Recovery

Ratings risk

Patience wanes

Agressive -Post collateral, liquidate,

Duration

Investors

Goldilox deals

Insurance

mutual fund

Alliance Bernsteil

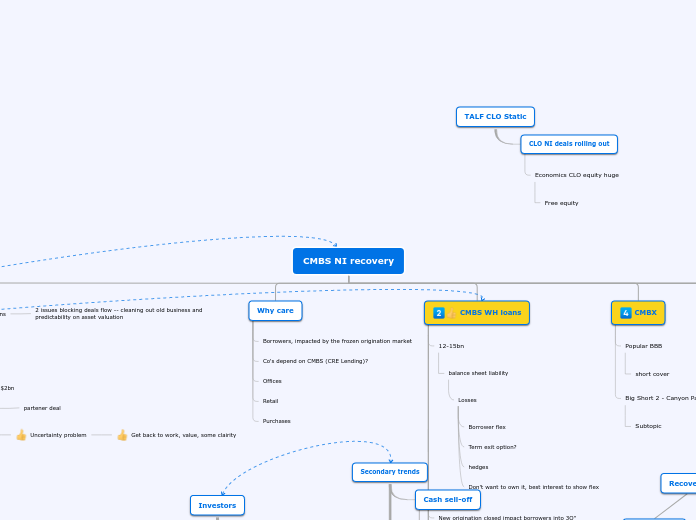

TALF CLO Static

CLO NI deals rolling out

Economics CLO equity huge

Free equity

Secondary trends

Buyers waiting

Opportunity funds

Cash sell-off

2-types seller--

forced sellers

raising cash-- recovery

YoY

Empirasign data, orderly flow

de-risk

impairment--

ratings

CMBS NI recovery

Questions

Profit

Risk

SFR Progressive

Single Family Rental, AAA 10x oversold

Progress Residential Trust (PROG) 2020-SFR2

TALF

Jawbone

SASB - liability

30% enhancement

NI TALF 1 not popular

CMBX

Big Short 2 - Canyon Partners 3/2019

Popular BBB

short cover

CMBS WH loans

Rating pressure, fixed costs, losses expand

Subtopic

Overtime harder to play nice forbearance runsout

Ratings, not wait until vaccine, Dec. turnaround, 1Q

Huge bargains at the high risk level of subs

Investors benefit stronger deals, harder to sell

New origination closed impact borrowers into 3Q''

12-15bn

balance sheet liability

Losses

Don't want to own it, best interest to show flex

hedges

Term exit option?

Borrower flex

Why care

Purchases

Retail

Offices

Co's depend on CMBS (CRE Lending)?

Borrowers, impacted by the frozen origination market

CMBS Conduit NI

Need to improve deals to grab investors

Not an investor problem like 2008

Uncertainty problem

Get back to work, value, some clairity

GS, DB Oversubscribed deals

4-5 more pipeline 700mm

WFCMT 2020-56

partener deal

Sized reduce from $2bn

Workouts

Transitional loans not for b/s

Borrower stress severe

Cover-Clean Portfolio

NEW-New issue hiatus 5-6mth BoA

Top of the story

3Q lull, until origination returns

2 issues blocking deals flow -- cleaning out old business and predictability on asset valuation