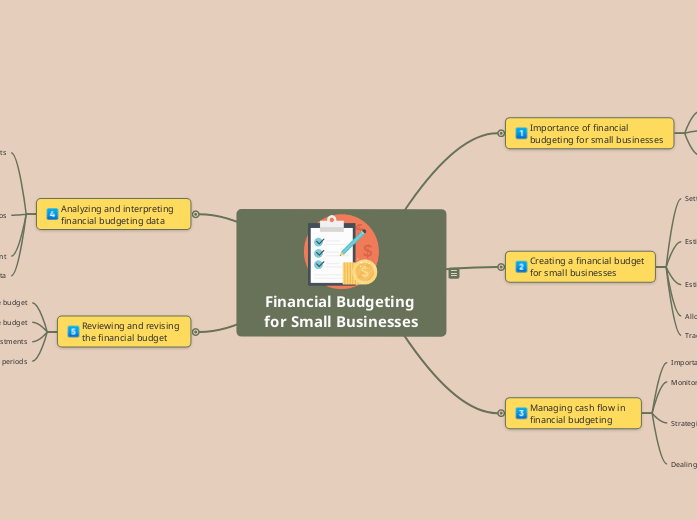

Financial Budgeting for Small Businesses

Note: Since the language of the input cannot be identified, the outline response is provided in English.

Reviewing and revising the financial budget

Revising the budget for future periods

Making necessary adjustments

Identifying deviations from the budget

Regularly reviewing the budget

Analyzing and interpreting financial budgeting data

Making informed financial decisions based on data

Identifying areas of improvement

Key financial ratios

Current ratio

Return on investment

Profit margin

Understanding financial statements

Cash flow statement

Balance sheet

Income statement

Managing cash flow in financial budgeting

Dealing with cash flow gaps

Strategies for improving cash flow

Negotiating better terms with suppliers

Increasing sales

Reducing expenses

Monitoring cash inflows and outflows

Importance of cash flow management

Creating a financial budget for small businesses

Tracking and adjusting the budget

Allocating funds for contingencies

Estimating expenses

Variable expenses

Fixed expenses

Estimating revenues

Other sources of revenue

Sales forecast

Setting financial goals

Long-term goals

Short-term goals

Importance of financial budgeting for small businesses

Challenges of financial budgeting for small businesses

Benefits of financial budgeting for small businesses

Overview of financial budgeting