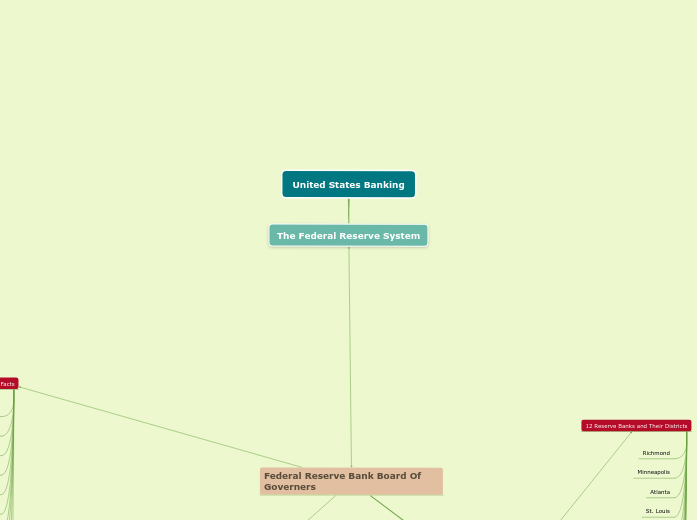

United States Banking

The Federal Reserve System

Federal Reserve Bank Board Of Governers

Federal Open Market Committee (FOMC)

District Reserve Banks

Other Depository Institutions (17,000)

Still under Federal Reserve Regulations

Credit Unions

Savings and Loan Associations

Savings Banks

Non Member Commercial Banks

Member Commercial Banks (3,000)

Medium

Large

JP Morgan

Bank of America

CitiBank

Goldman Sachs

Small

State Chartered Banks Can Become Members if Qualified

Cannot Sell Fed Stock

National Banks Have to Be Members

38% of the 8,039 Commercial Banks are Members of the Federal Reserve System

Must hold 3 percent of captial as stock of Reserve Bank

All member banks hold stock in reserve banks of corresponding district and receive dividends from them.

Nine Directors per District Bank

6 Elected By Member Banks

3 Appointed By Board of Governors

Supervise Commercial Banks

Conduct Research on Econmic Activity

Handle Treasury payments, securities, cash management

invesment activities.

Sells Treasury Notes for the US Treasury

Provide Financial Services to Banks In District

President and Vice President must be Approved By Federal Reserve B.O.G

Each Reserve Bank Have Board Of Directors

Make loans available at discount to other banks

12 Reserve Banks and Their Districts

Boston

Philadelphia

New York

Owns 1/4 of assets in Fed System

Chicago

Kansas City

Cleveland

Dallas

Sanfrancisco

St. Louis

Atlanta

Minneapolis

Richmond

Conduct Open Market Operations (Quantitative Easing, Purchasing or Selling of Securities)

Distric Bank Directors Apparently Bring in the

influence of the private sector persepective.

Meets about 8 Times a year in Disctric of Columbia

The Chairman of the Board Of Governors Chairs the FOMC

Manages the Nations Money Supply

Voting Members Consist Board of Governors(majority), President from the District Bank of New York and 4 other presidents of District Banks.

Influences Federal Funds Rate through

open market operations.

Sets Monitary Policy

Facts

Represents United States in negotiations with foreign goverments

Approves Discount Rate

(interest rate at which Banks

can borrow from Federal Reserve Banks

in their district)

Set the interest rate on required reserves (interest that federal reserve banks pay to other banks for the money held as required reserves)

Set the interest rate on excess reserves (interest that federal reserve banks pay to other banks for the money held as excess reserves)

3 Different Version of the Discount Rate

1. Primary Credit Rate

2. Secondary Credit Rate

3. Seasonal Credit Rate

Sets Margin Requirements

Sets Reserve Requirements

Located in Washington D.C.

Oversee Reserve Banks and Approve Directors

Go to All FOMC Meetings and Have Majority Vote

Chairman and Vice-Chairman Serve 4 year terms

Serve 14 Year Terms, staggered

Members Appointed By President and Confirmed By Senate