MAT.116

4.1

Effective Rate of Interest

Effective Rate of Interest Formula

r_eff = (1 + r/m)^m - 1

r_eff = APY (convert back to percent)

r = APR (convert to decimal)

m = conversion periods per year

Synonyms

Effective rate

APY

Equivalent simple interest rate (for one year)

Present Value

Present Value Formula for Continuous Compound Interest

P = Ae^(-rt)

A = future value (principal + interest) (dollars)

P = present value (dollars)

r = nominal interest rate (convert to decimal) (annual)

t = time (years)

Present Value Formula for Compound Interest

P = A(1 + r/m)^(-mt)

A = future value (principal + interest) (dollars)

P = present value (dollars)

r = nominal interest rate (convert to decimal) (annual)

m = conversion periods per year

t = time (years)

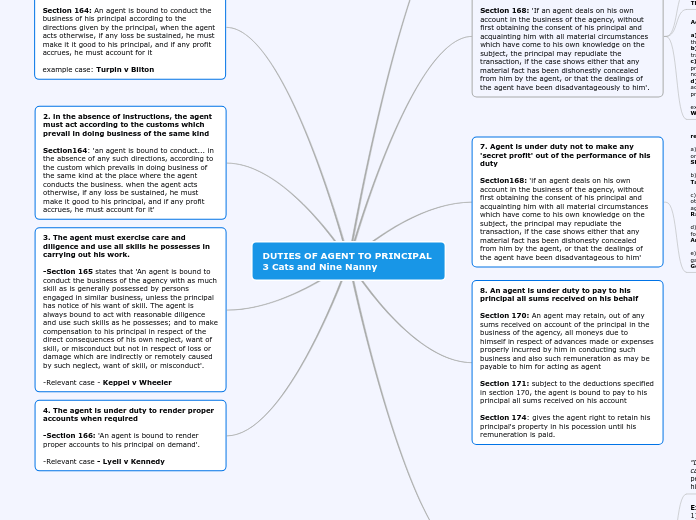

Terminology

Future value = accumulated amount

Present value = principal

These terms are tricky because they are really only relative to each other; that is, future value comes after present value in time.

Using Logarithms to Solve Problems in Finance

Guidelines

When the variable is an exponent, logarithms must be used to bring the variable out of the exponent.

The relevant rule is

log_b m^n = n log_b m.

However, if the variable is in the base of an expression with a fixed exponent, we can use roots to help in isolating the variable.

The relevant rule, assuming m represents nonnegative values, is

(m^n)^(1/n) = m.

Continuous Compounding of Interest

Uses

It is not practical for everyday interest calculations.

It is useful for certain theoretical work in finance.

It is also useful for quantities that don't increase at set intervals, like inflation and population growth.

Continuous Compound Interest Formula (Accumulated Amount)

A = Pe^(rt)

A = accumulated amount (principal + interest) (dollars)

P = principal (dollars)

r = nominal interest rate (convert to decimal) (annual)

t = time (years)

Infinite Interest?

Compound Interest

Compound Interest Formula (Accumulated Amount)

A = P(1 + r/m)^(mt)

A = accumulated amount (principal + interest) (dollars)

P = principal (dollars)

r = nominal interest rate (convert to decimal) (annual)

m = conversion periods per year

t = time (years)

Conversion Periods

We assume the conversion period is a constant length of time from one interest calculation to the next.

We represent the number of conversion periods in one year by the letter m.

Typical conversion periods are the following:

Annual, m=1Semiannual, m=2Quarterly, m=4Monthly, m=12Daily, m=365Nominal Interest Rates

Nominal

Stated

APR

Exponential Function

Simple Interest

Accumulated Amount Formula

A = P(1 + rt)

A = accumulated amount (principal + interest) (dollars)

P = principal (dollars)

r = interest rate (convert to decimal) (annual)

t = time (years)

Simple Interest Formula

I = Prt

I = simple interest (dollars)

P = principal (dollars)

r = interest rate (convert to decimal) (annual)

t = time (years)

Simple interest is only ever accrued based on the original principal.

Linear Function

Typically a function of time, though it can be thought of as a function of principal or interest rate