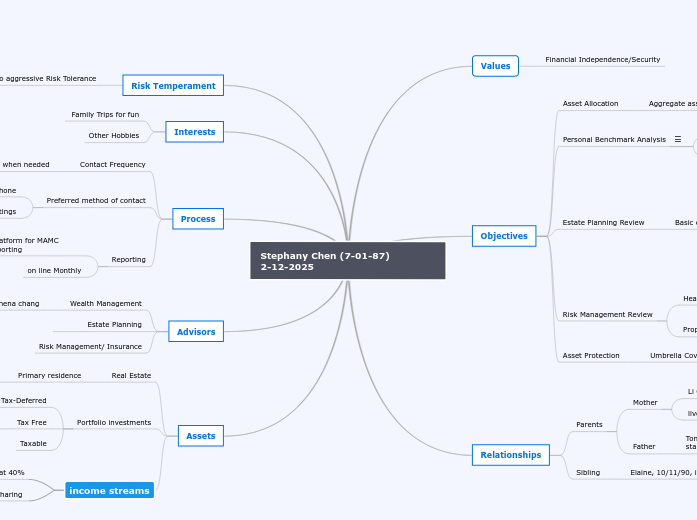

av Athena Chang 2 måneder siden

118

Stephany Chen

Planning for retirement involves a detailed analysis of various personal and financial factors. It's important to determine the desired retirement age for both the client and their spouse, as well as to review all sources of retirement income, including Social Security benefits.