To help management make decisions and serve the needs of bankers/investors outside of the business.

Gathering any financial information about the activity of the business

Uses records to provide evidence of purchases

Classifying different financial data, rearranging the data for financial analysis, and summarizing the data in a neat, readable way.

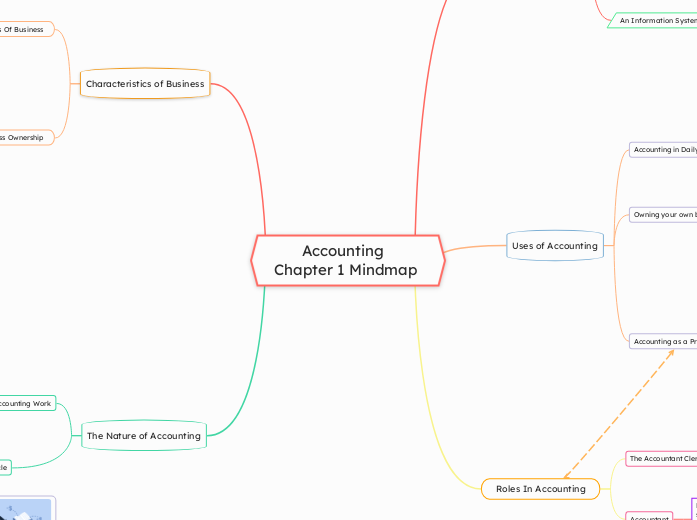

Accounting

Chapter 1 Mindmap

The Nature of Accounting

The Accounting Cycle

Outer Circle - Ongoing intermitten activities

Inner Ring - Activies Done Annually

Categories of Accounting Work

Miscellaneous Activities

Activities that occur at unpredicted times (accounting employee resigns, concerns over bank loan size, etc.)

Periodic Accounting Activities

Activities that occur at regular intervals (weekly, biweekly, monthly)

Routine Daily Activity

Activities that occur the same way every day (Processing bills, preparing cheques, daily banking, etc.)

Characteristics of Business

Forms of Business Ownership

Corporation

Owned by Shareholders

Partnership

Two or more people own the business

Sole Propietorship

Single owner of the business

Types Of Business

The Non-Profit Organization

Carry out social needs without

trying to collect a profit

Manufacturing and Producing Business

Producing: Collect and sell raw materials

(e.g. farms, mining)

Manufacturing: Buys raw materials and

converts them into products (e.g. car companies)

The Merchandising Business

Buys and Resells goods at a

higher price (e.g. supermarkets)

The Service Business

Sells a service to people

(e.g. salon, car wash)

Roles In Accounting

Accountant

Requires more education and experience, making sure the correct data is put into the accounting system, analyzing financial statements and making reports for management.

The Accountant Clerk/Book Keeper

The work of an Accountant Clerk is known as bookkeeping, including ensuring transactions are properly recorded, recording account entries in books of account, making many types of payroll records, and carrying out all bank transactions. Accountant clerk's are usually more entry level accountants.

Uses of Accounting

Accounting as a Profession

When becoming a professional accountant, there are entry-level and high-level positions. People filling these spots can have little to no training or multiple years of experience. Accountants get training from high school, college or university, and gather on-the-job experience to be prepared.

There used to be 3 jobs you could get as a professional accountant, however it is now merged as one: Chartered Professional Accountant (CPA).

Management/Institutional Accountant - Works for large companies, the government, banks, universities, etc.

Public Accountant - Works for the general public (anyone who pays them), doing an important task called Auditing. An audit is the testing of records and procedures of a business so that they can express their opinions on their financial statements.

Owning your own business

When creating your own business, a business owner has to deal with banking, keeping track of accounts payable and recievable, keeping accounting records for the government, making income tax statements, and possible preparing payroll and payroll deductions.

Accounting in Daily Life

Having accounting knowledge can prove useful in daily life, as it can help when dealing with personal business affairs like personal budgeting, personal financial records, and preparing income tax return. It also allows you to take any business opportunities

What is Accounting?

An Information System

Preparing Financial Reports

Rearranging, summarizing, and classifying

Preparing/Collecting Records

Gathering Financial Information