e

Fundamental Accounting Practices

Business transaction: cause the

financial position of a business to

change (per event per transaction)

On accounts

Receipt on account

A/R and Bank(cash)

Payment on account

A/P and Bank(cash)

Sold on credit

A/R and Capital

Purchased on credit

Assets and A/P

Equation analysis sheet

Steps

5. Update the balance sheet

4. Make sure each transaction has two individual items are changed

3. Start record each transaction

2. Record the initial balances from its corresponding balance sheet.

1. Write down the fundamental accounting equation and list the items in the assets, liabilities, and owner’s equity sections

Source Document

Business paper

Ex: Invoice, Telephone bill, cheque

copies, store receipts

Ledger: All accounts put together

Trial balance

Debit != Credit -> not in balance

Debit = Cedit -> in balance

Debit credit theory

T-account

Exeptional Balance (an account ends up with a balance opposite to its normal one)

Ex: overpay an account payable; Customer overpays account balance, etc

Account Balance

First record all the transactions on T-account, then subtract the smaller total from the larger total. Write the result under the larger of the two pin totals.

Dollar value of an account and shows whether it is a debit or a credit

Steps(Assets on left; Liabilites & OE on right in the beginning)

3. Record the transactions

2. Record the initial amount for each account

1. Write the names of accounts

Asset=Debit: on right; Liability=Owner's Equity=Credit: on left

Liability/Owner's Equity -> Debit: -, Credit: +

Asset -> Debit: +, Credit: -

Double Entry Theory

Total debit entry=Total credit entry

First entry debit, second is credit

Balance sheet: shows the

financial position of an individual,

company, or other organization on a

certain date.

Fundamental Accounting

Equation

Assets = Liabilities + Owner’s Equity

Assets – Liabilities = Owner’s Equity

Owner's Equity: The difference between our

assets and our liabilities

Liabilities: Things the company owes

Ex: Acounts Payable, Bank Loan, Mortgage

Assets: Resources (things) owned by a business

Ex: Cash, Accounts Receivable, Supplies, Equipment, etc

Correct order

Liabilities

Due day: list what you need to pay first at first

Assets

Order by useful

life

Order of Liquidity

Steps to create a balance sheets

8. Add dollar signs to the first number in each

column, the total assets, and the total liabilities

and equity.

7. Put two ruled line below the two totals

6. Calculate the total Assets and total Liabilities and Equity on a same line with a ruled line (they should be same amount)

5. Calculate Owner's Equity

4. Total the liabilities with a ruled line

above the total.

3. List all the liabiities under the liabilities subheading

2. List all the assets under the assets subheading

1. Write the heading: Who, What, When.

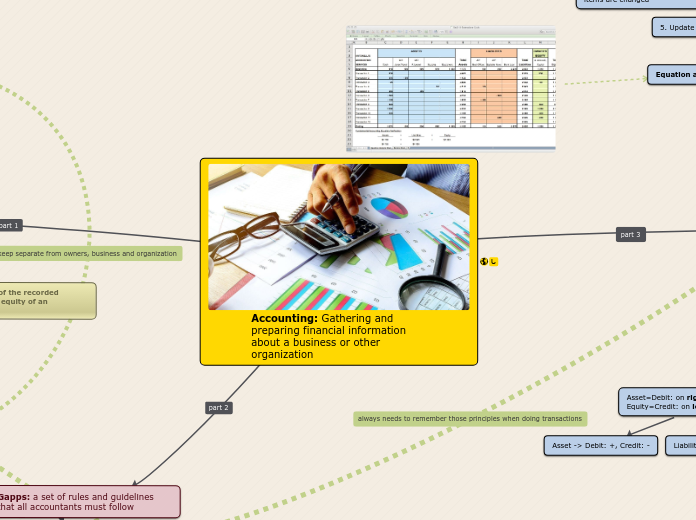

Accounting: Gathering and preparing financial information about a business or other organization

Gapps: a set of rules and guidelines that all accountants must follow

Key principles

Going Concern Concept

Assumes that the business will continue to operate unless it is known that it will not

Principle of Conservatism

Accounting for a business should be fair and reasonable

Ex: You can't say your business worth 1,000,000,000 dollars when you just get started because that's impossible.

Revenue Recognition Principle

Revenue must be recorded when the transaction was complete

Time Period Concept

Consistent time periods

The global standard time periods are monthly, quarterly and yearly.

Full Disclosure Principle

All information needed for a full understanding of a company’s financial statements must be included with the financial statements

Consistency principle

Once you adopt an accounting principle or method, continue to follow it consistently

Matching Principle

Each expense item related to revenue earned must be recorded in the same accounting period as the revenue it helped to earn

Ex: If a bought a thing in 2019 but no one use it until one year later someone use it to make money/do things, then the expense should be recorded 2020.

Objectivity Principle

Provide objective evidence

Ex: You can not say this dessert is the most delicious one in the world because that's probably not correct.

Cost Principle

Record the value as the purchase price.

Ex: If your company used $30 to buy an item, but one day later, it changed to $40, you need to record the money as $30 as this is how much you pay to buy it.

Business Entity concept

Keep separate from the personal affairs of owner, other business or organization

Ex: Business owner can use money for personal things

Accounting Concept

Forms of Ownership

Corporation

Highly regulated by provincial and federal government

Ex: Business names that include Inc (Incorporated), Corp(corporation) or Ltd(limited)

Partnership

Business that owned by two or more partners, share responsibilities and costs

Ex: McPearson & Scott Charterd Accountants

Sole proprietorship

Business that owned by a single person

Ex: Dr.Joe Dimitry; Dentist

Types of Business

Non-profit business

Businesses that do not earn money

Ex: charities; amateur sports organization; curches, etc

Manufacturing business

Buy raw materials and manufacture goods

Ex: computer manufacturer; food-processing company,etc

Merchandising business

Sell physical items (buy from a manufacturer)

Ex: clothing store; department store; grocery store, etc

Service business

Only sell services to customers, provide intangible things instead of physical and durable things. Provided by skilled people

Ex: accounting firm; catering company; cinema; teacher; doctor, etc

Claim Against the Assets

Owners (Called owner's equity)

Creditors (Called liabilities)

Financial Position

The current balances of the recorded assets, liabilities, and equity of an organization