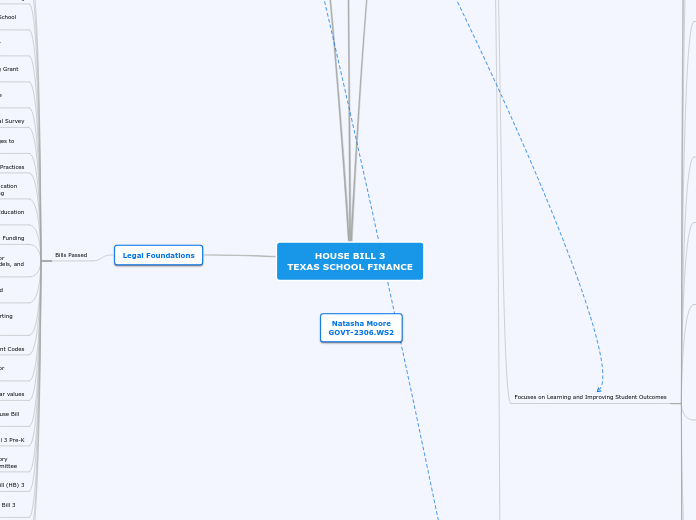

Natasha Moore

GOVT-2306.WS2

HOUSE BILL 3

TEXAS SCHOOL FINANCE

Legal Foundations

Bills Passed

House Bill 3 (HB3) Implementation: Tax rate compression

House Bill 3 (HB3) Implementation: Salary Increases

Minimum Salary Schedule Increase pursuant to House Bill 3 (HB3)

TEA Information Resources on House Bill (HB) 3

House Bill 3 (HB3) Implementation: State Compensatory Education (SCE) Allotment and the SCE Advisory Committee

House Bill 3 Pre-K

Recapture Formula Changes and Reductions Under House Bill 3 (HB 3)

House Bill 3 (HB 3) Implementation: Current year values

House Bill 3 (HB 3) Implementation: College, Career, or Military Readiness Sections

Updates to Program Intent Codes

House Bill 3 (HB 3) Implementation: Changes to Reporting Requirements and Creation of the Registry of Persons Ineligible to Work in Public Schools

House Bill (HB 3) Implementation: Small and Mid-sized District Allotmen

House Bill 3 (HB 3) Implementation: College, Career, or Military Readiness CTE, Incentives for High School Models, and High School Equivalency

House Bill 3 (HB 3) Implementation: Charter School Funding

House Bill 3 (HB 3) Implementation: Gifted/Talented Education Certification and Funding

House Bill 3 (HB 3) Implementation of the Special Education and Dyslexia Allotment and Senate Bill 2075 Monitoring

House Bill 3 (HB 3) Implementation: Reading Practices

House Bill 3 (HB 3) Implementation: Update on Changes to the Bilingual Education Allotment

House Bill 3 (HB 3) Implementation: Teacher Appraisal Survey

House Bill 3 (HB 3) Implementation: Teacher Incentive Allotment

House Bill 3 (HB 3) Implementation: Blended Learning Grant Program

House Bill 3 (HB 3) Implementation: Reading Advisory Committee

House Bill 3 (HB 3) Implementation: Additional Days School Year

House Bill 3 (HB 3) Implementation: Transportation Funding

House Bill 3 (HB 3) Implementation: Financial Aid Application

House Bill 3 (HB 3) Implementation: K-2 Diagnostics

Interest Groups

Opponents

lawmakers favoring district control of educator salaries

Supporters

School District Employees

Texas Education Agency

Texas Association Of School Administrators

Texas Commission on Public School Finance

Texas Association of School Boards

Texas State Teachers Association

Association of Texas Professional Educators (ATPE)

Texas Parent PAC

Texas Home School Coalition Association

Teachers

Parents

Goals

What the policy says

Reduces and Reforms Property Taxes and Recapture

New Requirements for Local Tax Increases

Bond election notices must include “THIS IS A PROPERTY TAX INCREASE” language

Tax Ratification Elections (TREs) must happen on uniform election days

New statutory language clarifies that a school district may not increase the M&O tax rate in order to create a surplus for the purpose of paying the district’s debt service. (i.e. no more “swap and drops” or “tax swaps”)

Effective January 1, 2020, Efficiency Audits must take place before a district seeks voter approval for increasing tax rates. LBB establishes the guidelines for the audit. Districts must select the auditor at least four months before the scheduled tax increase election date;

Max M&O Tax Rates Drop From $1.17 To $1.068

Recapture cut from $3.6B to $2.0B in year one

Additional board local discretion

Tax rates continue to decline as property values grow

more than 2.5%

Tax rates drop an average of 8 cents in year one

Focuses on Learning and Improving Student Outcomes

Subsidizes High School Equivalency Exams

Requires TEA to enter into a MOU with the Texas Workforce Commission to fund a subsidy for persons 21 years of age and older to take high school equivalency exams

Blended learning Grant Program

Establishes a blended learning grant program that prioritizes LEAs with the highest enrollment of educationally disadvantaged students

Math Innovation Zones blended learning program qualifies

A school may receive a grant for no more than four consecutive years.

To receive a grant, a school must:

Provide a report on outcomes of blended learning model (after 4th year)

Certify to TEA the implementation of the blended learning model

Provide training to teachers/personnel on effective blended learning practices

Develop a blended learning plan

Expanding Learning Opportunities

Additional Instructional Days

Summer CTE Grant Program:

Commissioner may collaborate with a private entity for this program

Establishes a grant program for career and technology courses during the summer

funding support for school systems that want to add instructional days (beyond the minimum 180 days) to one or more of their elementary school calendars:

takes effect for the 2020-21 school year

Not subject to compulsory attendance

Campuses receive the greater of the funding under district/charter partnerships (SB 1882, 85th Regular Session) or additional instructional days - not both

Half-day ADA funding for up to an additional 30 days of instruction (i.e. days 181 to 210)

For grades Pre-K to grade 5

Increased SPED support

New Dyslexia Allotment and CCMR Funding

Establishes CCMR outcomes bonus funds for each special education student who graduates college, career, or military ready

In addition to other CCMR outcomes bonuses for which the student may help the district earn funding, every student who receives special education and graduates CCMR entitles a district to $2,000

Additional funding is provided to support students with Dyslexia

Students may qualify for both SPED and Dyslexia Allotments

School districts and charter schools will now receive a weight of 0.10 multiplied against the Basic Allotment for each student that has been identified as having dyslexia or a related disorder

Increased Resources, Planning and Training

Requires the Commissioner to establish a Special Education Advisory Committee to make recommendations regarding financing special education

Committee report due by May 1, 2020 which includes an analysis of moving towards funding services rather than instructional arrangement

Authorizes a district to pay compensation incentives to teachers that complete autism training at a regional Education Service Center (ESC)

Increases Special Education weight from 1.1 to 1.15 for students served in a mainstream setting

Outcomes Bonus and CTE Funding Expansion

Removes High School Allotment

Previous funding for the HS Allotment has been redirected to the basic allotment

Requires every student to fill out a FAFSA to graduate (Allows for opt-out)

Establishes a FAFSA advisory board to advise on policy and implementation

Adds a reimbursement to districts to offer one free college & one free industry entrance exam per student before they graduate

Reimbursement for one HS student for any of the 220 approved Industry Based

Credentials (IBC)

Reimbursement for one HS student for SAT/ACT/TSIA

CTE funding expansion

New funding to support the P-TECH and New Tech HS models

Extends to CTE & Tech Apps courses offered in grade 7

Adds Technology Applications to funding weight – including all computer science

Establishes a CCMR Outcomes Bonus paid for each annual graduate above a certain threshold percentage. Requires Commissioner to adopt rules

Special Education: In addition to the above, $2,000 for each CCMR graduate enrolled in special education

Non-Economically Disadvantaged: $3,000 for each CCMR graduate (Likely to be above the first 25% of non eco-dis graduates)

Economically Disadvantaged: $5,000 for each CCMR graduate (Likely to be above the first 13% of eco-dis graduates)

College, Career, and Military Readiness Plans

Requires boards of school districts and open-enrollment charter schools to adopt college, career and military readiness plans and post on their website

Boards must monitor progress towards the goals at least annually

Goals are adopted for all students, and for disaggregated student groups

Boards must set specific annual college, career and military readiness performance goals for each campus for five years

Dual Language

Expands the Bilingual Education Allotment to increase student support for literacy in English and other languages

Requires TEA to develop tools to assist school districts and charters to implement these programs

Incentivizes districts to integrate English learners and native English speakers into dual language programs

Includes incentivized funding for dual language

0.05 for native English speaking students

0.15 for LEP students

two-way program models

Dyslexia funding

School districts and open-enrollment charter schools now receive a weight of 0.10 multiplied against the Basic Allotment for each student that has been identified as having Dyslexia or a related disorder

Improved Reading Diagnostic Instruments

HB 3 amends statute regarding the use of kindergarten readiness reading diagnostics

Districts must communicate the result of this diagnostic to parents within 60 calendar days

Requires the Commissioner to establish a common kindergarten readiness standard to ensure alignment across the state

Requires the Commissioner to adopt a multi-dimensional assessment tool that includes a reading instrument

Preparing New Teachers

To earn a certificate to teach Pre-K to grade 6, a candidate must demonstrate proficiency in the science of teaching reading on a certification examination by January 1, 2021

Word comprehension

Phonological Awareness

Syllables, phonemes etc.

Decoding

Alphabet, sound correspondence

Sight Recognition

of familiar words

Language comprehension

Literacy Knowledge

Print concepts, genres, etc.

Verbal Reasoning

Inference, metaphor etc.

Language Structure

Syntax, semantics, etc.

Vocabulary

Breadth, precision, links etc.

Background Knowledge

Facts, concepts, etc.

Improving Reading Outcomes

HB 3 amends statute to include multiple reading initiatives

Requires TEA to:

Establish a Reading Standards Advisory Board

Monitor implementation and report to the legislature

Provide technical assistance

Requires districts to certify to the TEA that the district:

Has integrated reading instruments to support Pre-K to grade 3 students

Prioritizes placing highly-effective teachers in K-2 and

Requires each teacher and principal in grades K-3 to attend reading academies by 2020-2021

Requires districts and charters to provide a phonics curriculum using systematic direct instruction in grades K-3

Early Literacy and Mathematics Proficiency

Requires boards of school districts and open-enrollment charter schools to adopt literacy and mathematics proficiency plans and post on their website

Plans must be posted online

School boards must monitor progress toward those goals at least once annually

Goals are adopted for all students and for disaggregated student groups

Boards must set specific annual reading and mathematics performance goals for each campus for five years

Full day Pre-K and K-3 reading support

To support districts who may need time to reach the quality requirements, a waiver is available

Waivers last up to three years and may only be renewed once

District must demonstrate they sought a public-private partnership

Requires consideration of partnerships with quality child care providers before issuing bonds for new classrooms

Requires high-quality program requirements of all prekindergarten classrooms in Texas

Early Education Allotment

Who is educationally disadvantaged or Limited English Proficient (LEP)

A student who is both educationally disadvantaged and limited English proficiency generates a funding weight of 0.20

In grades K-3

Funds must be used to support implementing early literacy and mathematics proficiency plans that lead to improved third grade proficiency

Increases Funding and Equity

Formula Transition Grants

The formula transition grant expires after five years (SY 2023-24)

Except for a small number of districts that received the 1992/93 hold harmless, no districts or open-enrollment charter schools lose funding relative to old law during SY 2019-20 or SY 2020-21

For school years ending in odd years (SY 2020-21, SY 2022-23, and SY 2024-25) school districts and charter schools receive the better of SY 2019-20 or SY 2020- 21 under old law

School districts and open-enrollment charter schools are entitled to receive the lesser of 103% of the M&O funding they would have received under old law, or 128% of the state average M&O funding under old law

Other Changes To Equalize Funding

Repeals the Staff Allotment and redirects the funding to the basic allotment

Disaster Aid, when appropriated, applies equally to recapture and non- recapture districts

Disaster aid for facility repair now includes vehicles and computer equipment

In prior law, only Chapter 41 districts received the ASF on top of their Tier One entitlement

Establishes an Equalized Wealth Transition Grant

The grant establishes a 5-year glide path off of the 1992-1993 Chapter 41 hold harmless (repealed by HB 3)

Recapture No Longer Impacts District Entitlement

Recapture for school year 2019-20 is reduced from $3.55 billion to $1.95 billion (45%)

Early Agreement Credit on recapture has been repealed

Recapture is now local revenue in excess of entitlement instead of on a wealth per WADA basis

Districts are now guaranteed that recapture will not reduce revenue below their entitlement level

Small and Mid-sized District Allotment

Establishes Small and Mid-sized adjustment as a stand-alone allotment

Adds new small district formula for districts under 300 students that are the only district in a county

Small and Mid-sized continues to be a multiplier for the Special Education Allotment to ensure maintenance of financial support.

Charter schools will now receive the weighted average funding amount for the Small and Mid-sized Allotment, with certain adjustments.

This new allotment improves transparency and separates student centric weights from district centric weights

Transportation Funding Changes

Amends statute for transportation from linear density to a simple $1.00 per mile reimbursement (set at $1.00 per mile in the General Appropriations Act)

Certain new transportation options have become eligible fo

Dual credit students (to a local college or a neighboring district)

Work-based learning site transportation under a district’s CTE program

Homeless students (regardless of distance to campus)

Previously, transportation funding was not provided to Chapter 41 districts. Now, transportation funding is equally available to all districts.

Gifted and Talented Allotment

If Commissioner determines a district has failed to comply, TEA shall reduce funding in an amount equal to the basic allotment multiplied by 0.12 and 5% of the students in ADA

Requires school districts and open-enrollment charter schools to continue to provide GT programs

Requires each district to annually certify to the Commissioner that the district has established a program for gifted and talented students

A district shall adopt a policy regarding the use of funds to support the program

Removes the Gifted & Talented (GT) Allotment as a discrete, stand-alone Tier One allotment

The GT Allotment funding amount was reallocated into the basic allotment

Fast Growth Allotment and NIFA

Increases the New Instructional Facility Allotment (NIFA) maximum annual appropriation from $25 million to $100 million

This increase aligns with the increase to the per student multiplier (from $250 to $1,000) that occurred in 2017

Adds a Fast Growth Allotment of 0.04 for each student in ADA to support rapidly growing districts

Final methodology subject to TEA rulemaking

Open-enrollment charter schools are not eligible

The top 25% of districts by enrollment growth over three years are designated as “Fast Growth” and are eligible for the allotment

Switch To Current Year Values

Utilizes current tax year property values (vs. prior tax year property values) for the local share calculation

This change almost completely eliminates the impact of property wealth on a district’s Tier One budget, so that Tier One is funded entirely based on formula determinations of student need and district characteristics

This change effectively rolls the “lag money” that previously resulted in varying amounts of revenue available to districts above or below formula entitlement into the basic allotment to equally benefit all districts

Cost of Education Index

Repeals the Cost of Education Index (CEI), so districts no longer receive funding based on a decades old metric

Requires TEA to study geographic variations in resource costs and cost of education, including transportation

Support for High-Needs Schools

Establishes a Drop Out Recovery and Residential Facility Allotment

Adds $275 per student in ADA in a drop out recovery school or residential facility

Equal treatment of ASF funding

Current year values equalizing Tier One

New Compensatory Education Spectrum

Comp Ed funding is provided for students who are educationally disadvantaged (i.e. eligible for free and reduced-priced lunch)

Formula for Comp Ed increases from 0.20 to a range of 0.225-0.275 per student based on the census block group of the student’s home address

Requires TEA to enact rules for tiering criteria

Requires TEA to establish an Advisory Committee on the Comp Ed Spectrum approach

Supports Teachers and Rewards Teacher Excellence

Do Not Hire Registry

All public schools must investigate and report suspected abuse or solicitation of a student or minor regardless of a resignation. Schools must also terminate, or otherwise not hire, anyone listed on the registry

TEA is required to create a new Do Not Hire Registry and place individuals on the Registry

Were found to be ineligible due to having certain criminal history

Were found by the Commissioner to be a non-certified person who abused a student or minor, or solicited / engaged in an inappropriate relationship with a student or minor

Had a State Board for Educator Certification (SBEC) certificate previously revoked for abusing a student or minor, or soliciting / engaging in an inappropriate relationship with a student or minor

Teacher Mentor Allotment Program

Districts must meet certain quality requirements when implementing their mentoring programs

Mentors must be trained, must cover specific topic areas with their mentees, and must have designated time to provide training to the new teachers whom they are mentoring

Mentors must work with new teachers immediately after they start and for their first two years as teachers

Increased Minimum Salary Schedule

This increases the minimum salary schedule (MSS) by $5.5K-$9K per creditable year of service (CYS)

Teacher Retirement System (TRS) contributions from the state for all who are subject to the MSS will be increased, reducing the amount LEAs fund out of their own budgets

Teacher Incentive funding

Funding ranges from $3,000-$32,000 per teacher per year, using new Compensatory Education spectrum system

goal of a six-figure salary for teachers who prioritize teaching in high needs areas and rural district campuses

30% of a district’s budget increase must go to increases in compensation & 75% of this total must go to teachers, librarians, counselors, and nurses, with priority given to veteran classroom teachers (greater than 5 years experience)

Funding Increases On Average - $635 per ADA