Floating topic

5 Fundamentals of a Future Ready Practice Management

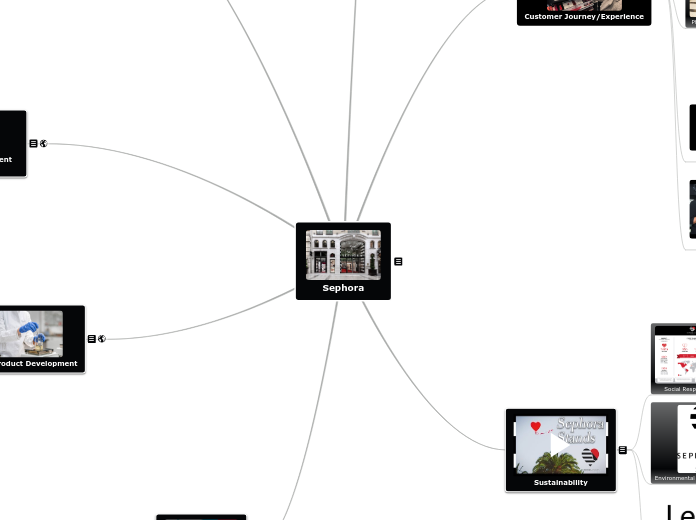

Client Focus

Risk & Regulatory

Technology & Operations: Enhance the client experience and drive operational efficiency with effective technology implimentation.

Architecture and Integration

A typical firm uses six types of software, which simply emphasizes API integration to improve the flow of information among numerous applications, such as CRMs and financial planning systems.

Technology Solutions

Leading firms take part in a smart, agile approach using technology, to optimize production & efficiency, deepen client engagement, and improve client communication.

User Experience

75% of Gen-Y investors expect technology as an integral part of investment management. Enriched UX incorporating online dashboards, collaboration tools, data aggregation software, and other features grow business.

Pursuing Digital Advice Solutions: Advisor

decisions are strategic and technical, impacting many facets of their business. Most advisors surveyed are interested in blending both human and digital elements into one client solution. This combination of high-tech and high-touch is key to a successful offering. The following four steps are a roadmap to consider when integrating digital advice solutions.

Step 4: Create the Go-to-Market Plan: A compelling message to share with current and potential clients on the benefits of your digital offering will bolster interest.

Establish success metrics

Document your implementation plan

Define transition plan

Develop a marketing and business development plan

Create your messaging platform

Step 3: Determine How to Deliver

Develop a Fee Structure: A clearly articulated Value Proposition is critical in showcasing what clients will receive for the fees they pay - and the specific value that your firm provides above and beyond that of the technology solution.

3c. Review Policies & Procedures: How will your operations, regulatory responsibilities, and risk management strategy

be impacted by your digital advice offering?

Know your client/ Fudiciary

Investment Review

Fraud and Cybersecurity

Record Keeping and Data Management

3b. Evaluate Resources Think through the entire offering to identify talent impacts – from hiring new resources to finding

associates with a different skill sets.

3a. Select the Right Tech Solution: A succinct view of the experience to create, and the critical features and functions required can help set your firm up for success.

Step 2: Design the Offering

Identify Important Features

Offering Naming

Define Engagement Model: Considering investment and wealth management, outline delivery and UX.

• Interaction in-person versus online?

• How and when to communicate with digital advice clients?

• Will clients interact with a call center or an advisor?

Online vault and interactive dashboard

Monthly eNewsletter with market

commentary and personal finance articles

Mid-year virtual check-in via email,

phone or online platform

Access to call center / service team

Annual meeting to review goals and needs

– conducted in-person or virtually

depending on client preference

Online acct. opening

Engaging website

Outline Products & Services: Design the offering to consider both the investment and wealth management provided

How will we segment our clients and price

our services to offer a range of solutions

that meet different client needs?

How will our offering be better or

differentiated from that of the competition

What are we willing and prepared

to offer to digital advice clients?

What do our target clients need?

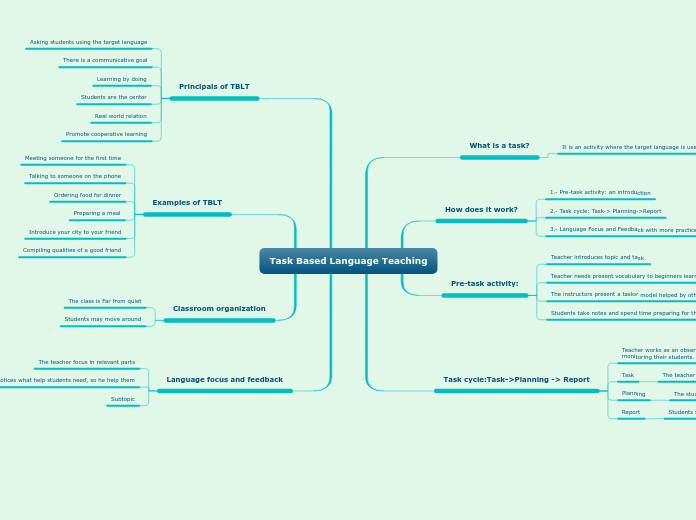

Step 1: Lay the Foundation: competitive wealth management firm of the future will have figured out how to combine hightechwith high-touch service to deliver an optimal

offer, at the right price point to the right client

segment, while meeting the firm's profitability goals."

Identify Targets: Who is digital advice solutions targeting? New client type, or improving service for existing clients?

Do-it-yourself investors that may prefer limited interactions

with an advisor.

Geographically dispersed clients who are comfortable with

online interactions.

Adult children of clients who are poised to inherit wealth.

Wealthy, but have a portion of their assets or planning

needs that could be managed with an online solution.

Have straightforward financial planning and investing

needs, as well as minimal client service needs.

Tech-savvy and enjoy using online applications to

manage their financial lives and track their goals any

time, any place.

High-earning professionals with the potential to

accumulate significant assets over time.

Younger, with investable assets below your required

minimum, but could be served profitably with an online

solution that has self-service options.

Specify goals: As with any significant project, defining your objectives clearly is paramount to success.

Efficiency-Oriented

Enable clients to have more online access

to their accounts and be more hands-on

Simplify the investment /

planning approach

Reduce the time spent with clients at inperson

meetings or on the phone

Reduce the manual work performed by

staff on operational tasks, like client

reporting, rebalancing, and billing

Serve smaller accounts more efficiently

and profitably

Growth-Oriented

Incorporate the latest technology to

attract advisors to our firm

Create a new stream of revenue/line of

business for a new group of target clients

Attract clients who don’t meet our

minimums, but are well positioned to

accumulate wealth

Diversify our client base by attracting

younger clients or less affluent clients

Experience-Oriented

Enhance the tools that our advisors use

to better serve clients

Upgrade our client experience by

incorporating the latest technology

Meet or exceed the changing expectations

of clients in our target market

Provide a modern experience for tech

savvy investors

Operations and Workflow

By enhancing operational efficiencies and the client and employee experience, workflows are helping advisors drive growth and profitability.

Strategy and Innovation:

Studies have identified strong correlations between technology implementation and advisor success metrics. "eAdvisors" (advisors who engage in tech greater than peers) had ~40% more AUM.

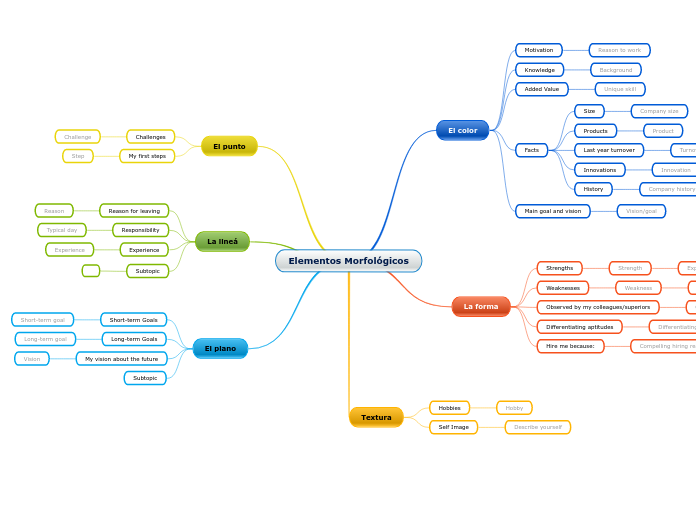

Talent: People are a firm's most valuable asset. Hire smart, adequately develop, and staff morale are tantamount to success.

Compensation

Training & Development

Workforce Planning

Strategy: Creates focus to capitalize on market opportunities by defining a clear strategy and business model for the long term

Business Analytics

Merges & Aquisitions

Succession Planning - Value Traps: Overlooked Opportunities to Help Maximize Firm Value

High-Performing Firms: Significance and focus of outperformance versus peers. Definition: High-Performing Firms excel in the areas of growth, profitability,and productivity.

Actions to Consider

Position your firm to capture

the intergenerational wealth

transfer

Focus business development

activities on younger investors.

Engage the adult children

of your existing clients

Identify and create next generation

owners who have the requisite skills to contribute to the growth of your firm.

If you are planning to pursue an internal

succession, begin identifying and grooming next-generation owners at least five to seven years before your planned exit

Commit to developing talent.

Identify the skills your team

needs to develop, and provide

a combination of additional

professional experiences and

training to help them reach their

potential.

Invest the time to strategically

manage your firm. Commit to

long-range strategic planning that

includes five- to 10-year goals.

Further, use KPIs to help manage

the fundamentals of your business.

Deepen your knowledge of drivers

of firm valuation

High-Performing Firms are better

positioned to help maximize firm

value

5. Build deeper client relationships

4. Build stronger organizations.

3. More actively plan for succession.

2. Demonstrate stronger growth

engines. H

1. Better understand what can

drive firm valuation.

“Taking Steps to Help Maximize the Value of Your Firm,” identifies eight specific value drivers you’ll want to consider:

8. Client demographics: The demographics of your clients provides insight on account growth or depreciation over time, indicating your firm’s

current stability and potentiality of future revenue.

7. Cost structure: External buyers will want to know the elements of your cost structure they can build on post-sale. Internal buyers will seek certainty about the cost structure's future direction to better predict cash flow.

6. Client experience: As your firm grows and matures, achieving scale may depend on your ability to develop a compelling organizational structure that increases value to customers and removes the client dependency on an

individual advisor.

5. Capabilities: Having a deep and well-rounded set of competencies is essential to maximize firm potential.

4. Leadership: Your firm’s ability to build and execute strategic vision—to grow revenue and operate effectively—rests on the business acumen of a strong management.

3. Organization: Your firm is often only as valuable as the price investors are willing to pay for your advice. That boils down to the quality of your internal talent “human capital.” Talent is critical to attracting and retaining new clients and revenue sources.

2. Revenue growth and structure: Potential buyers will want to know the firm’s rev. growth potential and hist. growth rate. They'll also seek to understand whether your revenue structure is fee- or commission-based and whether fee-based advisors charge for additional services

1. Firm size: Your firm’s value is directly correlated to your size. As a firm grows, the ability to scale wealth management business—without being highly dependent on any one associate—increases

Strategic Planning: Leading Well in Times of Upheaval. Define Your Firm’s Strategy In A Changing Landscape

Lesson #5: Shape the organization

around your personal anchor.

Lesson #4: Master the tactics of “judo

and sumo.”

Lesson #3: Think platforms, not products

Lesson #2: Make big bets, without

betting the company.

Lesson #1: Formulate a vision for the future to inform the present.

Business Models