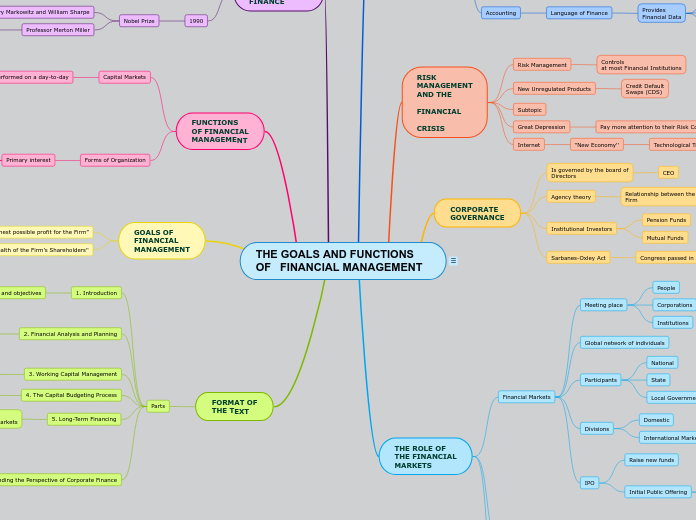

THE GOALS AND FUNCTIONS OF FINANCIAL MANAGEMENT

THE GOALS AND FUNCTIONS OF FINANCIAL MANAGEMENT

FORMAT OF

THE TEXT

Parts

6. Expanding the Perspective of Corporate Finance

Integrative tool

Valuation concepts

Portfolio Considerations

Capital Budgeting

Profit Management

External growth strategy and serves

5. Long-Term Financing

Sources and uses

of funds in the Capital Markets

4. The Capital Budgeting Process

The decision on Capital outlays

Consideration of

Market Value Maximization

3. Working Capital Management

Risk-return Analysis

2. Financial Analysis and Planning

Study

Development of comprehensive pro forma Statements

Budget

construction techniques

Ratio Analysis

1. Introduction

Examines the goals and objectives

GOALS OF

FINANCIAL

MANAGEMENT

''Maximize the Wealth of the Firm’s Shareholders''

“Earn the highest possible profit for the Firm”

FUNCTIONS

OF FINANCIAL

MANAGEMENT

Forms of Organization

Primary interest

Corporation

Legal Entity

unto itself

Most important type of Economic Unit

Partnership

Two or more Owners

Sole Proprietorship

Offers the Advantages

Single-person Ownership

Performed on a day-to-day

Financial Management

Receipt and Disbursement of Funds

Inventory Control

Credit Management

EVOLUTION OF

THE FIELD OF

FINANCE

1990

Nobel Prize

Professor Merton Miller

Area of Capital Structure Theory

Professors Harry Markowitz and William Sharpe

Financial Theories

1950

Finance moved away

Real capital

Long-term Plant and Equipment

Financial Capital

Money

1930

Depression ever

THE ROLE OF

THE FINANCIAL

MARKETS

Capital Markets

Significant impact

Creating tremendous competitive

Securities have a

life of more than one year

Corporate and Government bonds

Preferred stock

Common stock

Money Markets

Short-term securities

Certificates of Deposit

Daily operations

Financial Markets

IPO

Initial Public Offering

Secondary Market

Securities are sold to the public

Primary

Market

Sale of securities

Raise new funds

Divisions

International Markets

Domestic

Participants

Local Governments

Public Financial Markets

State

National

Global network of individuals

Meeting place

Institutions

Corporations

Corporate Financial Markets

People

CORPORATE

GOVERNANCE

Sarbanes-Oxley Act

Congress passed in 2002

Institutional Investors

Mutual Funds

Pension Funds

Agency theory

Relationship between the Owners and the Managers of the Firm

Is governed by the board of

Directors

CEO

RISK

MANAGEMENT

AND THE

FINANCIAL

CRISIS

Internet

“New Economy''

Technological Transformation

Great Depression

Pay more attention to their Risk Controls

Subtopic

New Unregulated Products

Credit Default

Swaps (CDS)

Risk Management

Controls

at most Financial Institutions

THE FIELD OF

FINANCE

Accounting

Language of Finance

Provides

Financial Data

Statement of Cash

Flows

Balance Sheets

Income Statements

Economics

Variables

Taxes

Interest Rates

Inflation

Unemployment

Disposable Income

Industrial

Production

Gross domestic product

Structure for Decision Making

Comparative Return Analysis

Demand Relationships

Pricing Theory

Risk Analysis