by Sebastian Szymanek 4 years ago

265

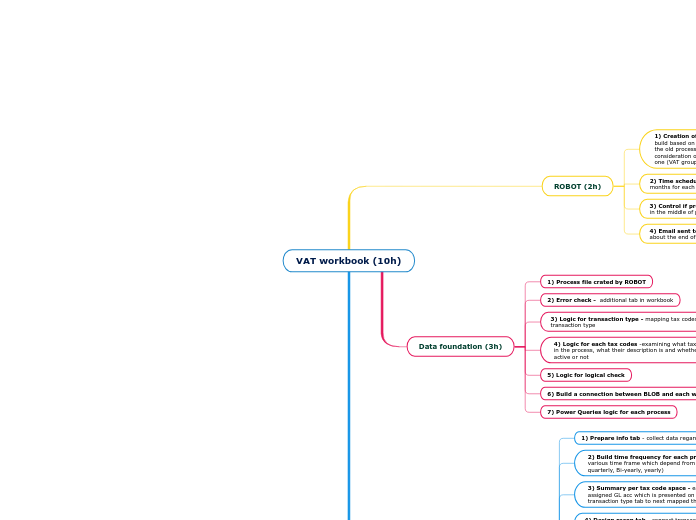

VAT workbook (10h)

The document outlines a structured approach to managing and automating VAT-related processes using a robot. Key tasks include creating variants based on time frequency and comparing them with old processes to ensure data integrity.