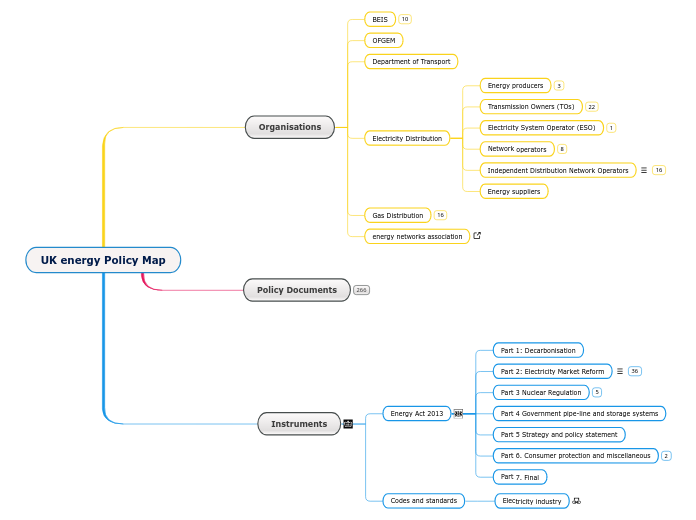

UK energy Policy Map

Instruments

Electricity industry

Energy Act 2013

Part 7. Final

Part 6. Consumer protection and miscellaneous

C2 Miscelllaneous

C1 Consumer protection

Part 5 Strategy and policy statement

Part 4 Government pipe-line and storage systems

Part 3 Nuclear Regulation

C5 Supplementary

C4 Functions of ONR

C3 Office for Nuclear Regulation

C2 Nuclear regulations

C1 The ONR's purpose

Part 2: Electricity Market Reform

Electricity Market Reform is a government programme aimed at attracting the investment needed to replace the UK’s ageing energy infrastructure and to decarbonise the UK’s electricity mix. This reform is the biggest change in the UK energy market since the privatisation in 1990.

The Electricity Market Reform aims to achieve its ambitions through two schemes:

- Contracts for Difference is a funding mechanism created to support new low-carbon energy generation capacity in the UK.

- Capacity Market is a mechanism for securing the electricity supply in the UK from reliable sources that can deliver energy when needed to provide back up for sources that are more intermittent like renewable energy sources.

C9 Miscellaneous

C8 Emmisions performance

C7 The renewables obligation: transitional arrangements

C6 Access to markets

C5 Conflict of interest and contingency arrangements

C4 Investment contracts

C3 Capacity market

3. Electricity Capacity Regulations (2014)

Roles and responsibilities

Roles and responsibilities under the Capacity Market

Regulator

- Monitoring the CM and enforcing the legislation

- Overseeing NGET’s delivery of its CM roles

- Making capacity market rules, while having regard to its principal objective, general duties, and the CM objectives

- Handling disputes which have been escalated following the Delivery Body disputes process

Capacity Market

Settlement

Services Provider

Elexon

- Carrying out verification of credit cover on behalf of the Settlement Body

- Procuring and managing settlement services and systems on behalf of the Settlement Body

- Managing changes to Balancing and Settlement Code (BSC) systems and documentation

Electricity

Settlements

Company (Settlement Body)

- Provide accountability, governance and control of the monies collected and disbursed under the Capacity Market (Payment) Regulations.

- Holding and monitoring credit cover from auction applicants;

- Verifying meter arrangements for capacity providers that either have complex sites or are not party to the Balancing and Settlement Code (BSC);

- Determining Capacity Market settlement disputes relating to the functions of the Settlement Services Provider; and

- Monitoring and reviewing the regulations relating to the settlement functions of the Capacity Market.

Delivery body

- Producing an annual capacity report for Government, which will advise on capacity requirements to meet the published reliability standard

- Operating core IT systems to support the running of capacity auctions, the pre-qualification process and the Capacity Market Register

- Operating business processes to support capacity auctions and pre-qualification, and producing supporting documentation/guides including the auction guidelines

- Operating business processes to support the management of each delivery year, e.g. contract management

- Appointing the Auction Monitor

Government

- Overall responsibility for policy and operation of the Capacity Market

- Reporting to Ministers / communication of Ministers’ decisions

- Finalising the design of new legislation and its implementation

- Producing the EMR Delivery Plan and annual updates to it

- Managing any future changes to regulations

- Determines the de-rating factors for interconnectors

Final Capacity Market Design presentation

Design

Payment

Delivery

Trading

Auction

Descending clock auctions

Capacity to procure

Capacity Market Rules

Policy Paper

The Electricity Capacity (Amendment) Regulations 2016

The Electricity Capacity (Amendment) (no.2) Regulations 2015

The Electricity Capacity (Amending )Regulations 2015

What is the capacity market

C2 Contract for difference

Low Carbon Contracts Company

Replaced Renewable obligation certificates

C1 General Considerations

Part 1: Decarbonisation

Policy Documents

Decarbonisation generalpolicy documents

Accelerating the decarbonisation of industrial clusters and dispersed sites

Continue to explore demand-side policies that support the development of markets for resource-efficient and low carbon products.

Increase availability of recycled materials and move to a more circular economy

through changes to regulation and increased accessibility of funding

Provide targeted UK Emissions Trading Scheme (ETS) free allowances on a

temporary basis and support from policies such as Carbon Border Adjustment Mechanisms (CBAMs)

Use Local Enterprise Partnerships (LEPs) and local authorities (LAs) to design local infrastructure plans in coordination with central government and devolved administrations.

Provide certainty of supply and a clear timeline for when low carbon hydrogen,

waste biomass, and carbon capture, utilisation, and storage (CCUS) will be available, using Contracts for Difference (CfDs) and government matchmaking.

Create incentives for electrification by increasing the availability of affordable

renewable electricity and shifting the burden of policy and network costs.

UK Energy White paper (Dec 2020)

Oil and gas

Industrial Energy

Buildings

Energy System

Gas Systems

We set price controls for the gas and electricity network companies of Great Britain. Price controls balance the relationship between investment in the network, company returns and the amount that they charge for operating their respective networks.

RIIO-2 is the second set of price controls implemented under our RIIO model. It's an investment programme to transform the energy networks and the electricity system operator to deliver emissions-free green energy in GB, along with world-class service and reliability.

We set the price controls according to the following sectors and timeframes:

RIIO-GD2

RIIO-GD2 is the price control for the gas distribution network, where network companies take gas from the transmission network and deliver it at safe, lower pressures to homes and businesses. The price control runs for five years, from 2021-2026.

Electrical Systems

UK Structure

Energy supply

Transmission and distribution network

Transmission Network Use of

System (TNUoS)

Tariff System

Residual Tariff

The residual tariff is a ‘balancing item’ and is set to ensure that the average TNUoS charge for all generators does not exceed the legal limit of €2.50/MWh. All generators pay the same residual tariff

Wider Tariff

Wider tariffs are intended to signal to generators the impact to the transmission system of connecting at different locations. As such, wider tariffs vary by geographic location of the point of connection with 27 charging zones across GB.

Generation charging zones are reviewed at the start of each price control period

Wider tariffs also vary by the generator type and historic output levels.

The load factor for each generator is re-calculated each year based on the three median outputs from the past five years of operation. There are two wider tariffs for intermittent generators in zone 3: the shared year round tariff and the not shared year round tariff.

These two tariffs are determined using the transport model under two different scenarios for generation operation.

The shared year round tariff is prorated by the load factor. The input parameters of the transport model are updated each year. The unit cost data associated with circuit types is reviewed at the start of each price control period

Transport model

Local substation Tariff

Local substation tariffs reflect the cost of the first MITS substation that each transmission connected generator connects to. These tariffs are updated annually for inflation. Beinneun Wind Farm connects to the GB transmission system at its local 132/33kV substation

Local circuit Tariff

Where a transmission connected generator is not directly connected to the MITS, the local circuit tariff reflects the cost of overhead lines and cables between the connection and the MITS. Local circuit tariffs are updated annually for inflation and for changes to network use (e.g. new connections). Beinneun Wind Farm is connected to the MITS at the Fort Augustus grid substation via 15km of 132kV overhead line. The use of this infrastructure is charged for through the local circuit tariff.

Main Interconnected Transmission System (MITS).

Review of TNUoS

Distributed System Operator

Consultation on Distributed System Operators

Reform to the long term development statement (LTDS) i

Reform to the long term development statement (LTDS) is the first key enabler in our work programme. Improvement to the LTDS is core to enhancing the availability of network forecasting and planning data, and will underpin a number of DSO functions.

Key enablers for DSO programme of work and the Long Term Development Statement

OFGEM Consultation

closed 2020

awaiting decision

Electricity System Operator

Transmission Network Owners

Reform to the Long Term

Development Statement (LTDS)

Energy generation

Balancing Services market

The ancillary (balancing) services market will continue to operate alongside both of the above mechanisms. Here, National Grid pays participants for the option to buy energy at an agreed price, helping National Grid in its obligation to keep the network in balance. Participants can be called on to provide generation or load-management capacity outside of stress events

STOR Short Term Operating Reserve

At certain times of the day we may need access to sources of extra power to help manage actual demand on the system being greater than forecast or unforeseen generation unavailability.

Where it is economic to do so, we will procure sources of extra power ahead of time through the STOR service. Providers of the service help to meet the reserve requirement either by providing additional generation or demand reduction.

The requirement for STOR varies depending on time of year, week and day.

Capacity market rules

smarter networks

energy networks innovation process ENIP

process document

Ofgem

Policy

RIIO

RIIO Revenue = Incentives + Innovation + Outputs

RIIO-T2 is the price control for the high voltage electricity transmission networks and high pressure gas transmission networks which transmit energy across Britain from where it is generated. The price control runs for five years, from 2021-2026.

The RIIO-T1 price control ran from 2013-2021.

RIIO-ED2

RIIO-ED2 is the price control for the electricity distribution network, where network companies take power from the transmission network and deliver it at safe, lower voltages to homes and businesses. The price control runs for five years, from 2023-2028.

The RIIO-ED1 price control covers the period from 2015-2023.

In the RIIO-ED2 price control, we will set regulated revenues and required outputs for the electricity distribution network operators (DNOs). In order to do this, we need information from the companies on the activities that they intend to undertake in RIIO-ED2, and their associated costs and outputs. Companies will provide this information to us in the form of a Business Plan, which we will then assess. Companies may earn a reward or be penalised based on our assessment of their plans.

RIIO-2 is the second set of price controls implemented under our RIIO model. It's an investment programme to transform the energy networks and the electricity system operator to deliver emissions-free green energy in GB, along with world-class service and reliability.

Keeping conumer bills low

Smart flexible energy system

Enabling whole system solutions

DSO Tranistion

Modernising energy data

Value for money for customers

Active programmes

Switching programme

Smart meter transition and data communication company &DCC)

REMIT wholesale market integrity

Onshore transmission project delivery

Offshore electricity transmission (OFTO)

Network price controls

2021-2028 (RIIO-2)

2013-2023 (RIIO-1)

Network cycber security

Network charging and access reform

Midata in energy programme

Interconnectors

Innovation Link

Gas System Operator Regulation (GSO)

Energy data and digitalisation

Electricity wholesale market lquidity

ESO (electricity system operator (ESO) regulation

Flexibility

Smart Power

BEIS: Future potential for Demand Side Response in Great Britain

BEISL Towards a smart energy system

National Infrastructure commission report

Subtopic

Full chain flexibility

Electricity system fexibility

Position Paper

Electricity settlement reform

Default tariff cap

Cosumer vulnerability protection

Capacity and Market EMR Dispute resolution

Industry

Compliance and eforcement

Renewables Obligation

The Renewables Obligation (RO) requires licensed electricity suppliers to source a proportion of the electricity they supply to UK customers from renewable sources. We set suppliers’ obligations as a number of Renewables Obligation Certificates (ROCs). The obligation levels for 2020/21, announced by the Department for Business, Energy & Industry Strategy (BEIS) on the 27 September 2019, are:

- 0.471 ROCs per MWh of electricity supplied to customers in England, Wales and Scotland

- 0.185 ROCs per MWh of electricity supplied to customers in Northern Ireland.

Using these obligation levels and multiplying by the total electricity supplied (MWh) to UK customers during this obligation period (1 April 2020 – 31 March 2021), the total obligation for 2020/21 is 119,090,744 ROCs. Split out for each obligation this is:

- 107,037,807 ROCs in England and Wales

- 10,694,439 ROCs in Scotland

- 1,358,498 ROCs in Northern Ireland.

Suppliers will have until 1 September 2021 to meet their obligations for 2020/21 (31 August for buy-out payments) by opting to either:

- Present ROCs to us;

- Make a buy-out payment of £50.05 per ROC; or

- Use a combination of ROCs and a buy-out payment.

Any suppliers who do not meet their obligations in full by the end of 1 September will need to make a late payment by 31 October.

RO Closed for new applications

Preplaced by CfD

ROCS 2020-2021

Codes and standards

Power & Energy

Gas and electricity

Retail Energy Code (REC)

Smart Energy Code (SEC)

Consolidated SEC

Gas

Supply Point Administration Agreement (SPAA)

Transition to the retail energy code

Retail Energy Code REC

NOW CLOSED

Independent Gas Transporter UNC (iGT UNC)

Uniform Network Code (UNC)

Electricity

System Operator - Transmission Operator Code (STC)

Distribution Code

Grid Code

Master Registration Agreement

Distribution Use of System Agreement (DCUSA)

Connection Use of System Code (CUSC)

Balancing and Settlement Code (BSC

Licensing

Network Innovation Allowance (NIA)

Ofgem Network Innovation Competition (NIC)

Ofgem Strategic Innovation Fund (SIF)

SIF Governance

SIF funding mecahnism

The SIF Funding Mechanism is established by the SIF Licence Condition. In each Regulatory Year, the Authority will calculate and, by direction, specify the net amount of SIF Funding (less any SIF Funding Return) that is to be paid to licensees and UKRI by the Electricity System Operator or NTS Owner, and the manner in which and the times at which the Electricity System Operator or NTS Owner is required to transfer that SIF Funding those funds. Recovering adm

Use of the ENA Smarter Networks Portal

Phases

Beta Phase

The Beta Phase focuses on the deployment of the solution to the Problem. The duration of the Beta Phase will depend on the scale and complexity of the solution deployed. Beta Phases will be of between six months’ and five years’ duration. Beta Phases are the largest of the Project Phases.

Alpha Phase

The Alpha Phase will focus on preparing and testing the different solutions to the Problem that are identified during the Discovery Phase, ahead of any future large-scale demonstration of the Project. It will also test the riskiest assumptions

Discovery Phase

: The Discovery Phase will define the Problem and the value in solving the Problem. It will also facilitate a common understanding of what energy consumers and network users need from the innovation and identify any constraints that may impact on solution of the Problem and options for the management of those constraints.

Costs

Route to market

Project plan and milestones

Impact

Innovation justification

The big idea

Project Summary

Problem definition

Criteria

Eligibility Criterion 8: Projects must be well thought through and have a

robust methodology so that they are capable of progressing in a timely manner.

Eligibility Criterion 7: Projects must provide value for money and be costed

competitively.

Eligibility Criterion 6: Projects must include participation from a range of

stakeholders

Eligibility Criterion 5: Projects must be innovative, novel and/or risky.

Eligibility Criterion 4: Projects must not undermine the development of

competitive markets.

Eligibility Criterion 3: Projects must involve network innovation

Eligibility Criterion 2: Projects must have clearly identified potential to

deliver a net benefit to gas or electricity consumers (whomever is paying for the

innovation).

Eligibility Criterion 1: Projects must address the Innovation Challenge set by

Ofgem.

Must cover two of these areas

8. Novel approaches to infrastructure investment, such as:

c. Determining the economic investment required for network resilience and

reliability through and beyond the transition

b. Coordinating approaches to siting assets to deliver more efficient capital

investment on the system

a. How to maximise efficiency in large scale network and system investments by

taking systems view across generation and demand side changes linked to

decarbonisation

7. Future policy and regulatory conditions as well as market designs to support whole

system approaches

6. Utilisation of data and development of new approaches which harness greater value

5. Assess the costs of potential energy demand reduction activities against alternative

interventions

4. Evaluating the costs and opportunities of repurposing or decommissioning existing

infrastructure and/or assets

3. Complementary and competing priorities between local, national, and international

energy systems

2. Coordinating energy transmission, distribution and system operation across gas and

electricity

1. Current and future needs for energy provision for heat, power, and transport

The SIF will support network innovation that contributes to the achievement of Net Zero, while delivering net benefits to energy consumers. It will coordinate network innovation funding with other public sector funding initiatives, thereby ensuring greater flexibility and strategic alignment in innovation funding, and eliminating both unnecessary duplication and funding gaps.

lean delivery, sprinters not supertankers

focus on commercialisation

integrated innovation and regulatory change

simplified application process with reduced barriers to entr

Responsive flexible challenges

zero emission transport

heat

data and digitalisation

whole system integration

Collaborative Foundation

Innovation Challenge

understand consumers’ preferences to inform future market designs which will help to optimise across networks and infrastructures.

improve coordination of emerging innovations across networks, generators, market participants, investors, local & national policy makers, consumers, and other key stakeholders

reduce complexity, bureaucracy and barriers to entry

reduce duplication and excessive variation of products, processes or services.

improve coordination between networks and other system participants

Ofgem Innovation Vision 2021 – 2025

Priority Innovation

Data & Digitalisation

Energy Data innovation aligned with

the Modernising Energy Data Programme

Cyber

Security

Future if Retail

Consumer Consumers’

role and acceptability

of products and solutions

Low Carbon Infrastructure

Electric Vehicles (EVs)

Smart Energy and

Energy Storage

Local: Localised approaches to decarbonisation

Gas & Hydrogen

Feasibility and safety

Built environment

Principles

Information on innovation should be widely disseminated

Innovation should be customer focused

Innovation should create value for the whole system

Strategy

Our strategy

6. Efficiency

5. Confidence

4. Partnership

3. Standards

2. Competition

1. Regulation

Ofgem strategic narrative: 2019-23

Transport

Power

Modelling

Consumers

Targets

Building world-leading digital

infrastructure for our energy system

Growing the installation of electric

heat pumps,

Consulting on whether it is

appropriate to end gas grid connections to new homes being built from 2025

Aiming to bring at least one large scale nuclear project to the point of Final Investment Decision

Establishing a new UK Emissions

Trading System,

Supporting the deployment of CCUS

in four industrial clusters

Targeting 40GW of offshore wind

by 2030

The Ten Point Plan (Nov 2020)

Point 10: Green Finance

and Innovation

Point 9: Protecting Our

Natural Environment

Point 8: Investing in Carbon

Capture, Usage and Storage

CCUS Incentivization and business model

Industrial carbon capture business model: May 2021 update

Industrial carbon capture - indicative heads of terms: December 2020 update (Annex E)

Dispatchable power agreement (DPA) business moel

Dispatchable power agreement (DPA) - heads of terms: December 2020 update (Annex D)

Dispatchable power agreement (DPA) - detailed explanation and examples: December 2020 update (Annex C)

Transport and storage business model

Transport and storage services (T&SCO) - government support package draft commercial principles: December 2020 update (Annex B)

Transport and storage services (T&SCO) licence - draft commercial principles: December 2020 update (Annex A)

Carbon capture, usage and storage: an update on business models (December 2020)

Point 7: Greener Buildings

Point 6: Jet Zero and

Green Ships

Point 5: Green Public Transport,

Cycling and Walking

Point 4: Accelerating the Shift

to Zero Emission Vehicles

Zemo partnership

Introduction of E10 Petrol

E10 petrol contains up to 10% renewable ethanol, which will help to reduce carbon dioxide (CO2) emissions associated with petrol vehicles and tackle climate change. Petrol in the UK currently contains up to 5% renewable ethanol (known as E5).

E10 petrol is already widely used around the world, including across Europe, the US and Australia. It has also been the reference fuel against which new cars are tested for emissions and performance since 2016.

Renewable Transport Fuel Obligation

nder the RTFO suppliers of transport and non road mobile machinery (NRMM) fuel in the UK must be able to show that a percentage of the fuel they supply comes from renewable and sustainable sources. Fuel suppliers who supply at least 450,000 litres of fuel a year are affected. This includes suppliers of biofuels as well as suppliers of fossil fuel.

The RTFO only covers biofuels used in the transport and NRMM sectors. For information on using bioliquids or biomass to generate heat or electricity see the Ofgem website.

Reform

Amending the Renewable Transport Fuels Obligation (RTFO) to increase carbon savings on land, air and at sea

Draft Legislation: The Renewable Transport Fuel Obligations (Amendment) Order 202

Targeting net zero - next steps for

the Renewable Transport Fuels

Obligation

Guidance

Demonstrating compliance: evidence

requirements

Use of Solar to generate hydrogen

Evidence of feedstock type in claims for double counted feedstocks

11.16 Considering the financial incentive that double counting of certain feedstocks presents, it will be particularly important to examine evidence of feedstock type for these claims. Evidence will be required that the fuel is indeed made from the feedstock that has been claimed and this evidence must come from the origin. Evidence will vary with feedstock type and source. For example, in the case of used cooking oil, evidence of the original collection of the oil from restaurants or other catering establishments would be required.

11.17 For RFNBOs, evidence of the amounts of each type of renewable electricity and/or renewable heat and/or renewable cold purchased will be required, providing assurance that bioenergy or fossil energy inputs have not been used to generate wholly RFNBO fuel volumes. Evidence that the feedstocks (materials providing atoms to the fuel) used (e.g. water, CO2) do not contain any energy will also be needed. In addition, evidence will be required that the fuel is indeed made from the process energy that has been claimed, and this evidence regarding the process energy must come from the origin (see section 10.14). For example, in the case of solar electricity, a power purchase agreement, or proof of ownership of the solar generation plant by the RFNBO plant, and meter readings would be required, plus a statement regarding the connection to the grid

Technologies

EVs

Fuels

High blend reneawble fuels

Biomethane

Hydrotreated vegetable oils

Biodiesels

B100

EN141214

B30

EN16709

B20

Hydrogen Belnded

Hydrogen Fuel Cell

Point 3: Delivering New and

Advanced Nuclear Power

Point 2: Driving the Growth

of Low Carbon Hydrogen

Hydrogen Incentivization and business model

Low Carbon Hydrogen Business

Model: consultation on a business

model for low carbon hydrogen

UK hydrogen strategy (Aug 2021)

UK Hydrogen analytical index

Point 1: Advancing

Offshore Wind

Organisations

energy networks association

Gas Distribution

Gas distribution operators

Wales&West Utilities

Cadent

Northern GAs Netwroks

SGN

SGN Natural Gas

furmus energy

Phoenix Natural Gas

Gas transmission operator

Northern Ireland

GNI (UK) Limited (North-South(

Belfast Gas Transmission Limited

Premier Transmission Limited

Manx utilities

national grid

Electricity Distribution

Energy suppliers

Independent Distribution Network Operators

Independent Distribution Network Operators (IDNOs) own, operate and maintain the newer parts of the electricity grid that supply housing and commercial developments and are directly or indirectly connected to the main distribution network. IDNOs do not have a specific geographical area and are regulated by Ofgem.

Vattenfall

Utility Assets

UK Power Distribution

Murphy

Leep Utilities

Last Mile Asset Management

Indigo Power

Harlaxton Energy Networks

GTC

Independent Power Networks Limited

The Electricity Network Company

Fulcrum

Forbury Assets Ltd (FAL) (SSE Eneterprise)

ESP Utilities Group

Energy Assets Networks

Eclispse Power Networks

Network operators

Western Power Distribution

UK Power Networks

Electricity North West

Northern Powergrid

Manx Utilities

Northern Ireland Energy Networks

Scottish and Souther Electricity Networks

Electricity System Operator (ESO)

National Grid ESO

Transmission Owners (TOs)

Northern Ireland Electricity Networks

National Grid

SP Energy Networks

Scottish and Southern Electricity Networks

Transmission

RIIO-T2

Full business plan

Five Goals

£199 million in efficiency savings from innovation

One third reduction in our greenhouse gas emissions

Every connection delivered on time

Aim for 100% transmission network reliability

Transport the renewable electricity

Innovation

Future energy - Local network plans for RIIO-ED2

Transition to DSO

Identifying the most cost effective solutions for energy customers

Enabling the energy transistion

Maintaining a safe and reliable grid

My electric avenue

Distribution

Transition

Energy producers

Balancing Services Market

Short Term Operating Reserve (STOR)

Capacity Market Supply

Department of Transport

OFGEM

BEIS

Companies (organisations)

Low Carbon Contracts Company & Electricity Settlements Company

Capacity Market

- Make sure we have enough reliable capacity to meet our peak electricity demands (typically winter evenings) and at the lowest cost to consumers

- Only procure what is necessary using competitive auctions. These are open to both power generators who can commit to be available when needed, and to large electricity users, who agree to reduce their usage when needed.

CfD's

Contracts for Difference works by creating a private contract between the renewable or low-carbon electricity generator and the Low Carbon Contracts Company (LCCC).

Generators can bid for these contracts in auctions if they meet the eligibility criteria to participate. These auctions are held every few years with a fixed budget and the aim to guarantee future electricity generation from the development of new low-carbon generation capacity.

The contract agrees to pay the difference between the strike price and the reference price for electricity generated. The strike price is the price that the generator bids at and this should reflect the cost of the investment in the generation technology. The reference price is the indicator of what the average market price for electricity will be in the UK.

The difference between these two prices is paid to the generator to subside the development and generation of the electricity. The generator will only receive payments when the project starts to generate electricity. The generator would still sell the electricity to energy market as usual but would receive this top-up to reach the agreed strike price.

This top-up amount is then charged as a levy on electricity suppliers under the Contracts for Difference (Electricity Supplier Obligation) Regulations 2014. The payment of the top-up amount and the levy on electricity suppliers is managed by the Low Carbon Contracts Company.

Framework document

Challenges

3. investment challenge

2. replacing old power stations

1. decarbonisation

Priorties

- fight coronavirus by helping businesses to bounce back from the impacts of COVID-19, supporting a safe return to the workplace and accelerating the development and manufacture of a vaccine

- tackle climate change: reduce UK greenhouse gas emissions to net zero by 2050

- unleash innovation and accelerate science and technology throughout the country to increase productivity and UK global influence

- back long-term growth: boost enterprise by making the UK the best place in the world to start and grow a business