by Kayla Rampersad - Turner Fenton SS (2572) 6 years ago

176

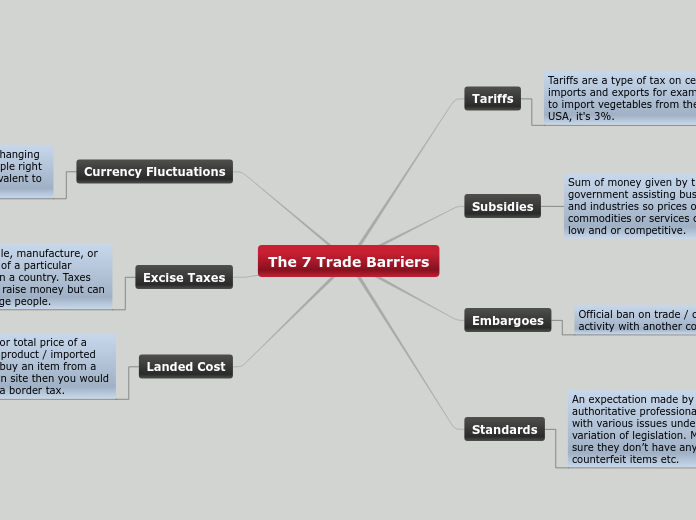

The 7 Trade Barriers

International trade involves several complex factors that can affect the overall cost and feasibility of importing and exporting goods. One significant factor is the landed cost, which includes all expenses associated with shipping a product, such as border taxes.