NON-TARIFF BARRIERS TO TRADE

Antidumping Regulations

Definition Based on Price

It occurs when the price of the product's country of origin is not available, an effort is made to determine the price of the product in a third market.

Dumping Margin

It is calculated as the amount by which the foreign market value exceeds the United States price

Antidumping Tax

It is implemented when the United States Department of Commerce determines that a class or type of foreign merchandise is sold at a price lower than its fair value and the United States International Trade Commission (ITC) determines that PIJV imports cause material damage or threaten do it to an American industry.

Dumpings

Persistent Dumping

It occurs when the manufacturer sells, permanently, at lower prices in the foreign market, it is used when a company conceives two markets differently in order to assign fixed costs and expenses to them.

Dumping Predator

It occurs when a producer temporarily lowers the prices charged abroad to put competitors out of business.

Sporadic Dumping

It occurs when a company has excess inventories in foreign markets by selling in them at lower prices than in the local market.

Dumping

It is recognized as a form of international price discrimination. It occurs when foreign buyers are priced lower than domestic buyers for the same product, after covering transportation costs and customs duties.

Subsidies

Export Subsidy

It is a benefit conferred on a company by the government that is contingent on export.

Subsidies to National Production

It is granted to the manufacturers of the products that compete in imports. The purpose is to encourage production and thus the vitality of producers who compete with imports.

Subsidy

Allows you to market your products at prices lower than those guaranteed by their current cost or profit considerations

Other Non-Tariff Barriers to Trade

Restriction on Maritime Transport and freightRestricción al Transporte Marítimo y los fletes

The US government demanded that foreign shipping companies be allowed to negotiate directly with Japanese stevedores to unload their ships, thus giving carriers a way to evade the restrictive practices of the Japan stevedores association. After a consultation between the two governments, an agreement was reached to liberalize port services in Japan.

CAFE standards

Average Fuel Savings Standards

(CAFÉ, corporate average fuel economy standards) represent the basis of the United States' energy conservation policy. The standards are based on the average fuel efficiency of all vehicles sold by manufacturers and apply to all passenger vehicles sold in the United States.

Social Regulation

It tries to correct a variety of undesirable side effects in an economy, which are related to health, safety and the environment, effects that the markets, which on their own, ignore

National Product Purchasing Policies

The US government passed a law called the Buy American Act. This law requires federal agencies to purchase materials and products from US suppliers if their prices are not “unreasonably” higher than those of foreign competitors.

Export Quotas

Export Quota

Its main purpose is to moderate the intensity of

international competition, allowing less efficient domestic producers to participate in markets that would otherwise be lost to foreign producers selling a superior product at a lower price.

Tariff Quotas

On-Demand Quota Allocation

It is the most common technique for the fees that are applied. Under this system, licenses are required to import with a tariff quota.

Tariff Quota

It allows a specific number of products to be imported at a tariff (for imports within this volume) while any imports above this level pay a tariff (those that exceed the quota).

Import Quotas

Selective Quota

To avoid the problems of a global quota system, import quotas are distributed to certain countries.

Global Quota

It allows a specific number of products to be imported each year, but does not specify where the product will be shipped from or who is allowed to import.

Import license

Specify the volume of imports allowed and the total volume must not exceed the quota

Import Quota

It is a physical restriction on the quantity of products that can be imported during a specific period.

These are measures that have been increasing since the 1960s and are intended to reduce imports and thus benefit domestic producers.

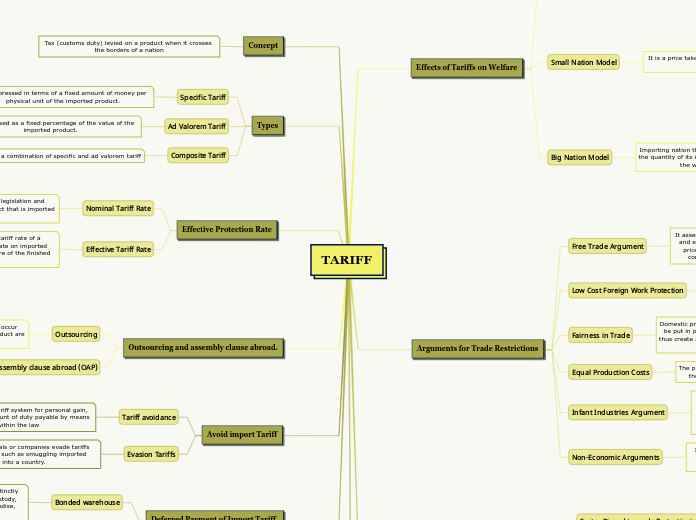

TARIFF

Tips:

- Cover letters should be one page long and divided into three to four paragraphs.

- In general, a relevant and short cover letter is best. Three paragraphs tops. Your go-to word count shouldn’t exceed 300 words.

- When sending a cover letter via email, include your name and the job you're applying for in the subject line of the message.

Deferred Payment of Import Tariff.

Free Trade Zone (FTZ)

FTZs expand the benefits of a tax precinct by removing restrictive aspects of customs enforcement and offering more adequate manufacturing facilities

Bonded warehouse

It is a place where the customs authorities indistinctly carry out the functions of handling, storage, custody, loading and unloading of foreign trade merchandise, inspection.

Avoid import Tariff

In the second paragraph you should show why you are the perfect fit.

Evasion Tariffs

You can also highlight your achieved results at the job.

It occurs when individuals or companies evade tariffs through illegal means, such as smuggling imported products into a country.

Tariff avoidance

You have the opportunity to express your qualifications for the job in more detail than on your resume.

It is the legal use of the tariff system for personal gain, in order to reduce the amount of duty payable by means that are within the law

Outsourcing and assembly clause abroad.

The third paragraph should prove that you’ll fit in and why the company is the perfect fit for you!

Assembly clause abroad (OAP)

It gives favorable treatment to products assembled abroad from components made in the United States.

Outsourcing

Show that you did your research and know something about the company, perhaps an upcoming project, etc.

It is a key aspect of the global economy. It can occur when certain aspects of the manufacture of a product are carried out in more than one country.

Effective Protection Rate

The best cover letter ending is by providing value.

Tell the hiring manager that you look forward to meeting them in person and discuss.

Effective Tariff Rate

Show that your experience and knowledge will let you succeed with the project and benefit the company.

It considers not only the nominal tariff rate of a

finished product, but also any tariff rate on imported inputs that are used in the manufacture of the finished product

Nominal Tariff Rate

It is published in the country's tariff legislation and applies to the value of a finished product that is imported into a country.

Types

A cover letter is a professional correspondence, so you should always use formal closing!

Best wishes

Cheers

Eagerly waiting for a response

Warm regards

Warmest regards

Warmly

Have a great day

Yours faithfully

Abbreviations

Emojis

Composite Tariff

It is a combination of specific and ad valorem tariff

Ad Valorem Tariff

It is expressed as a fixed percentage of the value of the imported product.

Specific Tariff

It is expressed in terms of a fixed amount of money per physical unit of the imported product.

Concept

The post script is a great hack to draw the hiring manager's attention one last time!

You should use the P.S. to tell something impressive about your career.

Tax (customs duty) levied on a product when it crosses the borders of a nation

Political Economy of Protectionism.

The first paragraph will determine if the hiring manager will read on.

Sector Biased towards Free Trade

e.g.: X let me know about the open position and suggested to contact you as they feel I would be a good fit for the position.

It includes exporting companies, their workers and suppliers. It also consists of consumers, including wholesale and retail traders, and of imported products.

Sector Biased towards Protectionism

You should mention the position you are applying for, as the hiring manager can often look for candidates for several job openings.

E.g.: I am writing to express my strong interest in the x position open at x company.

It consists of companies that compete against imports, unions that represent workers and suppliers of companies in that industry.

Arguments for Trade Restrictions

You should address a cover letter directly to the hiring manager.

The hiring manager will see your greeting first so that makes it one of the most important parts of your cover letter. Also, people are most likely to react to the sight of their own names.

Non-Economic Arguments

It states that a country can put itself in danger in the event of an international crisis or war if it is heavily dependent on foreign suppliers.

Infant Industries Argument

This argument does not deny the validity of the free trade case. However, he argues that for free trade to make sense, trading nations must temporarily protect their newly developed industries from foreign competition.

Equal Production Costs

The promoters of a scientific tariff seek to eliminate what they consider to be unfair competition from abroad

Fairness in Trade

Domestic producers claim that import restrictions should be put in place to offset these foreign advantages and thus create a level playing field in which all producers can compete on fair terms

Low Cost Foreign Work Protection

One of the most common arguments to justify the protectionist cover of trade restrictions is that tariffs are necessary to defend domestic jobs against cheap foreign labor

Free Trade Argument

It asserts that if each nation produces what it does best and enables trade, in the long run all will enjoy lower prices and higher levels of production, income and consumption than could be achieved in isolation

Effects of Tariffs on Welfare

The header of every professional cover letter should include your contact information, employer's contact information.

Big Nation Model

You may want to create an email account solely to career search. It should include your first and last name only.

Importing nation that is large enough so that changes in the quantity of its imports, through tariff policy, influence the world price of the product.

Neighbor Impoverishment Policy

Effect of the terms of trade

National Income Effect

Small Nation Model

It is a price taker, facing a constant world price level for its imported product.

Tariff Dead Weight

Consumer effect

Protectionist effect.

Redistribution effect

Income effect

Consumer and producer surplus

It refers to the difference between the amount that buyers would be willing and able to pay for a product and the actual amount that

they pay. And the producer; It is the income that producers receive above the minimum amount required toinduce them to offer the product.