によって Luis Ruiz 4年前.

247

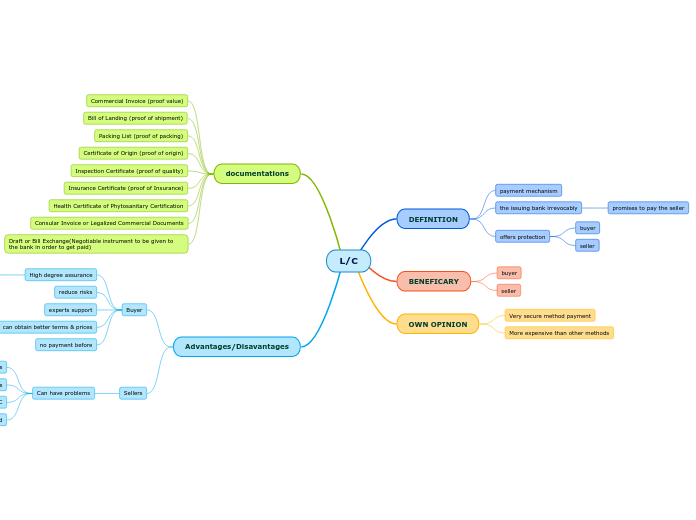

L/C

A letter of credit (L/C) is a financial instrument used in international trade to ensure secure payment between buyers and sellers. It is more expensive than other payment methods but offers a high level of security.

によって Luis Ruiz 4年前.

247

もっと見る

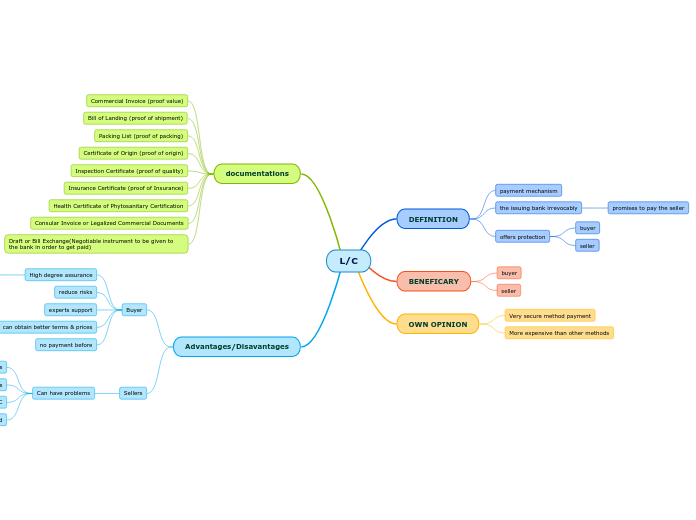

discrepancies documents presented

can cause issuing bank cancel L/C

try modify terms of L/C

interruption in operations

unacceptable costs

impossible delivery times

Goods will be delivered