IAS 38 (Intangible Assets)

Type in the name of your subject.

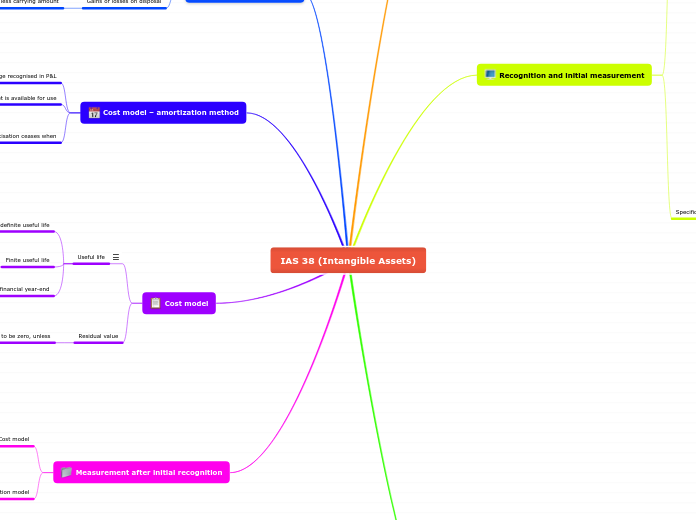

Measurement after initial recognition

Add detailed notes about each lecture, so that when the time comes to prepare for exams, you will have an easier and quicker overview.

Revaluation model

Not further discussed as very rare and only possible for intangibles for which there exists an active market

Add a short description of your homework and any details you need in order to understand and complete the task.

Revalued amount less accumulated amortisation and impairment losses

Cost model

Cost less accumulated amortisation and impairment losses

Add a list of questions to help you recap your lecture.

Cost model

Add here all the details about your projects.

Residual value

Assumed to be zero, unless

Commitment by a third party to purchase or active market and

− It is probable that such a market will exist at the end of the useful life

- Residual value can be determined by reference to that market

Useful life

Factors to be considered when determining the useful life

- The expected usage of the asset by the entity and whether the asset could be managed efficiently by another management team

- Typical product life cycles for the asset and public information on estimates of useful lives of similar assets that are used in a similar way

- Technical, technological, commercial or other types of obsolescence

- The stability of the industry in which the asset operates and changes in the market demand for the products or services output from the asset

- Expected actions by competitors or potential competitors

- The level of maintenance expenditure required to obtain the expected future economic benefits from the asset and the entity’s ability and intention to reach such a level

- The period of control over the asset and legal or similar limits on the use of the asset

- Whether the useful life of the asset is dependent on the useful life of other assets of the entity

Review at the end of each financial year-end

Add the team members.

Change in accounting estimate accounted for prospectively

Finite useful life

Add a short project description.

Allocation of the depreciable amount (= cost – residual value) on a systematic basis over the useful life

Indefinite useful life

Add the project name.

No amortisation, but annual test of impairment according to IAS 36 (Impairment of Assets)

Cost model – amortization method

Schedule your course ahead. Knowing all the information will make everything easier.

Amortisation ceases when

The asset is classified as held for sale in accordance with IFRS 5 – Non-current Assets held for Sale and Discontinued Operations or the asset is derecognised

Amortisation begins when the asset is available for use

Amortisation charge recognised in P&L

Add the class information for each week.

Retirements and disposals

Gains or losses on disposal

Proceeds less carrying amount

Elimination from balance sheet when

Disposed of or no future economic benefits are expected from its use or disposal

Some remarks

Add key information about the books you've read. If you feel it's necessary, you can add a small summary of your readings in the Notes section.

IAS 38 requires to expense (passer en charge)

Training costs

Advertising costs

Relocation costs

Start-up costs

Development expenses

In some cases no material further development expenses are to be incurred from the moment all criteria to capitalise were met

In pharma and life sciences industry it is very rare that development expenses are capitalized (technical feasibility criterion)

Intangibles acquired in

a business combination

The fact that the acquirer has no intention to further use these intangibles is not a reason not to recognize them at fair value

Intention not to use has no

impact on initial fair value

In process R&D to be

recognised as well

Add summary of the content of a book

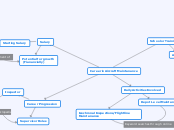

Recognition and initial measurement

Review your resource requirements and tick off the devices you will need as well as their availability. Add others, if necessary.

Specific principles

Internally generated intangible assets

Expense to P&L

Development expenses

Capitalisation of development costs if, and only if

−All these criteria are met :

− technical feasibility

− intention to complete

− ability to use or sell the asset

− probability of future economic benefits

− availability of resources (technical, financial)

− expenditure can be reliably measured

Research expenses

Examples of research activities :

• Gaining new knowledge

• Search for applications of research findings

• Search for alternatives to materials, products, processes, etc.

• Formulation, design, evaluation and selection of possible alternatives for new or improved materials, products, processes, etc.

All expenditure on research should be expensed when incurred

None of intangible asset arising form research (or research phase) should be recognised

Internally generated goodwill

Not recognised as an asset (expense to P&L)

Acquisition in a business combination

At fair value based on

− Quoted market prices (active market)

− If no active market, use techniques to estimate fair value

• multiples/profitability

• discounted future cash flows...

Reliable measurement => always considered to be satisfied

Acquired in a separate acquisition

Measurement

Expenditures that are not part of the cost of an intangible asset

− Costs of introducing a new product or service (incl. advertising and promotional activities)

− Costs of conducting business in a new location or with a new class of customers (including costs of staff training) and administration and other general overhead costs

Cost components when purchased

− Purchase price, import duties and purchase taxes, directly attributable expenditure of preparing the asset for its use

and less trade discounts & rebates

At cost

Recognition

Reliable measurement => usually satisfied (particularly when payment is in monetary assets)

Probability criterion => always satisfied

An asset meeting the definition of an intangible asset should be recognised when

Select as needed:

It is probable that future economic benefits associated with asset will flow to the enterprise and cost of asset can be measured reliably

Definition

Type in all the info you would like to know about this subject. If there is something you don't know yet, no problem! You can fill in the blanks along the way.

Aller voir le slide 48 semaine 2

Did your teacher present the objectives of this course? Write them down and add anything else that might help you reach these objectives.

Examples : ➢ Computer software

➢ Patents

➢ Motion picture films

➢ Import quotas

Add details about your teachers' evaluation criteria. This way you will know the aspects you need to focus on.