Acc Chapter 2

Assumptions

Economic Entity

Going Concern

Time Period

Monetary Unit

Principles

Full disclosure

Cost

Revenue Recognition

Matching Principle

Constrains

Conservatism

Materiality

Useful Information

Reliable

Neutral

Verifiable

Relevant

Decision making

Timeliness

Feedback

Predicted value

Use of Financial Statements

Income Statement

Definitions

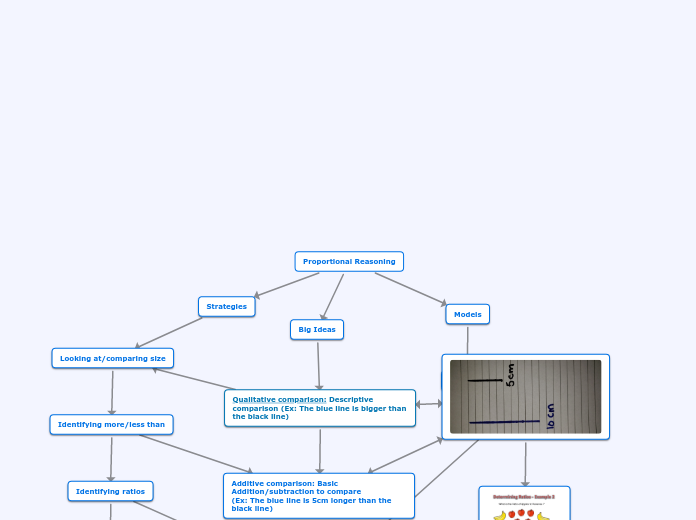

Ratios

Uses

Intercompany comparisons

Single competitor

Industry-average comparisons

Based on average ratios for particular industries

Intracompany Comparisons

Two years for the same company

Type

Solvency Ratios

Survival over a long period of time

Liquidity Ratios

Short-Term ability of the company to pay its obligations and meet unexpected needs for cash

Profitability Ratios

Measure income or operating success in a period of time

Expresed

Proportion

1.44:1

Rate

1.44

Percentage

144%

Mathematical relationship between one quantity and another

The classified Balance Sheet

Groups

Liabilities

Stockholders' Equity

Retained Earnings

Income retained by the firm

Common Stock

Investment of Stockholders

Long-Term liabilities

5 Pension Liabilities

4 Lease liabilities

3 Long-Term notes payable

2 Mortgages Payable

1 Bonds Payable

Pay after a year

Order of Magnitude

Current liabilities

5 Taxes

4 Interest payable

3 Bank loans payable

2 Wages Payable

1 Accounts payable

Obligations to pay in one year or operating cycle

Assets

Intangible assets

2 Patents, Copyrights, and trademarks

1 Goodwill

Not physical substance yet often are very valuable

Property, Plant, and Equipment

Assets with long useful lives

- Depretiation

3 Equipment

2 Buildings

1 Land

They spread the total cost to various annual expenses

Long-Term Investments

2 Long-Term assets

Buildings not being used

1 Stocks and Bonds

Investments or assets that held for more than a year

Current Assets

Companies list assets in order they are able to convert it to cash

6 Prepaid Insurance

5 Supplies

4 Inventories

3 Accounts receivable

2 Short-term investments

1 Cash

Convertible in Cash within a year or operating cycle.