arabera ANIS ALIA ASYIKIN JUMARI 2 years ago

452

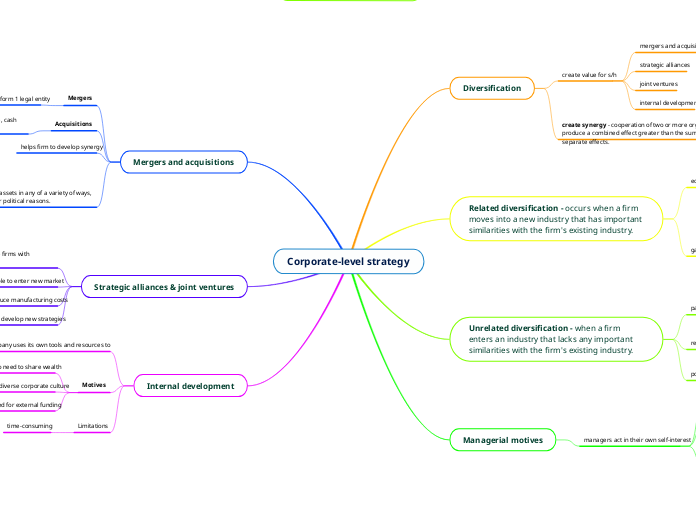

Corporate-level strategy

Organizations often develop strategies at the corporate level to achieve growth and competitive advantage. Managers may sometimes act out of self-interest, employing tactics like greenmail, poison pills, and golden parachutes to deter takeovers.