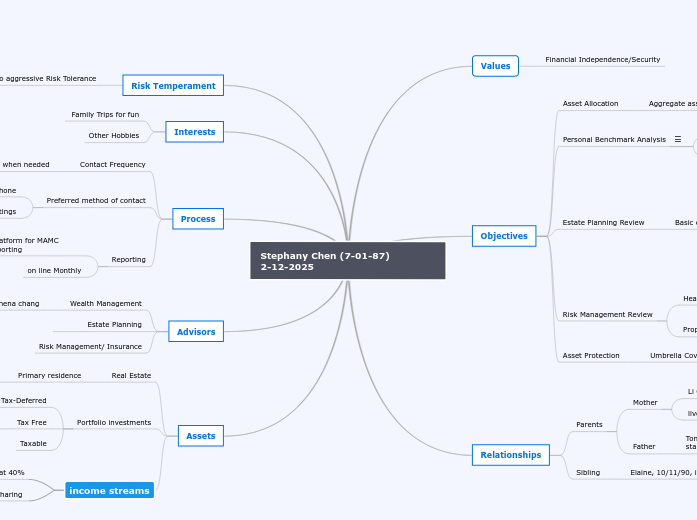

Stephany Chen (7-01-87) 2-12-2025

Assets

income streams

Revenue Sharing

Base Salary $280,000 with bonus at 40%

Portfolio investments

Taxable

Tax Free

Tax-Deferred

Real Estate

Primary residence

Advisors

Risk Management/ Insurance

Estate Planning

Wealth Management

MAMC, Athena chang

Process

Reporting

on line Monthly

Web reporting via Orion Platform for MAMC Performance quarterly reporting

Preferred method of contact

In person for review meetings

e-mail or phone

Contact Frequency

Annual and when needed

Interests

Other Hobbies

Family Trips for fun

Relationships

Sibling

Elaine, 10/11/90, in NJ Fashion Marketing

Parents

Father

Tony 69 , lives in San Diego CA in good financial standing

Mother

lives in San Diego CA in good financial standing

Li Chuan 67

Risk Temperament

moderate to aggressive Risk Tolerance

Objectives

Asset Protection

Umbrella Coverage

Risk Management Review

Property insurance

Health insurance

Estate Planning Review

Basic estate planning documents

Health Care Power of Attorney,

Medical Directives,

Power of Attorney,

Trusts,

Wills,

Personal Benchmark Analysis

PBA Questioner

Personal

- Retirement Age (Client):

- Retirement Age (Spouse):

Holdings

- Add non-investment assets?

- Automobiles

- Real Estate

- Other

- Mortgage

- Student loans

- Other

Contributions

- Well the client be making contributions?

- When

- What Accounts

- How much

- Amount of years

Tax Assumptions

- Where is the client currently living?

- Where is the client planning to live after retirement?

Type of Analysis

- Should we run one, two or three scenarios?

- Solve using a target annual retirement income need?

- Solve at 85% comfort level?

- Other

Retirement Income

- Add Social Security a benefit or other source of retirement income?

Purchase Residence in 2-3 years time

Retirement

Asset Allocation

Aggregate asset allocation

Coordinate asset location among different MAMC accounts

Values

Financial Independence/Security