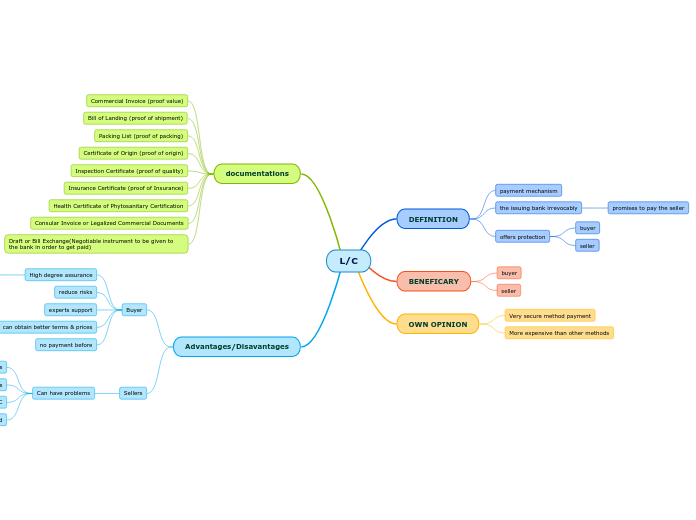

L/C

Advantages/Disavantages

Sellers

Can have problems

discrepancies documents presented

can cause issuing bank cancel L/C

try modify terms of L/C

interruption in operations

unacceptable costs

impossible delivery times

Buyer

no payment before

can obtain better terms & prices

experts support

reduce risks

High degree assurance

Goods will be delivered

documentations

Draft or Bill Exchange(Negotiable instrument to be given to the bank in order to get paid)

Consular Invoice or Legalized Commercial Documents

Health Certificate of Phytosanitary Certification

Insurance Certificate (proof of Insurance)

Inspection Certificate (proof of quality)

Certificate of Origin (proof of origin)

Packing List (proof of packing)

Bill of Landing (proof of shipment)

Commercial Invoice (proof value)

OWN OPINION

More expensive than other methods

Very secure method payment

BENEFICARY

DEFINITION

offers protection

seller

buyer

the issuing bank irrevocably

promises to pay the seller

payment mechanism