a Lorenzo Covre 6 hónapja

85

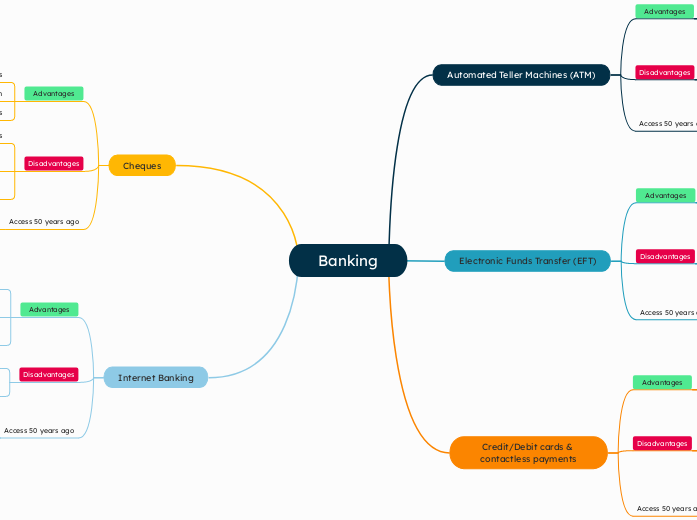

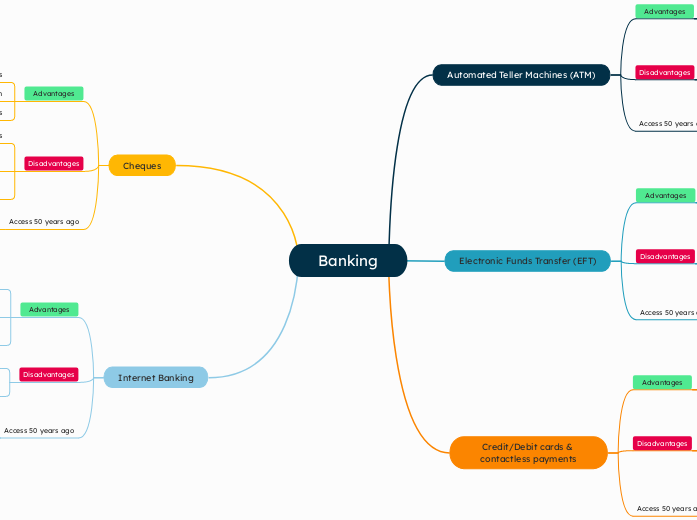

Banking

Modern banking has evolved significantly with the advent of internet banking, which allows users to perform various transactions remotely, reducing the need for physical visits to bank branches.

a Lorenzo Covre 6 hónapja

85

Még több ilyen