioxide emissions

Growth in renewable industries

Corporations pay taxes to local economies in the form of property taxes

Income for land owners in the form of leases or royalties

Jobs

Construction of transmission line

Support staff of the energy generators

Companies involved in installation of generators

Increases in renewable energy

Some renewable energy production is unreliable

Increase in energy choices

Market competition

Threatens existing energy producers

Reduce the incentive to invest in new power plants

Creates declining prices for energy

Loss of Jobs in aging power sources

Lower energy bills for customers