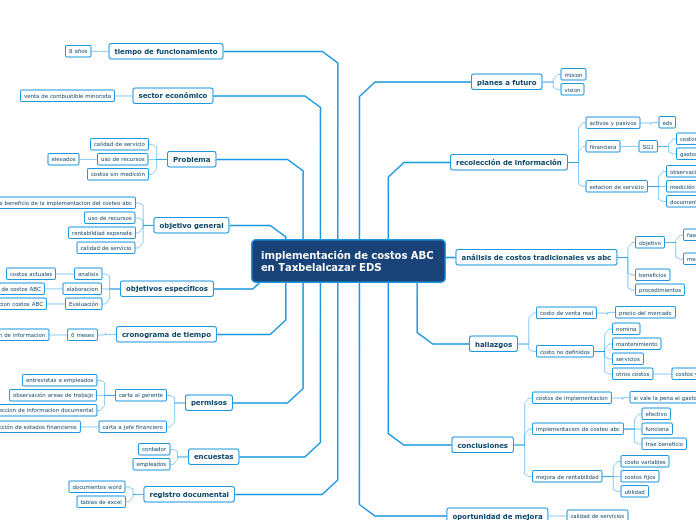

implementación de costos ABC en Taxbelalcazar EDS

Think of a name for your business.

registro documental

To become an officially recognized business entity, you must register with the government.

Corporations will need an 'articles of incorporation' document, which includes your business name, business purpose, corporate structure, stock details, and other information about your company.

tablas de excel

There are four types of stocks that an investor should own:

- Growth stocks - shares you buy for capital growth;

- Dividend stocks - stocks of choice for the income-seeking investor;

- Initial Public Offerings - stocks that mark the first time that companies make their shares available to the public;

- Defensive stocks - stocks that provide a constant dividend and report stable earnings regardless of the state of the share market as a whole

documentos word

Your business purpose is the reason you have formed your company boiled down to a single sentence.

encuestas

You’ll use your employer identification number (EIN) for essential steps to start and grow your business, like opening a bank account and paying taxes.

Some states require you to get a tax ID as well.

empleados

Tax Identification numbers can be found on tax assessments in the right upper corner on the first page.

Get federal and state tax ID.

contador

The Employer Identification Number is a unique nine-digit number assigned by the Internal Revenue Service to business entities operating in the United States for the purposes of identification.

Apply for an Employer Identification Number.

permisos

The licenses and permits you need for your business will vary by industry, state, location, and other factors.

carta a jefe financiero

The licenses and permits you need from the state, county, or city will depend on your business activities and business location.

inspección de estados financieros

What are the state license and permit you already have?

carta al gerente

You'll need to get a federal license or permit if your business activities are regulated by a federal agency.

Requirements and fees depend on your business activity and the agency issuing the license or permit. It's best to check with the issuing agency for details on the business license cost.

recoleccion de informacion documental

What is the issuing agency of your federal license or permit?

observación areas de trabajo

Type in a description of your business.

entrevistas a empleados

What is your business activity?

cronograma de tiempo

Unless you're planning to be your only employee, you will need to hire a great team to start your company.

6 meses

Type in his/her name.

recolecion de informacion

What is his function in your business?

Choose from the ones below or type in another.

Business partnerRecruiterMarketing SpecialistProgrammerAccountant

objetivos específicos

When you are trying to open a business bank account, think about the benefits it should offer:

- Professionalism

- Protection

- Preparedness

- Purchasing power

Evaluación

Documents you need:

- Employer Identification Number (EIN) (or a *Social Security number, if you're a sole proprietorship)

- Your business's formation documents

- Ownership agreements

- Business license

beneficios de implementacion costos ABC

Which of these documents do you have?

Employer Identification Number (EIN) (or a Social Security number, if you're a sole proprietorship)Your business's formation documentsOwnership agreementsBusiness license

Find a way to obtain the other ones.

elaboracion

There are a lot of bank accounts with benefits out there, but you have to be careful that the one you choose is worth the money.

propuesta de costos ABC

Choose from the list or type in the benefits offered by the bank you are interested in.

Low introductory offersLow interest rates for savings and checkingLow interest rates for lines of creditLow transaction feesEarly termination feesMinimum account balance fees

analisis

Shop around to make sure you find the lowest fees.

costos actuales

How do you consider the fees you will pay for the bank you found? If they are too high, think about changing it.

low feeshigh fees

objetivo general

Before you start selling your product or service, you need to build up your brand.

Create a website.

rentabildiad esperada

Choose colors for your brand.

Choose a font pair to build your brand.

determinar los beneficio de la implementacion del costeo abc

Create a logo that can help people easily identify your brand.

Use it on your company website and on social media.

Problema

Create a sales and Marketing strategy

costos sin medición

Ask your customers and potential customers for permission to communicate with them.

Ask for their consent to contact them with further information about your business.

Use opt-in forms. They usually pertain to email communication.

uso de recursos

elevados

Type in the names of your products.

calidad de servicio

Choose from these ones or add other marketing channels that you think will help you promote your business in the best way.

The more you use, the better!

Email marketingSocial media MarketingFacebook AdsGoogle AdsSEOContent marketingTelesales

sector económico

Like any element of running a business, there are multiple growth strategies that you can try.

venta de combustible minorista

Type in some ideas to grow your business.

You have some examples here:

Collaborate with more established brands in your industryPartner with a charity organizationVolunteerAttend networking eventsHost eventsGet to know your customersOffer great customer serviceMeasure what works and refine your approach as you go

tiempo de funcionamiento

Consider an exit strategy in case your business does not work.

In this way, you can make a substantial profit or at least to limit losses.

8 años

Think of an exit strategy or choose from the following examples:

sell the company to investorssell to another companymake as much money as possible, then close down the business

oportunidad de mejora

Before you can register your company, you need to decide what kind of entity it is.

Learn about the various legal business structures that are available.

It is up to you to determine which type of entity is best for your current needs and future business goals.

calidad de servicios

What kind of business structure are you interested in?

Type in or choose from the list below.

Sole ProprietorshipPartnershipLimited Liability Company (LLC)Corporation

conclusiones

Your business location is an important decision. The choices you make could affect your taxes, legal requirements, and revenue.

Where you locate your business depends in part on the location of your target market, business partners, and your personal preferences. In addition, you should consider the costs, benefits, and restrictions of different government agencies.

mejora de rentabilidad

As a business owner, it’s important to understand your federal, state, and local tax requirements.

This will help you file your taxes accurately and make payments on time.

utilidad

What are the restrictions?

costos fijos

What are the benefits?

costo variables

What are the costs?

implementacion de costeo abc

Consider the tax landscape for the state, county, and city. Income tax, sales tax, property tax, and corporate taxes can vary significantly from place to place.

trae beneficio

What is the property tax?

funciona

What is the sales tax?

efectivo

What is the income tax?

costos de implementacion

If you buy, rent, build, or plan to work out of the physical property for your business, make sure it conforms to local zoning requirements.

Neighborhoods are generally zoned for either commercial or residential use. Zoning ordinances can restrict or entirely ban specific kinds of businesses from operating in an area.

si vale la pena el gasto

Type in region-specific business expenses.

hallazgos

Starting any business has a price, so you need to determine how you're going to cover those costs.

The choices you make could affect your taxes, legal requirements, and revenue.

costo no definidos

Find out how much money you need to start a business with a break-even analysis.

It will help you determine when your business will become profitable.

otros costos

The break-even point is the level of production at which the costs of production equal the revenues for a product.

Use this formula to calculate the break-even point.

Fixed Costs / (Average Price – Variable Costs) = Break-Even Point

costos y gastos no definidos

Use this formula to calculate the break-even point.

Fixed Costs / (Average Price – Variable Costs) = Break-Even Point

servicios

Variable costs are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of marginal costs over all units produced.

Type in the variable costs.

Some examples are:

sales commissionsdirect labor costscost of raw materials used in productionutility costs

mantenimiento

To calculate the average purchase price of your shares you have to divide the total amount invested by the total number of shares bought.

Type in the average price.

nomina

Fixed expenses or costs are those that do not fluctuate with changes in production level or sales volume.

They include such expenses as rent, insurance, dues and subscriptions, equipment leases, payments on loans, depreciation, management salaries, and advertising.

Type in the fixed costs.

costo de venta real

precio del mercado

Choose from these ones or add other ways of funding.

Self-fundingFriends and familyBusiness grantBusiness competitionAngel investorsVenture capitalCrowdfundingBusiness loanStart up loanBusiness credit cardBusiness overdrafts

análisis de costos tradicionales vs abc

There are four types of plans:

- Operational Plan

- Strategic Plan

- Tactical Plan

- Contingency Plan

If you are raising money from investors, you should include a brief section of your business plan that details exactly how you plan on using your investors’ cash.

beneficios

Schedule the next critical steps for your business.

Show investors that you understand what needs to happen to make your plans a reality and that you are working on a realistic schedule.

objetivo

Every business has some form of competition.

medir los costos de los recursos utilizados

Type in the name of your competitor.

eficiencia

fases

Forecasts are your projections for the next years.

actividades

This shows the expenses related to making your product or delivering your service.

It should not include regular business expenses such as rent, insurance, salaries, etc.

procedimientos

For example, If you are a product company, break down your forecast by target market segments or into major product categories.

If you are forecasting sales for a restaurant, break down your forecast into these groups: lunch, dinner, and drinks.

compra, ventas

Type in some forecasts.

recolección de información

Conduct market research. Gather information about potential customers and businesses already operating in your area. Use that information to find a competitive advantage for your business.

estacion de servicio

The target market refers to consumers with similar characteristics (age, location, income, lifestyle etc.) and are considered most likely to buy a business's market offerings or are likely to be the most profitable segments for the business to service.

documentación física

SOM: Your Share Of the Market (the subset of your SAM that you will realistically reach-particularly in the first few years of your business)

Type in SOM.

medición de tiempos

SAM: Your Segmented Addressable Market or Served Available Market (the portion of TAM you will target)

Type in SAM.

observacion

TAM: Your Total Available or Addressable Market (everyone you wish to reach with your product)

Type in TAM.

financiera

Some examples of popular industries are:

- The Business Services Industry

- The Food and Restaurant Industry

- The General Retail Industry

- The Technology Industry

- The Health, Beauty and Fitness Industry

- The In-Home Care Industry

- The In-Home Cleaning and Maintenance Industry

- The Sports and Recreation Industry

- The Travel and Lodging Industry

- The Automotive Repair Industry

SG1

Choose from the list below or type in an industry you want to analyze.

The Business Services IndustryThe Food and Restaurant IndustryThe General Retail IndustryThe Technology IndustryThe Health, Beauty and Fitness IndustryThe In-Home Care IndustryThe In-Home Cleaning and Maintenance IndustryThe Sports and Recreation IndustryThe Travel and Lodging IndustryThe Automotive Repair Industry

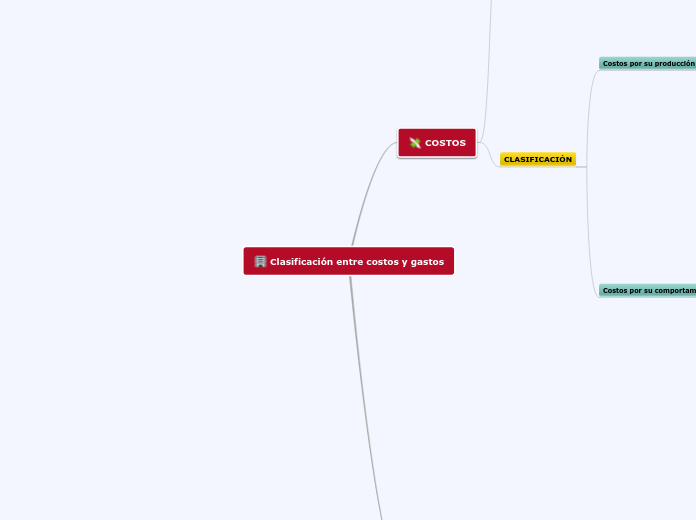

gastos

Highlight the disadvantages of investing in this industry.

Type in disadvantage.

costos

Highlight the advantages of investing in this industry.

Type in advantage.

activos y pasivos

Nowadays, many people are considering starting their own business.

Come up with a brilliant idea, that nobody tried before.

eds

Type in a business idea.

planes a futuro

What is your motivation?

vision

mision

Type in the reasons for starting a business.