por fernanda rodriguez 4 anos atrás

235

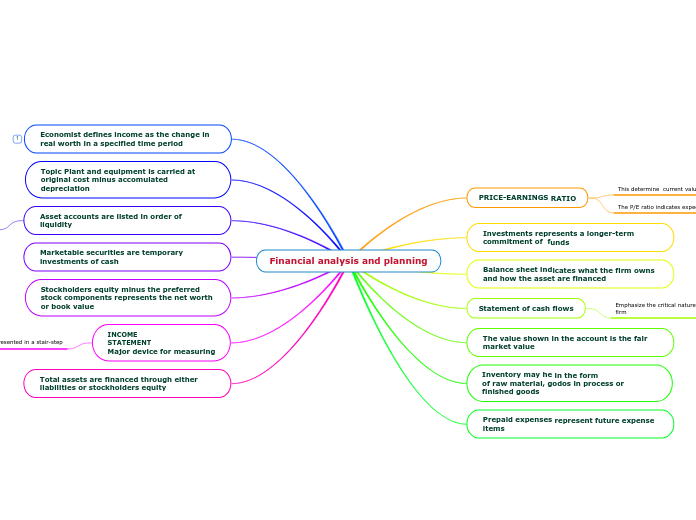

Financial analysis and planning

Analyzing financial statements involves understanding various elements that reflect a company's financial health. Key components include assets, liabilities, and stockholders' equity, which together finance a company'