Allocation of capital

Secondary market

Primary market

Structure and fuctions

Capital markets

Markets that have a life of more than a year

Money Markets

Deals with short-term securities

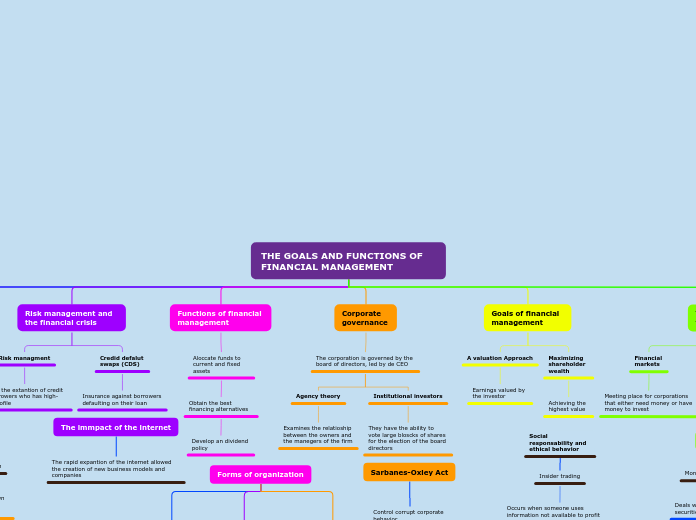

Social responsability and ethical behavior

Insider trading

Occurs when someone uses information not available to profit

Sarbanes-Oxley Act

Control corrupt corporate behavior

Forms of organization

Corporation

Its a legal entity unto itself

Subchapter S corporation

Articles of incorporation

Partnership

Two or more owners

Sole propertioship

Represents single-person ownership and offers simplicity at decision making

The immpact of the internet

The rapid expantion of the internet allowed the creation of new business models and companies

Modern issues in finance

Desinflation

A slowing down of prices increases

Inflation

Increase of prices

Capital structure theory

The study of the relative importance of debt and equity

THE GOALS AND FUNCTIONS OF FINANCIAL MANAGEMENT

Format of the text

Introduction

Examines the goals and objectives of the financial management

Working capital management

Techniques for managing the dhort-term assets ans liabilities are examined

The capital budgeting process

The decision on capital outlays

The role of the financial markets

Corporate financial markets

Where corporations such as Nike and Ford raise funds

Public financial markets

Borrowers of funds for education, welfare,etc

Financial markets

Meeting place for corporations that either need money or have money to invest

Goals of financial management

Maximizing shareholder wealth

Achieving the highest value

A valuation Approach

Earnings valued by the investor

Corporate governance

The corporation is governed by the board of directors, led by de CEO

Institutional investors

They have the ability to vote large bloscks of shares for the election of the board directors

Agency theory

Examines the relatioship between the owners and the manegers of the firm

Functions of financial management

Aloccate funds to current and fixed assets

Obtain the best financing alternatives

Develop an dividend policy

Risk management and the financial crisis

Credid defalut swaps (CDS)

Insurance against borrowers defaulting on their loan

Risk managment

Allows the extantion of credit to borrowers who has high-risk profile

Evolution of the field of finance

Real capital

Long-term plan and equipment

Financial capital

Money, credit

The field of finance

Accounting

Provides finance data through the statements

Economics

Provides a structure for decision making