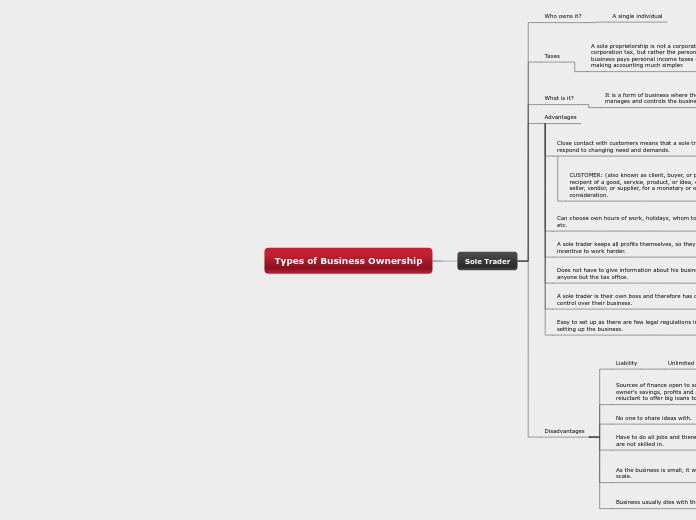

Direction of

the company

Control

Sources

Supply

Budget

trustworthy

costs

accounting records

both costs

Establishment

optimal combination

Volume

Utility

Cost

balance point

complex

Fixation

Prices

Determine

Total cost

accounting principle

reflects the

fixed costs

Level of

production

finished

Certain

Universal

accepted system

Profesión contable

physical

Valuación

process and finished

Higher

direct costing

Disadvantages

principle of

accounting

Accounting period

does not reflect the

fixed costs

production level

determined period

generate

disorients

unit costs

Minors

inventories

lower

Tradicional información

Decisions

Incomplete costing

Statement of income

loss caused

Ability

not factory

used

Advantage

have

Better control

sources

utilities

Comparison

units

values

Various periods

Obtaining

Break-even point

Fluctuations

Unit cost

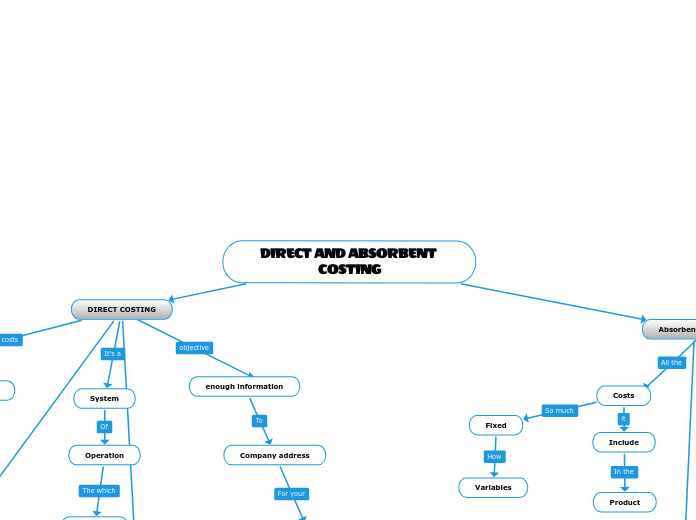

DIRECT AND ABSORBENT COSTING

Absorbent costing

Apply

Costing

valuation

Distribution

fixed costs

Variable costs

Manufacturing costs

Acknowledged

Method

Valuation

inventory

Purposes

External reports

Costs

Fixed

Variables

Include

Product

DIRECT COSTING

Production

Fixed costs

Constants

the capacity

Produce or sell an item

enough information

Company address

Process

planningstrategic

System

Operation

Evaluate

Sales cost

Variable manufacturing cost

Inventory

Variable Costs

assigned

Products