av Даша Ковтун 5 år siden

642

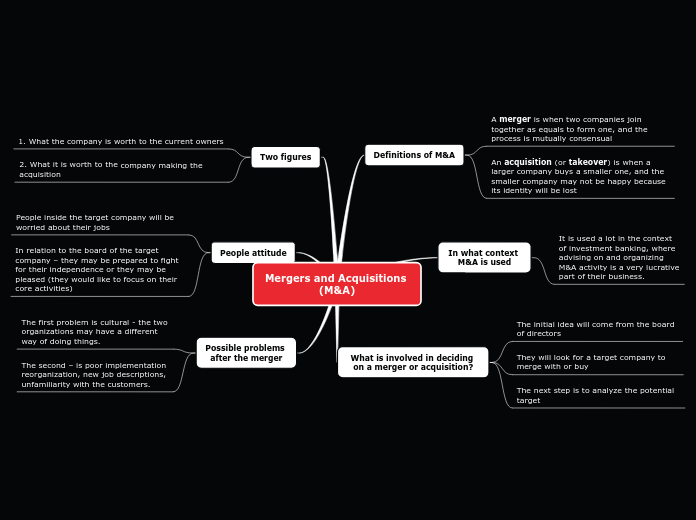

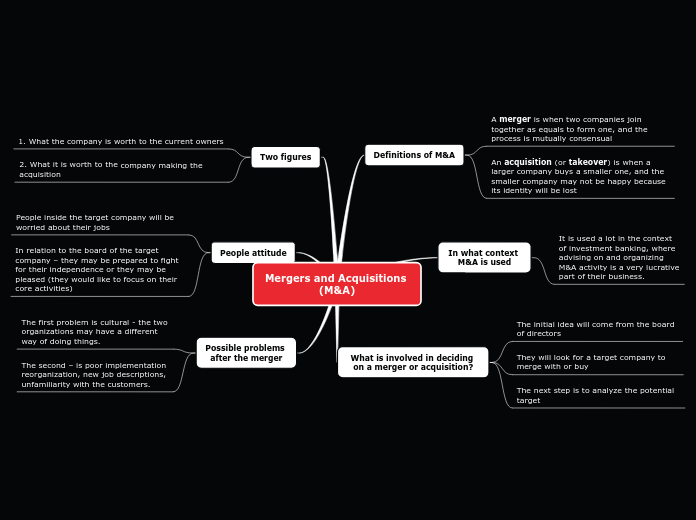

Mergers and Acquisitions (M&A)

In the realm of business, mergers and acquisitions (M&A) represent significant strategic maneuvers where companies either merge to form a unified entity or one company acquires another.

av Даша Ковтун 5 år siden

642

Mer som dette