FORMS AND SIIF

SIIF

Open government

Vital for decision making

Allows

Incorporating information systems into public management

Articulated and dependent data generating scheme

Tax administration

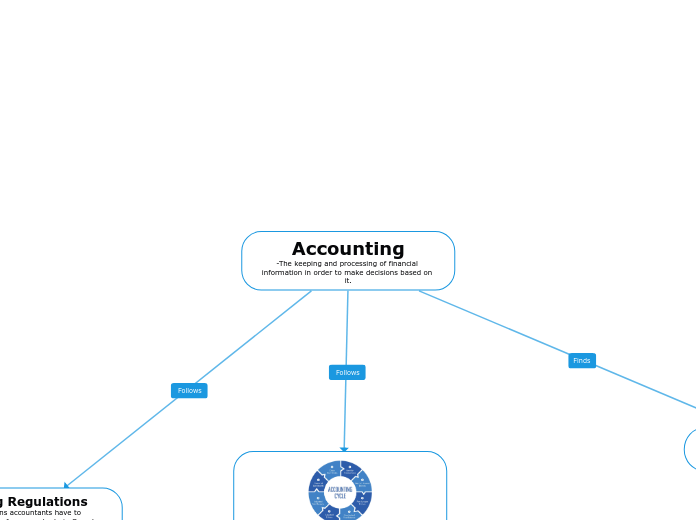

Accounting

Treasury

Public credit

Budgetary

Financial

Mitigating corruption risks in public management

Achievement of results

Better spending

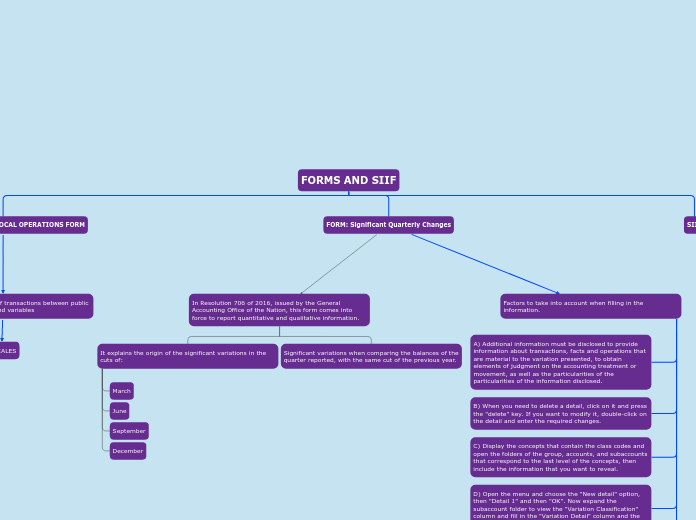

FORM: Significant Quarterly Changes

Factors to take into account when filling in the information.

F) At the end of the completion, go to forms/validate and execute the action. If validation errors are generated, the respective corrections must be made.

E) Note to convert the semicolon to a period, because when copying the text to Excel the period may split the text into two cells. Remove spaces at the end of rows and columns, as well as any other special characters other than those requested, which may cause errors. characters other than those requested, which may cause errors.

D) Open the menu and choose the "New detail" option, then "Detail 1" and then "OK". Now expand the subaccount folder to view the "Variation Classification" column and fill in the "Variation Detail" column and the value that is the object of the explanation.

C) Display the concepts that contain the class codes and open the folders of the group, accounts, and subaccounts that correspond to the last level of the concepts, then include the information that you want to reveal.

B) When you need to delete a detail, click on it and press the "delete" key. If you want to modify it, double-click on the detail and enter the required changes.

A) Additional information must be disclosed to provide information about transactions, facts and operations that are material to the variation presented, to obtain elements of judgment on the accounting treatment or movement, as well as the particularities of the particularities of the information disclosed.

In Resolution 706 of 2016, issued by the General Accounting Office of the Nation, this form comes into force to report quantitative and qualitative information.

Significant variations when comparing the balances of the quarter reported, with the same cut of the previous year.

It explains the origin of the significant variations in the cuts of:

December

September

June

March

CONVERGENCE RECIPROCAL OPERATIONS FORM

Is used to report balances of transactions between public entities grouped between and variables

VARIALES

variables are current and non-current balances of the form balances and movements in convergence at quarterly cut-off date

public accounting information must be entered

you must select the subaccount in which the information is to be included.

a window appears with a list of all available entities.

you can double-click on any of them to choose the entity with which you have the reciprocal operation.

with which you have the reciprocal operation. Another way is by typing the code or the name in the filter that appears in the upper right part of the

in the filter that appears at the top right of the selector. To view the code entered in the

column, open the key of the sub-account and the record of the code and the name of the entity will appear both in the "concepts" column and in the "concepts" column.

in both the "concepts" column and in the "Reciprocal entity" column.

Place the cursor in order in the columns "CURRENT VALUE" and "NON-CURRENT VALUE" and record horizontally in the row of each item the respective values, taking into account the following

horizontally register in the row of each concept the respective values, taking into account the rules of the signs.

rules of the signs.

The values recorded in the variables "current ending balance" and "non-current ending balance" must be equal to or less than the "current ending balance" or "non-current ending balance" of the sub-account in the

formCGN2015_001_SALDOS_Y_MOVEMENTS_CONVERGENCE, otherwise, the validation will generate an error.

- The entries are made only at the sub-account level, the system calculates the other levels when you refresh or validate the form.

the system calculates the other levels when refreshing or validating the form. If you are going to correct a record, place the cursor in the cell and double-click on it.

double click on it, this will activate it for correction.

When you have finished incorporating all the records of the form, go to the Forms/Validate option and execute the action.

and execute the action.