arabera mark jenkins 17 years ago

329

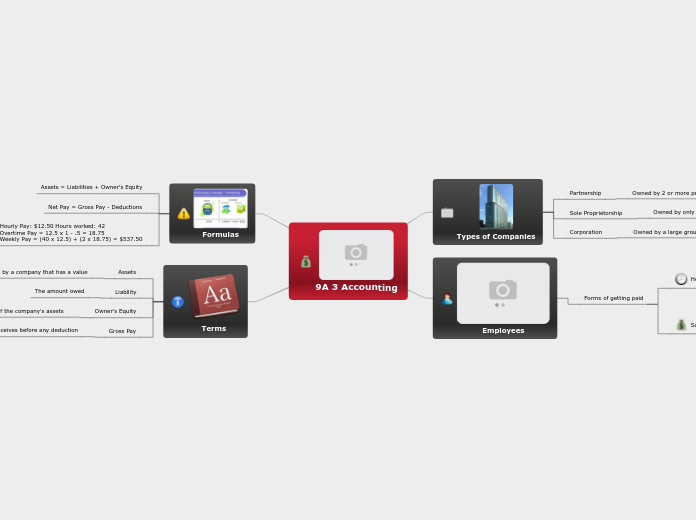

Companies

Limited companies possess a distinct legal identity, requiring adherence to extensive formalities which can consume significant management time. These entities are distinguished by their ability to sell shares privately, thereby reducing financial risk for investors and facilitating easier growth funding and a wider range of borrowing opportunities.