realizată de Mindomo Team 11 luni în urmă

15930

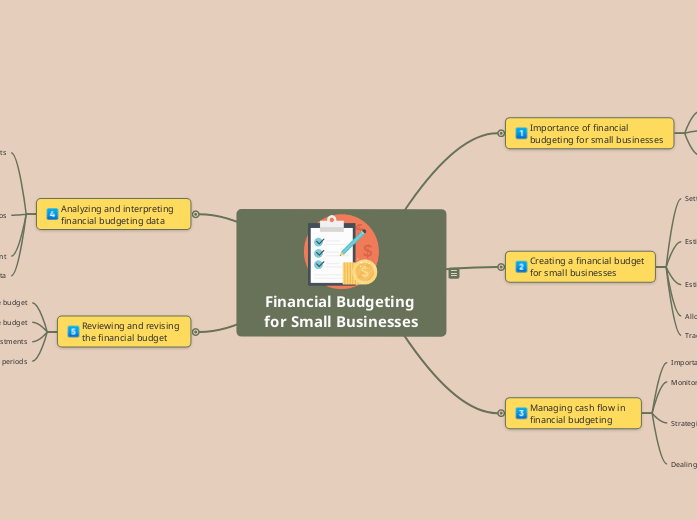

Financial Budgeting for Small Businesses

Effective financial budgeting is crucial for small businesses to maintain stability and achieve growth. Managing cash flow is a significant aspect, involving strategies like increasing sales, negotiating better terms with suppliers, and reducing expenses.