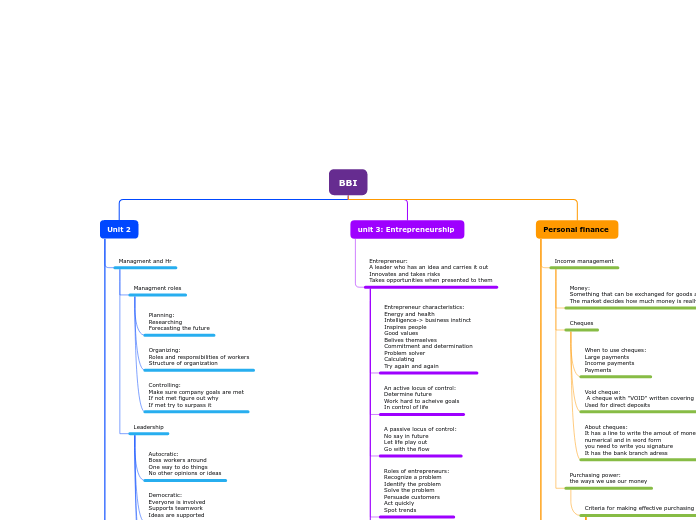

BBI

Personal finance

Budgeting:

A plan for saving money and smart spending

Rule of 72:

72/I(Interest) = # of years to double money

Compound interest:

Interest earned on interest

Compound interest formula:

PV(Present value) x R(Interest rate) x T(Time) = I(Interest)

Variable expenses:

Expenses that aren't set

Food, gas, entertainment

Fixed monthly expenses:

Bills

Income after taxes:

Amount of money you have after taxes every month

Components of a budget:

Revenue

Expenses

Preparing a personal budget:

1: Calculate your assets

2:Calculate what you own

3:Calculate what you owe

4:Calculate what you spend

Financial plan should include:

Saving and investing

Paying down debt

Insurance

Taxes

Retirement planning

Estate planning

Savings and banking

Types of bank accounts

Chequing account:

Meant for money you pal to use for day to day purchases

Savings account:

For setting aside money for large purchases or emergencie

Financial institutions

Credit unions:

Run and owned by members who use the bank

Sometimes charge a refundable fee to be a member

Trust companies and banks:

These make money for share holders

Deductions:

Mandatory or voluntary money taken off your paycheck

Expenses in Canada:

Utilities

Rent or Mortgage

Internet

Food

Entertainment

Net income formula:

Income-deductions= Net income

Taxes:

Anyone who earns an income is obligated to pay provincial and federal income taxes.

Graduated tax system is based on how much money you make from your income.

More taxes payed:

Hst (13%)

Property tax

Other taxes (Things like tobacco)

Voluntary deductions:

Optional deductions you voluntarily are having taken off your pay

Company pension plan

Savings

Life insurance

Mandatory deductions:

Deductions that must be taken off your pay by law

Income tax

employment insurance

Canada pension plan

Income and payroll

Payroll

Piecework:

Paid depending on the number of items you make or sell

Formula:

Money per item x Number of items(made or sold)

Comission:

Based on a percentage of the item you sell

Salary+Commision:

A small salary+a small percentage of what you sell

Formula:

Amount sold x commision percentage(decimal form) + salary

Straight commision:

You sell to be paid

Formula:

Amount sold x commision percentage(decimal form)

Hourly:

Paid per hour worked

Formula:

Hourly money x Hours worked

Overtime:

one and a half more than the normal hourly pay

Formula:

Regular hours + Overtime hours(1.5)

Salary:

Monthly-12 pay cheques

bi-weekly-26 pay cheques

weekly-52 pay cheques

Formula:

Salary/number of pay periods = Money paid per cheque

Payroll terms

Salary:

Paid the same amount without any overtime hour money

Piecework:

Paid for every time you make the item

Comission:

Paid a precentage amout based on your sales

Hourly rate:

The set amount of money you make per hour

You also get paid 1.5 x more money

per overtime hour you work

discretionary income:

Total amount of money a person earns when all basic needs are deducted

Net income:

Total money a person earns after taxes are deducted

Gross income:

Total money a person earns before taxes

Income management

Purchasing power:

the ways we use our money

Criteria for making effective purchasing decisions

Warranties and guarantees:

Warranties: provides services after-sale on a product for a certain period of time

Guarantees: A formal promise that goods or services are at a certain quality

service:

What you're paying someone else to do for you

Comparison shopping and product information:

How you compare items

compare must haves and pro's vs con's of items

Quality:

Should you pay more and get better quality goods/services

or

Should you pay less and get low quality goods/services

Buyer behavoir:

Every buyer has different needs and wants

Costs:

What are your monthly costs?

Money available:

How much money can you get?

Cheques

About cheques:

It has a line to write the amout of money,

numerical and in word form

you need to write you signature

It has the bank branch adress

Void cheque:

A cheque with "VOID" written covering it

Used for direct deposits

When to use cheques:

Large payments

Income payments

Payments

Money:

Something that can be exchanged for goods and services

The market decides how much money is really worth

unit 3: Entrepreneurship

Entrepreneur:

A leader who has an idea and carries it out

Innovates and takes risks

Takes opportunities when presented to them

Elevator pitch:

A quick persuasive speech to spark interest about

what you're doing

Innovation:

Improving on something already made

Invention:

Making something new

Roles of entrepreneurs:

Recognize a problem

Identify the problem

Solve the problem

Persuade customers

Act quickly

Spot trends

A passive locus of control:

No say in future

Let life play out

Go with the flow

An active locus of control:

Determine future

Work hard to acheive goals

In control of life

Entrepreneur characteristics:

Energy and health

Intelligence-> business instinct

Inspires people

Good values

Belives themselves

Commitment and determination

Problem solver

Calculating

Try again and again

Unit 2

Production

Factors of production

Land/natural resources/raw material

Capital

Human resources/labour

Entrepreneurship

Improving productivity

Training

Capital investment

Investment in technology

New inventory systems

Production stages

Grading:

Checking products for quality and size

Quality control:

Standards needed to be met for the product

Processing:

making one item into another

Purchasing:

Buying raw material

Accounting

Income statements

Income statement rules:

3 dollar signs

underline to end something

Double underline to end income statement sheet

Happens over a period of time

Income statement equation:

Revenue-expenses=net income or net loss

Net loss:

Losses

Revenue is smaller than expenses

Net income:

Profit

Revenue is bigger than expenses

Expenses:

Costs already paid

Product expense

Revenue:

Money earned by doing a service or selling something

Tutoring fees

Balance sheet

30 days poem

Balance sheet rules:

Total assets = Total liabilities

4 dollar signs

Underline to end something

Double underline to end the balance sheet

Assets - Liabilities = Owners Equity

On assets side cash is 1st, accounts receivable is 2nd

On liabilities side Accounts payable is 1st

Balance sheets are based on a certain time

Formula: A=L+OE

Fundamental accounting equation:

Assets=Liabilities- Owners equity

Owners equity:

Net worth

What you own - what you owe = networth

assets-liabilities=networth

Capital

Liabilities:

Debts that are owed

Something not yet payed

it is payable

Car payements

Assets:

Anything that's owned and has a money value

Cash

Boat

land

Marketing

Competition:

Producers compete with eachother to meet consumers wants

Indirect competition:

Companies competing for consumers

Subway vs McDonalds

Direct competition:

Similar products meeting the same need

Gatorade vs Powerade

Advertising media

Factors to select the medium:

Reach

Selectivity

Lead-time

Technical requirements

Cost

Cost:

The money used to make the ad

Can you get someone to promote for a low price

Technical requirements:

how difficult is the process of making the ad

Lead-time:

How much time is necessary to get the ad ready

Selectivity:

Is the selected media able to target in on the audience

Reach:

The amount of the target audience that is exposed to the message

Advertising medium:

Print advertising: Magazines, fliers

Broadcast advertising: Radio, television

Outdoor advertising: Billboards, events

Digital advertising: Internet, social media

Aida (The selling formula)

Action:

Directly tell the audience what to do

Make them decide to get it

Desire:

Make them want the product or service

Appeal to their needs and wants

Explain why they need the it

Interest:

Hold the consumers attention

Make them take their time to read over the message

Help them pick out the message

Attention:

Use something big and bold to catch people's attention

4 P's of marketing

Promotion:

Advertising the product

What can make people buy it

How people find out about the product

Place:

Location to sell product

Manufacter, Wholesaler, Retailer, Consumer

Price:

How much the product costs

Find the equilibrium

Product:

The product itself

Name and labeling

How to make it

Managment and Hr

Leadership

Maslows motivators

Reasons for demotivation:

Lack of recognition

Boredom

Criticism

Needs:

Existence needs(Basics and saftey) People work to earn money

Relatedness needs(Belonging and self esteem) Work to earn money but don't want to get to know colleagues

Growth needs(Self esteem and self actualization) Work for promotion

Growth needs motivators:

Offer support on completing tasks

Encourage thinking for themselves

Keep people informed

Relatedness needs motivators:

Show respect

Delegate responsibilities

Praise people

Existence need motivators:

Pay enough money

Good workplace

Incentives

Laisezz-Faire:

Small direction to members

Mainly independent

Advice is only given if asked

Democratic:

Everyone is involved

Supports teamwork

Ideas are supported

Autocratic:

Boss workers around

One way to do things

No other opinions or ideas

Managment roles

Controlling:

Make sure company goals are met

If not met figure out why

If met try to surpass it

Organizing:

Roles and responsibilities of workers

Structure of organization

Planning:

Researching

Forecasting the future