por Lorenzo Covre hace 5 meses

83

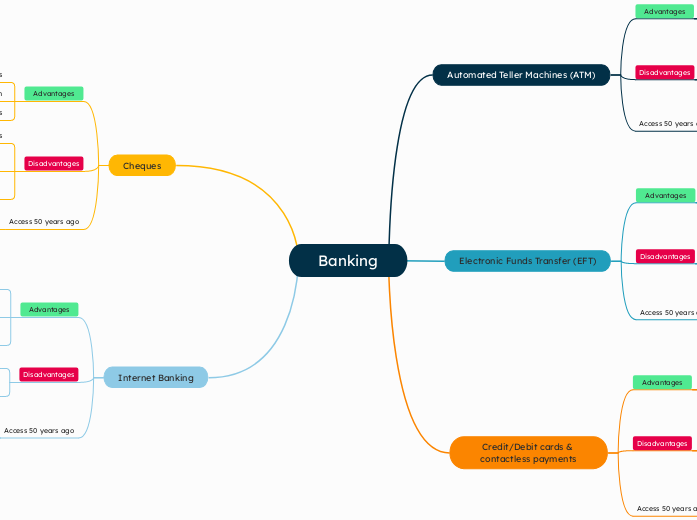

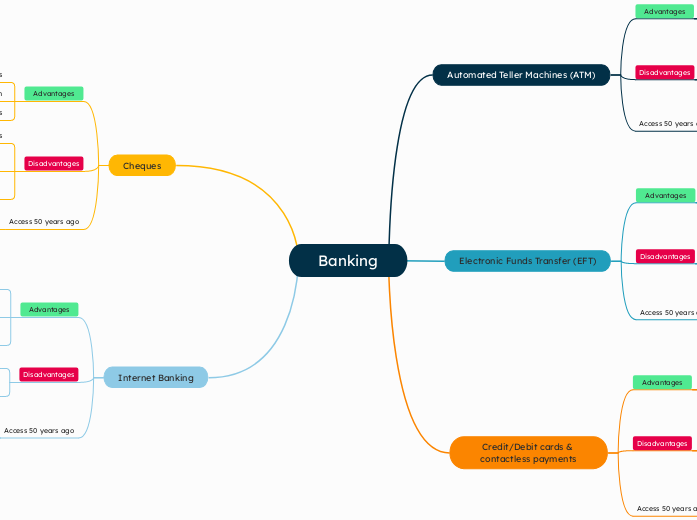

Banking

Modern banking has evolved significantly with the advent of internet banking, which allows users to perform various transactions remotely, reducing the need for physical visits to bank branches.

por Lorenzo Covre hace 5 meses

83

Ver más