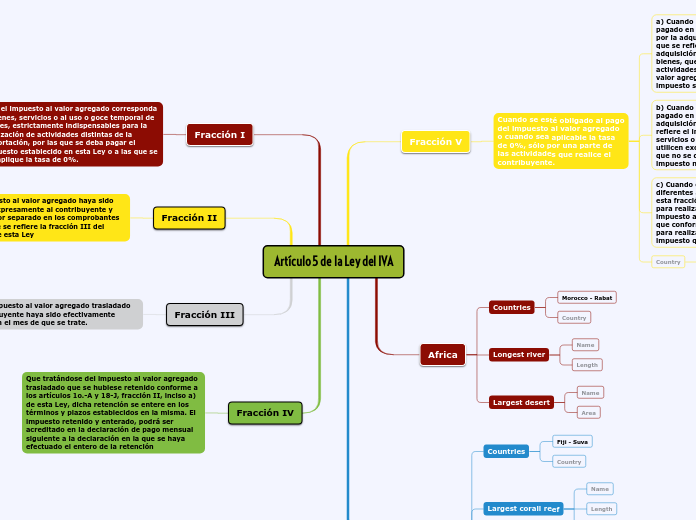

Artículo 5 de la Ley del IVA

The first division between continents was made by ancient Greek navigators, who named them 'landmass, terra firma'.

Generally classified by convention rather than any strict criteria, nowadays seven regions are regarded as continents from a geopolitical point of view.

Fracción IV

Europe is separated from Asia by the Ural mountains and the Caspian Sea.

It is surrounded by water on three sides: Mediterranean Sea in the south, Atlantic Ocean in the west, and the Arctic Ocean in the north.

Three-fourth of the world's potatoes grow in Europe.

Que tratándose del impuesto al valor agregado trasladado que se hubiese retenido conforme a los artículos 1o.-A y 18-J, fracción II, inciso a) de esta Ley, dicha retención se entere en los términos y plazos establecidos en la misma. El impuesto retenido y enterado, podrá ser acreditado en la declaración de pago mensual siguiente a la declaración en la que se haya efectuado el entero de la retención

Europe has many exceptional animals, birds, and reptiles with unique methods of staying and hunting.

Name at least 4 of them.

Fracción III

Antarctica is not only the coldest place on Earth but also the highest, driest, windiest and emptiest, completely covered with ice.

75% of the world's ice and 70% of the Earth's fresh water is located here.

Summer months of December to February give 24 hours of light, while the winter months of late March to late September are pitch dark the whole day.

There are no permanent inhabitants, except for scientists maintaining research stations in Antarctica.

Que el impuesto al valor agregado trasladado al contribuyente haya sido efectivamente pagado en el mes de que se trate.

Fracción II

You can find on this continent:

- the world's largest river as per water volume, the Amazon.

- the highest volcanoes of the world -- Mt. Cotopaxi and Mt. Chimborazo.

- the country, Brazil, which is the largest coffee producer in the world.

- the second-highest mountain range in the world, the Andes.

Que el impuesto al valor agregado haya sido trasladado expresamente al contribuyente y que conste por separado en los comprobantes fiscales a que se refiere la fracción III del artículo 32 de esta Ley

There are 12 countries that make up South America.

Name as many of you can! Don't forget about their capitals.

Fracción I

North America has five time zones and it is the only continent with every type of climate.

North America was named after the explorer Amerigo Vespucci and is also known as the 'New World'.

The world's largest sugar exporter among the seven continents - Cuba - also called the 'sugar bowl of the world' is located here.

Que el impuesto al valor agregado corresponda a bienes, servicios o al uso o goce temporal de

bienes, estrictamente indispensables para la realización de actividades distintas de la

importación, por las que se deba pagar el impuesto establecido en esta Ley o a las que se les aplique la tasa de 0%.

There are 23 countries that make up North America.

Name as many of you can! Don't forget about their capitals.

Australia

Australia is the world's smallest continent and is also known as an 'island continent' as it is surrounded by water on all sides.

It includes 14 countries and it is the least populated continent.

Its name comes from the Latin word 'australis' meaning 'southern' because it lies entirely on the south of the equator.

Animals

Australia is home to some animals that can't be found anywhere else in the world.

Name at least 6 of these unique animals.

Largest monolith

The largest sandstone monolith can be found here and it is one of Australia's most recognizable natural icons. It is the largest monolith in the world.

Name this rock and write down one of the characteristics it is famous for.

Famous for

Largest corall reef

The largest coral reef can be found here.

Name this coral reef, add its length and mention what type of coral is it.

Type

Out of 14, how many countries you can name?

How about these countries' capitals?

Fiji - Suva

Africa

Of the seven continents of the world, Africa is the second largest.

Africa comprises 54 countries and it is the hottest continent.

The equator passes through the middle of Africa and it receives direct sunlight throughout the year.

The world gets 66% of its chocolate, 50% of the gold and 95% of the diamonds from Africa.

Largest desert

The largest hot desert in the world which used to be a lush region with many plants and animals.

The current climate makes it a difficult place for any life to exist. It is hot, dry, and windy.

Very hot during the day but the temperature can drop sometimes to below freezing at nights.

It rarely rains, some regions can go years without seeing a drop of rain.

Name this desert.

Area

Longest river

The world's longest river can be found here, famed for its ancient history and the archaeological sites along its shores.

This river gave rise to the early Egyptian civilization.

Name this river and add its length.

Length

Name

Countries

Out of 54, how many countries you can name?

How about these countries' capitals?

Morocco - Rabat

Fracción V

Asia is the world's largest continent of the seven continents in size, as it covers one-third of the earth's surface.

It includes 50 countries, and it is the most populated continent, 60% of the total population of the Earth lives here.

Cuando se esté obligado al pago del impuesto al valor agregado o cuando sea aplicable la tasa de 0%, sólo por una parte de las actividades que realice el contribuyente.

Name as many as you can out of the 48 countries located in Asia.

Write down the capitals too.

Country

Capital

c) Cuando el contribuyente utilice indistintamente bienes diferentes a las inversiones a que se refiere el inciso d) de esta fracción, servicios o el uso o goce temporal de bienes, para realizar las actividades por las que se deba pagar el impuesto al valor agregado, para realizar actividades a las que conforme esta Ley les sea aplicable la tasa de 0% o para realizar las actividades por las que no se deba pagar el impuesto que establece esta Ley.

b) Cuando el impuesto al valor agregado trasladado o pagado en la importación, corresponda a erogaciones por la adquisición de bienes distintos a las inversiones a que se refiere el inciso d) de esta fracción, por la adquisición de servicios o por el uso o goce temporal de bienes, que se utilicen exclusivamente para realizar las actividades por las que no se deba pagar el impuesto al valor agregado, dicho impuesto no será acreditable.

a) Cuando el impuesto al valor agregado trasladado o pagado en la importación, corresponda a erogaciones por la adquisición de bienes distintos a las inversiones a que se refiere el inciso d) de esta fracción, por la adquisición de servicios o por el uso o goce temporal de bienes, que se utilicen exclusivamente para realizar las actividades por las que se deba pagar el impuesto al valor agregado o les sea aplicable la tasa de 0%, dicho impuesto será acreditable en su totalidad