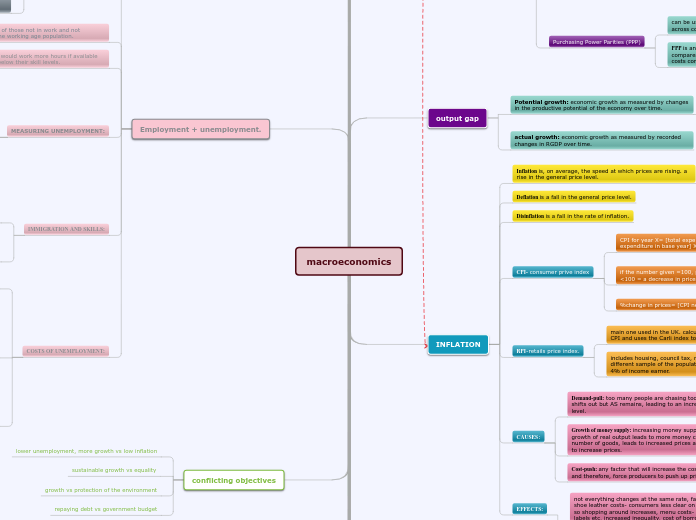

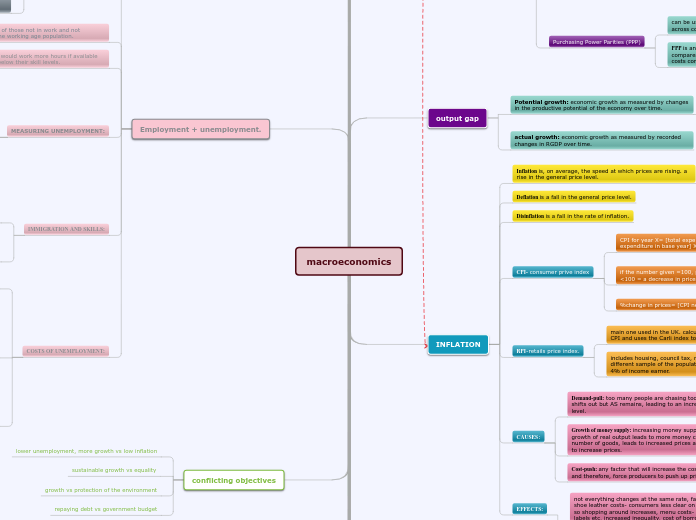

macroeconomics

the multiplier

MPW: the increase in withdrawals from the circular flow (S+T+M) divided by the increase in income that caused them.

MPS: the increase in saving divided by the increase in income that caused it.

the multiplier effect: an increase in investment or other injection will lead to an even greater increase in income. 1/MPW

Balance of Payments

current account imbalances: high economic growth is often associated with low unemployment and increased inflationary pressures.

Primary and Secondary Incomes

SECONDARY: a range of transfers to and from overseas organisations. example of an invisible.

PRIMARY: loan of factors of production abroad. in the UK mainly from interest, profit and dividends on assets owned abroad.

trade in services

trade in intangibles therefore, invisibles. bought by foreigner the money goes into the UK called export credit in services, if bought by the UK known as debits.

Current Account

Visibles: trade in goods. visible exports result in an inward flow of money and are recorded as a +. visible imports are -. VALUE OF ALL VISIBLES=BALANCE OF TRADE.

where payments for the purchase and sales of goods and services are recorded.

conflicting objectives

repaying debt vs government budget

growth vs protection of the environment

sustainable growth vs equality

lower unemployment, more growth vs low inflation

Employment + unemployment.

COSTS OF UNEMPLOYMENT:

loss of productive capacity due to hysteresis- reduction in the LRAS.

lost tax revenue reducing the ability of governments to spend due to a reduction in national income.

BENEFITS?

leisure time/family time more valuable than income?

opportunity to retrain

creates new businesses as the unemployed

are forced to set up their own businesses

controls inflation

stops rising wages

loss of output, shown by a reduction in RGDP from Y1 to Y2.

IMMIGRATION AND SKILLS:

Immigration: take lower paid jobs, creates further jobs, reduce labour shortages by increasing the labour force, higher tax revenue, depresses wage rates,, increases cost of services, less UK workers=less motivation.

outwards movement: relieves unemployment, pressure off benefits, less demand for housing, political pressure, reduction in LRAS, reduce tax revenues.

MEASURING UNEMPLOYMENT:

comparison: LFS>CC: females looking for work are not entitled to benefits, older males may be collecting pensions or are supported by a spouse- not entitled to benefits but are not seeking work, a time lag on registering as unemployed and actually being made unemployed (no delay with LFS), CC may include those in a hidden economy collecting benefits.

LFS-labour force survey: survey of 44,000 household every month, covers economic activity, household structure, sex, age etc.

classifies unemployed as those without a paid job, could stare work in a fortnight, have looked for a job in the last 4 weeks or are waiting for an obtained job.

Claimant count: counts the number claiming unemployment benefits, main measure in the UK until 1997.

underemployed: those who would work more hours if available or are in jobs which are below their skill levels.

inactivity rate- the number of those not in work and not unemployed divided by the working age population.

types on unemployment

seasonal- those who are unemployed at certain times of the year.

structural- when the pattern of demand and production changes leaving workers unemployed in labour markets where demand has shrunk.

regional- due to job vacancies in a different geographical location to the job seeker.

cyclical- due to a low level in consumer demand.

classical/real wage- when workers are unemployed because real wages are too high and inflexible, leading to insufficient demand for workers.

hidden: those who would take a job is offered but are not in work or seeking work.

frictional: when workers are unemployed for short lengths of time between jobs.

Supply-side policies

Deregulation: the process of removing government controls from the market. aims to encourage more firms to provide goods, but instead encourages "creaming" of markets, only producing the most profitable goods.

Privatisation: the sale of government organisations or assets to the private sector. ( argued that organisations have a decreased profit incentive).

education, training, healthcare, minimum wage, benefits, trade unions, infrastructure.

market-based policies: policies designed to remove barriers to the efficient working of free-marketers, these limit output and raise prices.

interventionist policies: policies designed to correct market failure, government intervening in a free-market to change the outcome.

demand-side policies

Monetary policy: interest rates, asset purchases to increase money supply (quantitative easing).

Fiscal policy: government spending and taxation.

a government surplus is when tax revenues are higher than the money spent by the government.

indirect taxes: a tax levied on goods and services. eg VAT.

direct taxes: a tax levied directly on individuals or companies. eg income tax.

Bank of England: operates monetary policy on an independent basis- most important decisions made by the monetary policy committee. main role is to control inflation rates, between 1-3%, if it exceed either the Governor must write to the Chancellor of the Exchequer why this happened and what the BOE will do.

The Great Depression: 15% unemployment 1932- 25% 1933. the banking system was not robust enough to cope with bad debts, allowed too much lending creating an unsustainable credit boom, banks were allowed to fail .

2008 Financial Crisis: the poor were encouraged to buy their own homes, interest rates very low for the first few years, more sales= bonuses and so more risky mortgages sold. when IR increased, many homes were repossessed, prices fell. used expansionary monetary policy, USA looser fiscal policy than UK

Trade Cycle

RECESSION, DEPRESSION, TROUGH OR SLUMP: economic activity is at a low, high unemployment, consumption, investment and imports will be low, deflation.

PEAK OR BOOM: national income is high, the economy may be working past full employment, consumption and investment will be high, tax revenues will be high, wages rising and profit increasing high imports, inflation.

Macroeconomic objectives

low and stable rate of inflation

balanced government budget

protection of the environment

greater income equality

low unemployment

balance of payments equilibrium

economic growth

national income

wealth: a stock of assets which can be used to generate a flow of production or income.

income: rent, interest, wages and profits earned from wealth owned by economic actors.

Circular flow of income: a model of the economy which shows the flow of goods, services and factors and their payments around the economy.

INFLATION

EFFECTS:

not everything changes at the same rate, fall in real incomes, shoe leather costs- consumers less clear on reasonable prices so shopping around increases, menu costs- cost of changing labels etc, increased inequality, cost of borrowing increases.

CAUSES:

Cost-push: any factor that will increase the cost of production and therefore, force producers to push up prices.

Growth of money supply: increasing money supply faster than the growth of real output leads to more money chasing the same number of goods, leads to increased prices as firms are forced to increase prices.

Demand-pull: too many people are chasing too few goods, AD shifts out but AS remains, leading to an increase in the price level.

RPI-retails price index.

includes housing, council tax, mortgage repayments. covers a different sample of the population to CPI, RPI excludes the top 4% of income earner.

main one used in the UK. calculated from the same survey as CPI and uses the Carli index to calculate.

CPI- consumer prive index

%change in prices= [CPI new - CPI old/CPI old] X100

if the number given =100, prices have not changed, a number <100 = a decrease in prices- vice versa.

WEAKNESSES: doesn't show individual spending patterns, could be calculation errors, there are expenditure survey absences (70-80% reply) which leads to distortion, delay in updating.

CPI for year X= [total expenditure in year X/total expenditure in base year] X100

Disinflation is a fall in the rate of inflation.

Deflation is a fall in the general price level.

Inflation is, on average, the speed at which prices are rising. a rise in the general price level.

output gap

actual growth: economic growth as measured by recorded changes in RGDP over time.

Potential growth: economic growth as measured by changes in the productive potential of the economy over time.

Output Gap: the difference between the actual level of GDP and the productive potential of the economy. There is a Positive output gap when actual GDP is above the productive potential and it is in boom. there is a negative output gap when actual GDP is below productive potential.

ECONOMIC GROWTH

Purchasing Power Parities (PPP)

PPP is an exchange rate of one currency for another which compares how much a typical basket goods in one country costs compared to that of another country.

can be used to compare the wealth and strength of currency across countries.

OTHER MEASURES

SEDA-(Sustainable economic develop assessment)

improving well-being doesn't take lots of GDP. Eg Brazil improve their equality with only 0.5% of GDP.

measures how growth leads to welfare and well-being. measures through income, employment, infrastructure, education etc.

HDI-(Human development index)

gives a broad measure of growth, easy to calculate, doesn't acknowledge inequalities, employment, housing or environment.

measuring through standard of living eg. health, education, income.

GDI-(gross national income)

measuring growth by changes in national income.

it is assumed that a higher real income will lead to increased happiness due to a better standard of living.

Value is GDP's monetary value at the prices of the day; volume is GDP adjusted for inflation.

As GDP increases it is likely that there has been economic growth

GDP per capita is the value of GDP once divided by the population

Nominal GDP is the total value of all goods and services in the economy at market price.

Subtopic

Real GDP is the total value of all goods and services in the economy adjusted for inflation- used to measure growth.

GDP is only a measure of the output of goods and services it does not take into account any human well-being or implements in equality etc.