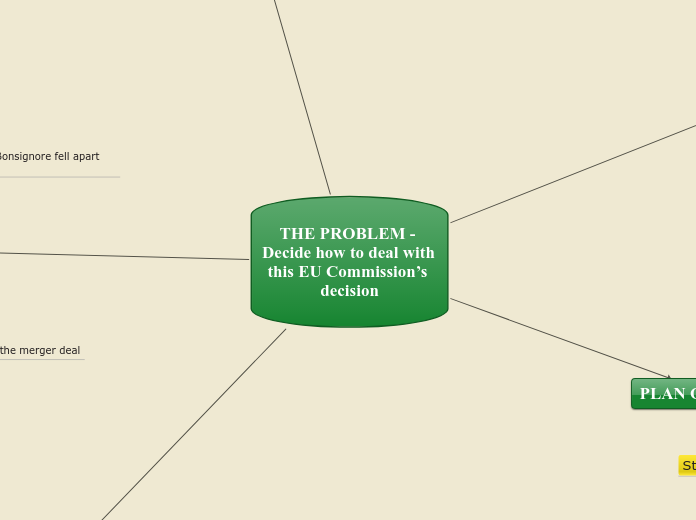

THE PROBLEM - Decide how to deal with this EU Commission’s decision

PLAN OF ACTION

Step two

1. Organize meeting with EU Commissar;

2. Present information;

3. together with the team try to convince him;

4. listen his opinion;

5. advise him to change the opinion of the commission;

6. wait for results;

Step one

1. instruct analysts to create a report on this issue;

2. see it and read;

3. share it with PR managers;

4. make a presentation;

5. take the negotiators who understand the situation;

SUMMARY

GE and Honeywell want to merge, but they face a problem. This problem is the European Commission, which sees in this merger a threat to the monopolization of the European aviation market. To resolve this conflict, Jack Welch needs to come up with what arguments he can convince them or negotiate more acceptable conditions.

ISSUE

Confidence EU Commission in the harm of this merger for the EU market

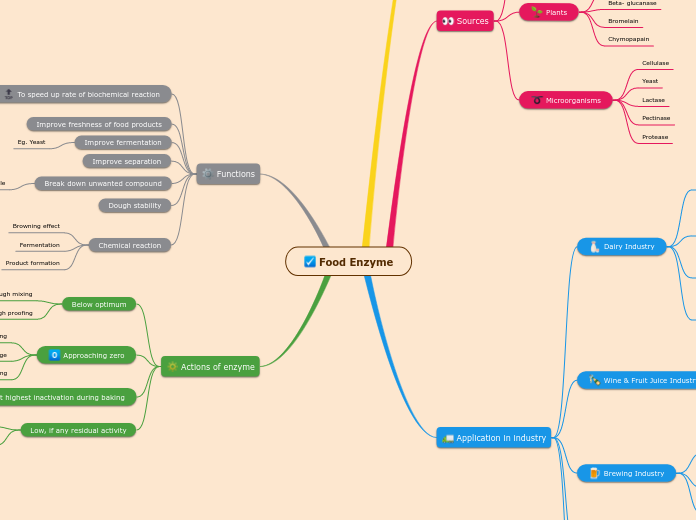

RECOMMENDATION - find examples of company’s merger in similar areas

b) less costly and gives more opportunities to challenge the decision of EU Commission

подтема

a) It is possible to give a practical example and a fictional fact that monopolies can be competitive and keep prices at a level that suits customers. Start from second point, if I start a business selling colored balloons in the center of city, I’d have a monopoly as a seller of a unique product. If we assume that I’m not very successful or that my colored balloons aren’t very popular, I will still maintain my monopoly, and lose a lot of money.

But let’s say that my colored balloons sales go high. My profit will attract competitors, and then I no longer have a monopoly, unless I keep my prices low or my product is so good that it out competes the competition—either in price or innovation. In either case, consumers are well served.

In real example can bring Google, which is not the dominant search engine because it has a monopoly, but because most consumers like it and the price of their service, and so they are big players in the advertising market.

OPTIONS

2. Create a separate company/subsidiary in the area of interest for joint cooperation

the commission will no longer bother

benefits for the new company and free business with partners

start from scratch, clean brand

the chance of appearance a new trial

1. Find examples of company’s merger in similar areas

Disadvantages

contra examples

obstinacy of the EU commissioner in final decision

Advantages

will allow to influence public opinion

help to prove that monopoles do not always lead to loss of money from customers

CAST OF CHARACTERS

1. Jack Welch - CEO of GE

10. Michael Bonsignore - Honeywell CEO

5. United Technologies Corporation (UTX) - merger company between GE and Honeywell

9. Mario Monti - Commissioner of the European Commission

2. European Commission is an institution of the European Union, responsible for proposing legislation, implementing decisions, upholding the EU treaties

8. the Antitrust Division of the Department of Justice (DOJ) - regulate business sphere for prevent trusts and monopolies

7. Jeffrey Sprague - the analyst of Salomon Smith Barneyю

3. General Electric is a diversified industrial and financial company, whose major product lines include appliances, lighting products, aircraft engines, plastics, power systems, medical imaging, broadcasting, and a wide range of financial services (consumer finance, leasing, private equity, credit cards, and so on). In 2000, GE employed 223,000 people in over one hundred countries and reported net earnings of $13b on revenue of $130b.

4. Honeywell is a manufacturer of thermostats, security systems, and industrial control products with Allied-Signal (a diversified manufacturer focused on aerospace). In 2000, Honeywell employed 125,000 people in 95 countries and reported net income of $1.7b on sales of $25b.

6. Joseph Campbell - the analyst of Lehman company

CHRONOLOGY

7. Initiation the merger deal

6. EU Commission spoke out against the merger

4. US Merger Review

1. Michael Bonsignore fell apart Honeywell

5. Statement’s companies about the future merger

2. Cancel the merger deal

3. The commission presented unfavorable conditions (European Merger Review)