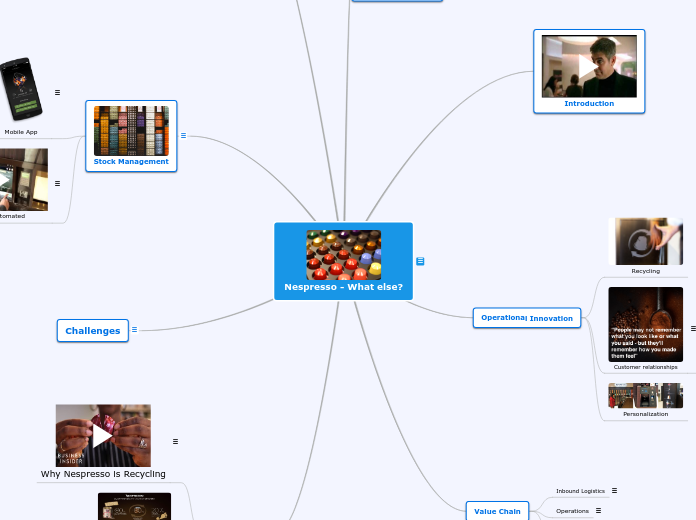

third step of SD

Scaling up through SD

Second step of SD

Level of Involvement :

1) Challenge

2) Sparring Partner

3) Financial Contribution

4) Product Endorsement

5) Company Endorsement

6) site or project dialogue

7) strategy dialogue

8) project joint venture or strategic joint venture

Elkington & Fennel (1998)

The crack point where companies need to feel part of something larger before going unto the next step

How did this need come about ?

before answering such a question we need to understand what sustainable development stands for. Follow subcategories of this theme in order to visualize the rest of idea.

Become an active promoter for SD

The need to implement these changes into the co. core values

Part of the whole strategic vision

The difference from any other form of scaling is the shift towards:

1) more ethical

2) long term

3) and sustainable business models

This again is beyond the first mover in advantage. After the global crisis and the environmental impacts companies in the nearer future will face an unprecedented challenge unless we scrape various outdated business models.

This is a call for a shared support which calls in the responsibilities of all of the other companies. However, the chain has started some of the biggest and most successful companies have embraced the challenge example:

Vodafone

Nike

Ikea

IBM

Microsoft

HSBC bank

Hotels

Therefore the question is not why but why not. Why are not the private companies seeing this is an opportunity to scale up? What are the number of challenges that researchers have been failing to discuss?

Accounts needs

to include non-

financial variables

Building New Business Models/more sustainable

Resource Dependency theory

Networking needs

Shared Value Creation

adding and changing the supply chain value

understand the various benefits of SD

Reputation

marketing

Need to become more efficient

Increases costs of emission

rise of energy costs

Partnering

Be able to scale up

Part of network theory

Tie-level Concept

The Tie-Level Theory (Kilduff & Tsai, 2003) forms part of a theoretical framework (4 theories):

1) focus on people

2) prefers to build a relationship with organizations that have an emotional, collaboration tie with.

Social Media Network includes:

a) Strength of relationship

b) Reciprocity

c) Multiplexity (i.e a company or NGO's name keeps popping up)

Notes:

Other Theories Include:

I) Stakeholder theory (Donaldson & Preston, 1995)

ii) Sustainable Development Business (Rainey, 2006)

ii) Motivational & Challenge Theory (Mendelson & Polonsky, 1995)

Creating and Protecting Value thru SD

Financial Value tool

the Financial Value tool is the include the following factors:

1) a stakeholder Analysis

- Risk Vs. Impact Matrix

2) NPV

- NPV of SD = NPV(2) - npv(1)

3) Value Protection (or maintenance/ Total Value)

- Direct Value Creation vs. Indirect Value

Protection, e.g. delays or disruptions caused by law or environmentalists

4) value Creation (Cost-benefit Analysis)

- Newmont Value Creation

5) Risk Quantification (Risk -benefit factors)

6) Quality of Sustainability (time factor)

7) Monte Carlo Simulation (distribution)

Stakeholder Theory

Stakeholder Theory:

Compromises the influence as well as increased engagement of their customers. For example having a product of service with high existence value would in turn increase the total value of the other products or services.

Increases TV thru existence value

increased call for responsibility

Ethical Consideration

The downfall or government action

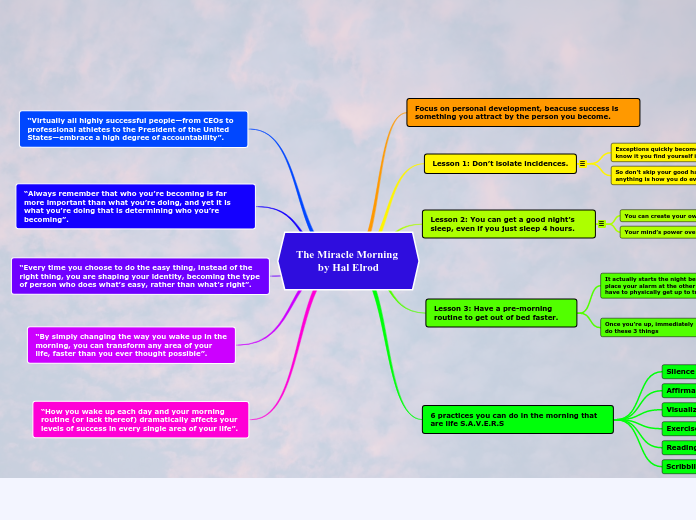

triple bottom line

Social, Economic, and environment:

These three factors where always there, especially when diluting these 6 capital drives:

1. Financial

2. Physical

3. Social

4. Intellectual

5. Human

6. Natural

Secondary Opportunities

waste management

reusing returns

recycling methods

transport

resources

time

increase on corporate governance

create new niche markets

Quality

promoting change

enter new markets

Firs step towards SD

Investing in sustainable development

rthff

Opportunities

Subtopic

Validating new niche markets

Enter new markets

PPP

Risks & challenges

Fast change pace

trade off graph is too steep

Evaluate success/

no standardized tools

Too much information with no real ROI

Ambiguous Metrics

expensive technology

fails to create a business case for SD

Goal alignment

Trade-off

Funds

Corporate Governance

Strategic Alignment

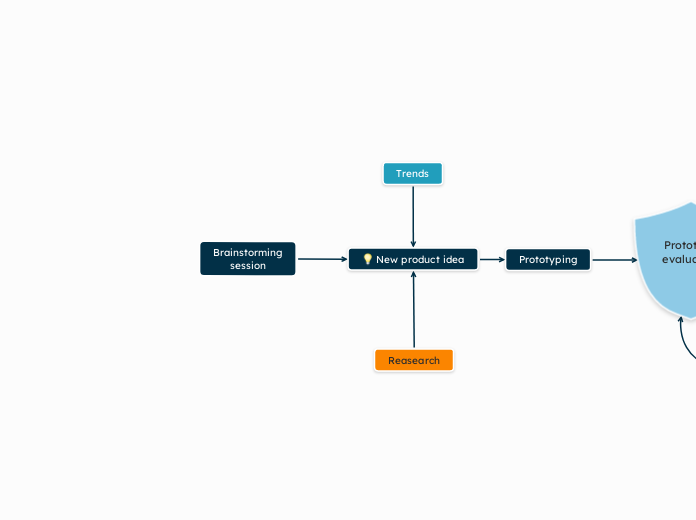

4 Key elements

1) Entrepreneurship

2) Strategic thinking

3) Visionary & exceptional Leadership (empowerment)

4) Leading change (proactive) thru innovation

stages

every step involves a number of tasks or challenges

feels there is a natural flow to it.