by Carla Chicaiza 4 years ago

1792

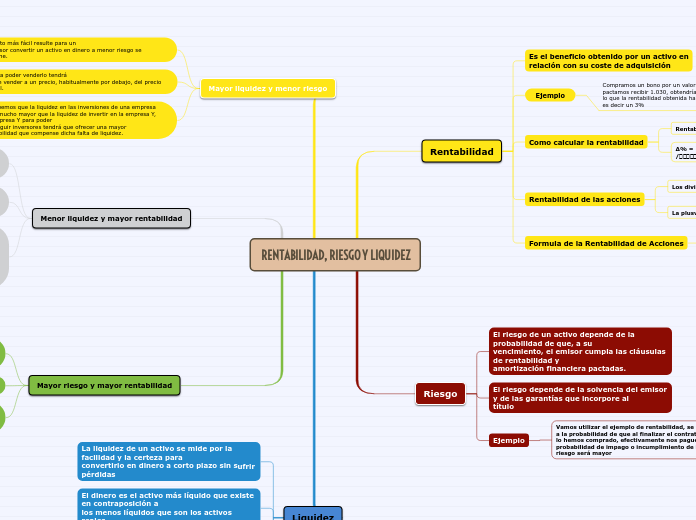

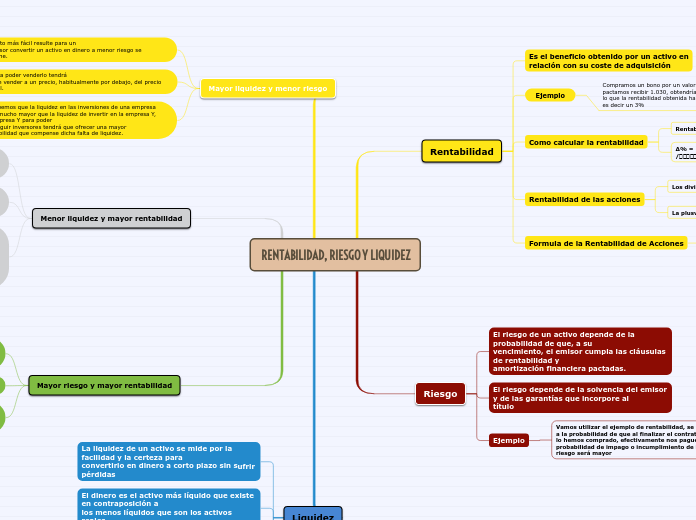

RENTABILIDAD, RIESGO Y LIQUIDEZ

by Carla Chicaiza 4 years ago

1792

More like this

The first division between continents was made by ancient Greek navigators, who named them 'landmass, terra firma'.

Generally classified by convention rather than any strict criteria, nowadays seven regions are regarded as continents from a geopolitical point of view.

Australia is the world's smallest continent and is also known as an 'island continent' as it is surrounded by water on all sides.

It includes 14 countries and it is the least populated continent.

Its name comes from the Latin word 'australis' meaning 'southern' because it lies entirely on the south of the equator.

The largest sandstone monolith can be found here and it is one of Australia's most recognizable natural icons. It is the largest monolith in the world.

Name this rock and write down one of the characteristics it is famous for.

The largest coral reef can be found here.

Name this coral reef, add its length and mention what type of coral is it.

Out of 14, how many countries you can name?

How about these countries' capitals?

North America has five time zones and it is the only continent with every type of climate.

North America was named after the explorer Amerigo Vespucci and is also known as the 'New World'.

The world's largest sugar exporter among the seven continents - Cuba - also called the 'sugar bowl of the world' is located here.

The specialty of some animals is they are found only in a particular region and nowhere else in the world. North America is home to many of such amazing animals.

Name at least 6.

Native Americans have lived along this river and its tributaries for thousands of years. Most were hunter-gatherers, but some formed agricultural societies.

Formed from thick layers of the river's silt deposits, this river's embayment is one of the most fertile regions of the United States; steamboats were widely used in the 19th and early 20th centuries to ship agricultural and industrial goods.

Name this river.

The world's largest freshwater lake by surface area and the third-largest freshwater lake by volume can be found here. It provides a route for the transportation of iron ore, as well as grain and other mined and manufactured materials.

Large cargo vessels called lake freighters, as well as smaller ocean-going freighters, transport these commodities across this lake.

Name this lake.

There are 23 countries that make up North America.

Name as many of you can! Don't forget about their capitals.

Europe is separated from Asia by the Ural mountains and the Caspian Sea.

It is surrounded by water on three sides: Mediterranean Sea in the south, Atlantic Ocean in the west, and the Arctic Ocean in the north.

Three-fourth of the world's potatoes grow in Europe.

Europe has many exceptional animals, birds, and reptiles with unique methods of staying and hunting.

Name at least 4 of them.

Europe is a large region, with several major rivers that connect its many countries. There are five primary rivers in Europe, and one of them flows through 10 countries, more than any other river in the world.

Name these rivers.

Es el beneficio que se obtiene fruto de la venta de dicha acción

Son la parte del beneficio de una empresa que se reparte entre los accionistas de la misma

Europe is one of the smallest continents, yet it is home to some of the largest mountain ranges.

About 20% of the total landmass of the continent is considered mountainous.

Name the 5 longest mountain ranges in Europe.

The most beautiful cities in the world can be found in Europe. History, architecture, arts, and famous cuisine is representative almost to each country.

Out of 51 countries how many you can name?

And how many capitals?