av atiqah ahmad för 7 årar sedan

304

Takaful guidline

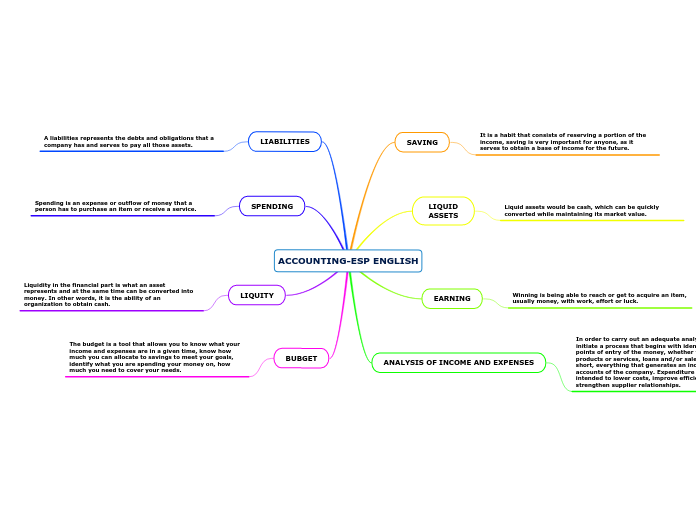

Effective management of a Takaful fund involves meticulous handling of several key areas to ensure compliance with Shariah principles and the financial stability of the fund. The valuation of liabilities requires setting appropriate and adequate provisions.