by Jeremy Green 12 months ago

153

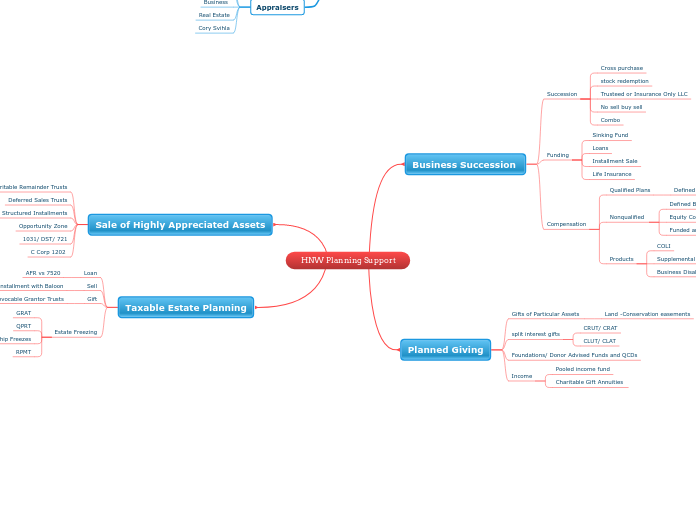

HNW Planning Support

High-net-worth (HNW) individuals often require specialized financial planning services to manage their wealth effectively. Strategies include the sale of highly appreciated assets and utilizing charitable remainder trusts to optimize tax benefits.