SWISS PRIVATE BANKING ID

(KYC Utility and more)

Risk and Mitigations

MITIGATIONS

Data Security by Design

Entity Keeps only AUDIT and LOG Data

Bank Data remains with the Bank

Personal Data Remains with the Client

Costs

Easier Churn

Increased Price Transparency

Lowers the Entry Barrier for new entrants (FINTECS)

Untertopic

Loss of Competitive Advantage

Data Security Concerns

Getting it Done

Operations

Hosting

Swiss Hosted

Required Technology Partnerships

If you look at their recent filings with the SEC, Twitter reports that as at 31st March 2015 they had 302 million active users and paid $142 million in the three months to 31st March for "Cost of Revenue" which they describe as:

Cost of revenue consists primarily of data center costs related to our co-located facilities, which include lease and hosting costs, related support and maintenance costs and energy and bandwidth costs, as well as depreciation of our servers and networking equipment, and personnel-related costs, including salaries, benefits and stock-based compensation, for our operations teams. Cost of revenue also includes other direct costs, amortization of acquired intangible assets, capitalized labor costs and allocated facilities.

Note the caveats in that, so we can't assume that 4 x 142 is the amount paid per year on equipment and power. However we do see that there is roughly $50 million increase in their fixed assets over the same three months, so let's make an assumption that there is operating costs over and above that so we get to something like $400 million per annum. Note that I'm not an accountant and they don't conveniently separate out data centre costs, so this is just my reading of the figures.

Taking all the above into account we see that Twitter is currently running at approximately $1.32 per active user per year.

I'd be happy for someone more familiar with the numbers to point out any obvious mistakes.

Analytics

Transaction Monitoring

Mantas

Actimize

Data Providers

Social Networks

Other Due Diligence Providers DBs

WorldCheck

LexisNexis

Data-Structure

Audit Data

Instrument Data

Documents

Physical Archiving / Doc Transportation

Storage

Contract and Documentation

Digitalization

Bank Client Data

Account

Risk

Operating Monitoring

Geographical Assessment

Legal Signature

Mandate Management

Investment Team / Organisation

Account Type

Portfolio and Positions

Investment Strategy

Restrictions

Investment Goals

Time Horizon

Cash Flows

Risk Capabilitiy

Risk Appetite

Risk Profile

Party Model

Legal Entity

Controlling Person

Legal Type

Person

Personal Link

Role in the Business relationship

Account Holder

Beneficial Owner

Family

Power of Attorney

Preferences and Restrictions

Knowledge and Experience

Personal Information

Source of Wealth

AML Risk

Education & Profession

Social Network

Documents ID

Country of Residence

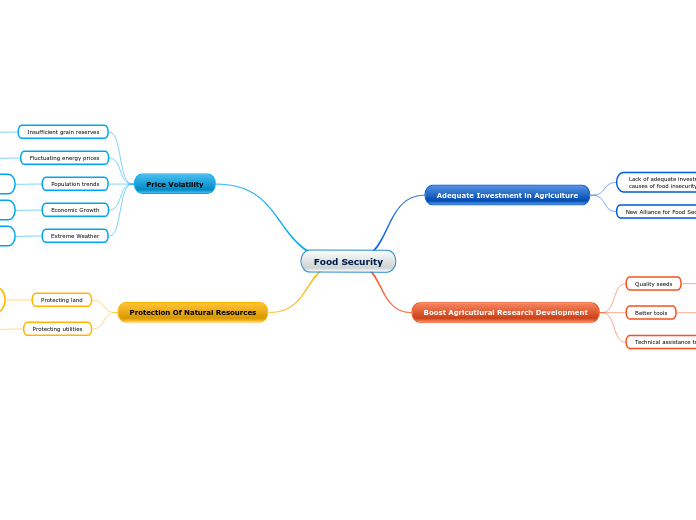

Challenges

Network and Stakeholders

Cross Border

FINMA

Affiliates

Fintechs

Insurance

Travel Industry

Real State

Luxury Industry

BANKS

Financial Services

Wealth Managements

Invest and Capital Markets

Chicken and Egg Problem

Marketing Costs

Information Capture & Corroboration

Geographic diversity

Multilanguage

Technology

Security

Agree on Data-Structure and Interfaces

Benefits

Regulator and Authority

Transparency Increase

Improved AML (holisitc view)

Bank

Platform approach - open collaboration for Fintechs/Banks and lower cost of Innovation

Explore and test for new sources of Revenue

Improving the RM and Investors Officers value and quality measurement

Reverse Enquiries from Clients

Prospecting Tool Qualified Leads

Reduced onboarding times

Solution for GDPR & MIFID Transparency & Confirmation Requirements

Reduced Cost

Cost Sharing of scarce/expensive specialists

Client

KYC Data Portability

Qualified Digital Identity

authorities

Improved Security

Means of Authentication

Transparency in the Onboarding Process

Granular Control over their data

Value-Add-Services

Peers Network

Co-investing clubs

VIP Club Cards (SoHo House, Business Clubs)

"Pay with your good name" High Value Payments

VIP Card

Lounges

Affiliate-Offerings

Concierge Services

Improved Onboarding Experience

Request for Investment Proposal

Easy-Access-to-Private Banks

Reputation

Increase my Personal Value

Savy Investor - share achievements among peers

Prestige