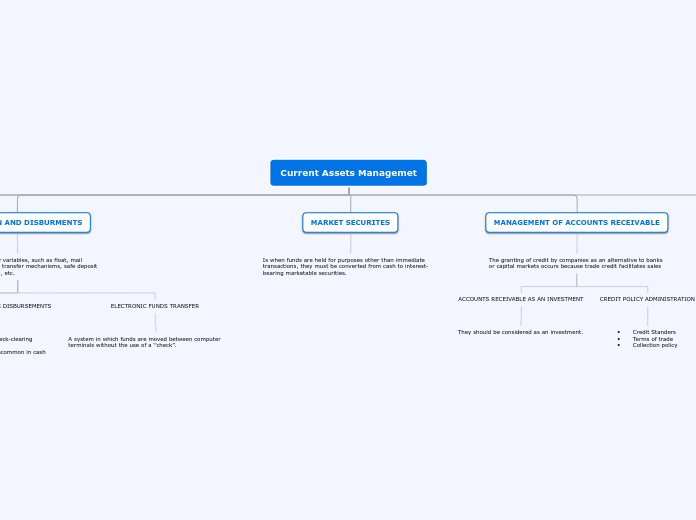

Current Assets Managemet

INVENTORY MANAGEMENT

All of these forms of inventory need to be financed, and their efficient management can increase a firm’s profitability.

JUST-IN-TIME

•Quality production that continually satisfies customer requirements

•Close ties between suppliers, manufacturers, and customers

•Minimization of the level of inventory

SAFETY STOCK AND STOCKOUTS

•Occurs when a company runs out of a specific inventory item and is unable to sell or deliver the product.

• Is inventory held in addition to regular requirements to protect against a shortage of an item.

THE INVENTORY DECISION MODEL

The two basic costs associated with inventory must be evaluated: transportation costs and ordering costs.

INVENTORY POLICY IN INFLATION (AND DEFLATION)

The problem can be partially controlled by taking moderate inventory positions.

MANAGEMENT OF ACCOUNTS RECEIVABLE

The granting of credit by companies as an alternative to banks or capital markets occurs because trade credit facilitates sales

CREDIT POLICY ADMINISTRATION

• Credit Standers

• Terms of trade

• Collection policy

ACCOUNTS RECEIVABLE AS AN INVESTMENT

They should be considered as an investment.

MARKET SECURITES

Is when funds are held for purposes other than immediate transactions, they must be converted from cash to interest-bearing marketable securities.

COLLECTION AND DISBURMENTS

It is a function with many variables, such as float, mail systems, electronic funds transfer mechanisms, safe deposit boxes, international sales, etc.

ELECTRONIC FUNDS TRANSFER

A system in which funds are moved between computer terminals without the use of a ‘’check’’.

IMPROVING COLLECTIONS AND EXTENDING DISBURSEMENTS

• We may expedite the collection and check-clearing process through several strategies

• The slowing of disbursements is not uncommon in cash management.

Float

Is due to shipping delays

CASH MANAGEMENT

Knowledge of the cash flow cycle can help in understanding cash management, and financial forecasting proformas as they are invaluable tools for identifying the cash needs of the business.

Reasons for Holding Cash Balances

Transactions balances, for compensating balances for Banks, and for precautionary needs.

COST BENEFITS ANALYSIS

It must consider explicit and implicit costs and benefits.

It provides a framework for identifying all changes resulting from a decision, some results will be incremental, increasing the value of the company, and others will be decremental, decreasing value.