por Ihsan Rafiansyah 3 anos atrás

988

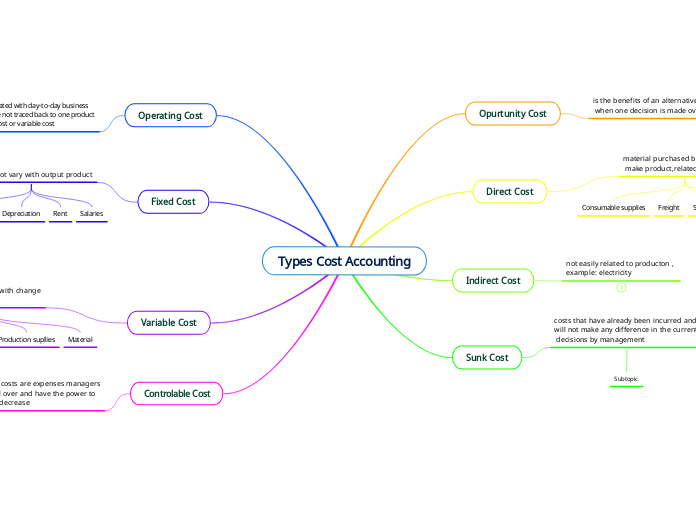

Types Cost Accounting

The text outlines various types of cost accounting, emphasizing their distinct attributes and implications for management decisions. Sunk costs refer to past expenditures that no longer influence current decisions.