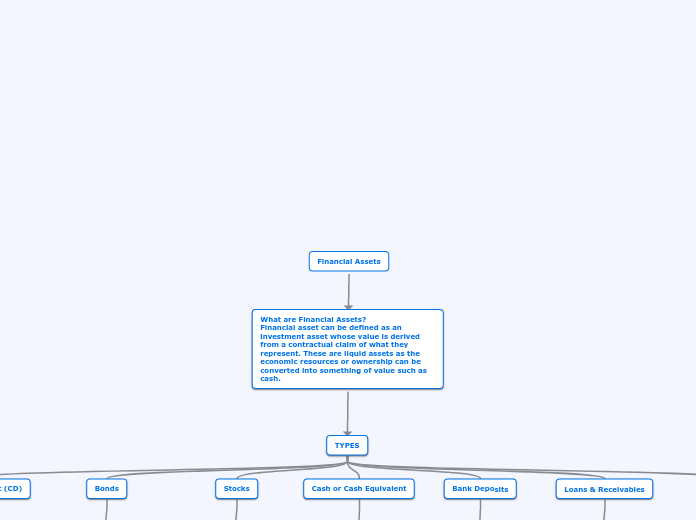

Financial Assets

What are Financial Assets?

Financial asset can be defined as an investment asset whose value is derived from a contractual claim of what they represent. These are liquid assets as the economic resources or ownership can be converted into something of value such as cash.

TYPES

Derivatives

Derivatives are financial assets whose value are derived from other underlying assets. These are basically contracts.

Loans & Receivables

Loans and Receivables are those assets with fixed or determinable payments. For banks, loans are such asset as they sell them to other parties as their business.

Bank Deposits

These are the cash reserve of the organization with Banks in saving and checking accounts.

Cash or Cash Equivalent

This type of financial assets is the cash or equivalent reserved with the organization.

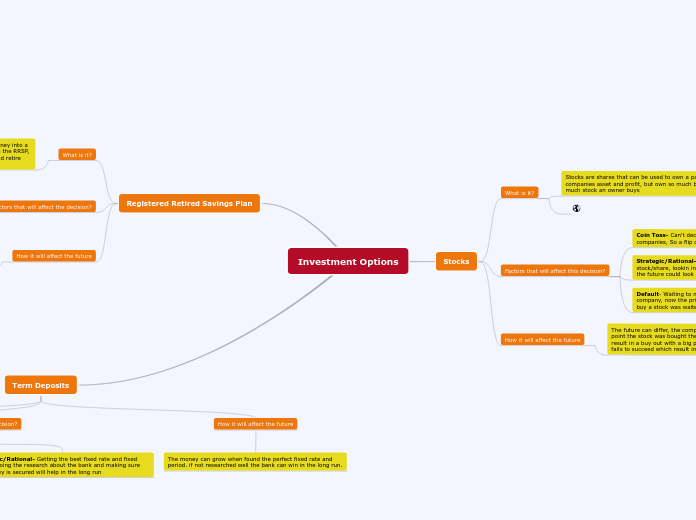

Stocks

Stocks do not have any maturity date. Investing in stocks of a company means participating in the ownership of the company and sharing its profits and losses. Stocks belong to shareholders until and unless they sell them.

Bonds

This type of financial assets is usually debt instrument sold by companies or government in order to raise fund for short-term projects. A bond is a legal document that states money the investor has lent the borrower and the amount when it needs to be paid back (plus interest) and the bond’s maturity date.

Certificate of Deposit (CD)

This type of financial asset is an agreement between an investor and a bank institution in which the customer keep a set amount of money deposited in the bank for the agreed term in exchange for a guaranteed rate of interest.